Big Pharma Stuck Between Investors and the Public

|

By LabMedica International staff writers Posted on 24 Sep 2012 |

Big Pharma currently comes across a range of pressures from generics manufacturers, governments, patient advocacy groups, investors, physicians, and even other pharmaceutical or biotechnology firms. In dealing with these pressures, companies are trying to focus upon the needs of their key stakeholder, the investors, or shareholders, according to recent market research.

As the timeframe of exclusivity shortens and regulatory requirements increase, companies are faced with declining profits and decreasing brand cachet, particularly in emerging markets, according to GlobalData, an international market research firm (London, UK). On top of this, they have to deal with reference pricing and rigorous healthcare cost controls being set up by various governments, particularly in Europe. According to Sanofi’s CEO, Chris Viehbacher, the financial situation in Europe has been costing Sanofi EUR 200-300 million a year as a result of governments’ healthcare spending cuts.

Sanofi has faced an interesting year in the limelight, with their latest hurdle being Sanofi’s pricing strategy in Japan coming under question. Sanofi’s IPV (inactivated poliovirus vaccine) Imovax Polio SC injection is currently priced at almost JPY 5,500 per syringe, which comes at an almost 270% price premium compared to the cost of the same vaccine in the United States. Japanese officials at the Ministry of Health, Labor, and Welfare (MHLW) have issued repeated letters to the executive board of the pharmaceutical behemoth, requesting that they revise prices prior to entry into the market.

Sanofi’s executives have held fast, and have issued strong statements to indicate that the price points instated for the IPVs were needed to recover costs incurred to enter the Japanese market. However, Sanofi faces the looming threat of new entrants from domestic combinatorial vaccine manufacturers that are ready to enter the market in the very near future, and will likely usurp Sanofi as the leading IPV vaccine manufacturer in Japan. Consequently, the company has little time to earn significant revenue from the sale of its polio vaccine in Japan.

In the case of vaccines, manufacturers are less and less inclined to invest because of reasons as simple as a poor business model. The vaccine segment, seen as a silver bullet by global health initiatives, is no cash cow for pharmaceutical companies. The one glitch to this oversimplification would be the influenza market, which benefits from antigenic shift of the virus, thereby resulting in the need for a new annual vaccine against the viral strain in circulation. As a company attempts to recoup costs of development, one sees this reflected in the price of each vaccine. However, as manufacturers reach superior levels of effectiveness with their vaccines, they are forced to substantiate the changing costs as patients move from one therapy to another, according to GlobalData analysts.

Now, one sees companies such as Sanofi that are finding themselves into a corner by a number of different stakeholders. Sanofi is currently in a lawsuit against physician buying groups, who maintain that Sanofi’s contracts imitate antitrust laws and limit healthy market competition. Novartis is also currently entangled in a lawsuit with Indian courts over the prices of cancer drug Gleevec, with the company emphasizing that most patients who participated in the trial did not have to pay out of pocket for the expensive drug treatment.

Gilead, a leader in HIV therapeutics, has similarly been pressured by health advocacy groups and other lobbyists to provide their therapies at a discount to patients in countries with a low annual gross domestic product (GDP). Gilead, potentially forced into responding to these claims, has surrendered to these external pressures, and agreed to participate in the transfer of technology to promote the distribution of their drugs as generics. In August 2012, the company signed deals with Mylan, Strides Arcolab, and Ranbaxy to manufacture low-cost generic versions of its HIV drug, Emtriva (emtricitabine).

Clearly, drug makers have to walk a fine line while attempting to please both investors and the public--two parties with contrasting expectations and demands. In spite of the efforts of companies like Gilead and Roche at running “access” programs, which aim to make their drugs affordable for developing countries, the public still winces at the massive profits announced by these drug makers every quarter. How profitable should pharmaceutical companies be in order to satisfy both sides? Should there be a limit to their profitability, keeping in mind the expensive, long, and risky drug development process? How do pharmaceutical companies validate that they care about patients if the very life-saving treatments they develop are too cost-prohibitive by those who need them the most? How involved should patient advocacy be in drug pricing, bearing in mind that with every “victory” they get, they come back with even more aggressive demands?

These are some of the imperative questions begging to be answered. Regardless of the enthusiasm shown during the launch of a new drug or vaccine, it all comes down to one thing in the end: pricing. Will pharmaceutical companies stand their ground or will they yield to the demands of the public? Sanofi has chosen the former, according to GlobalData, at least for now.

GlobalData is a global business intelligence provider. The company’s research and analysis is based on the expert knowledge of over 700 business analysts and 25,000 interviews conducted with industry insiders yearly.

Related Links:

GlobalData

As the timeframe of exclusivity shortens and regulatory requirements increase, companies are faced with declining profits and decreasing brand cachet, particularly in emerging markets, according to GlobalData, an international market research firm (London, UK). On top of this, they have to deal with reference pricing and rigorous healthcare cost controls being set up by various governments, particularly in Europe. According to Sanofi’s CEO, Chris Viehbacher, the financial situation in Europe has been costing Sanofi EUR 200-300 million a year as a result of governments’ healthcare spending cuts.

Sanofi has faced an interesting year in the limelight, with their latest hurdle being Sanofi’s pricing strategy in Japan coming under question. Sanofi’s IPV (inactivated poliovirus vaccine) Imovax Polio SC injection is currently priced at almost JPY 5,500 per syringe, which comes at an almost 270% price premium compared to the cost of the same vaccine in the United States. Japanese officials at the Ministry of Health, Labor, and Welfare (MHLW) have issued repeated letters to the executive board of the pharmaceutical behemoth, requesting that they revise prices prior to entry into the market.

Sanofi’s executives have held fast, and have issued strong statements to indicate that the price points instated for the IPVs were needed to recover costs incurred to enter the Japanese market. However, Sanofi faces the looming threat of new entrants from domestic combinatorial vaccine manufacturers that are ready to enter the market in the very near future, and will likely usurp Sanofi as the leading IPV vaccine manufacturer in Japan. Consequently, the company has little time to earn significant revenue from the sale of its polio vaccine in Japan.

In the case of vaccines, manufacturers are less and less inclined to invest because of reasons as simple as a poor business model. The vaccine segment, seen as a silver bullet by global health initiatives, is no cash cow for pharmaceutical companies. The one glitch to this oversimplification would be the influenza market, which benefits from antigenic shift of the virus, thereby resulting in the need for a new annual vaccine against the viral strain in circulation. As a company attempts to recoup costs of development, one sees this reflected in the price of each vaccine. However, as manufacturers reach superior levels of effectiveness with their vaccines, they are forced to substantiate the changing costs as patients move from one therapy to another, according to GlobalData analysts.

Now, one sees companies such as Sanofi that are finding themselves into a corner by a number of different stakeholders. Sanofi is currently in a lawsuit against physician buying groups, who maintain that Sanofi’s contracts imitate antitrust laws and limit healthy market competition. Novartis is also currently entangled in a lawsuit with Indian courts over the prices of cancer drug Gleevec, with the company emphasizing that most patients who participated in the trial did not have to pay out of pocket for the expensive drug treatment.

Gilead, a leader in HIV therapeutics, has similarly been pressured by health advocacy groups and other lobbyists to provide their therapies at a discount to patients in countries with a low annual gross domestic product (GDP). Gilead, potentially forced into responding to these claims, has surrendered to these external pressures, and agreed to participate in the transfer of technology to promote the distribution of their drugs as generics. In August 2012, the company signed deals with Mylan, Strides Arcolab, and Ranbaxy to manufacture low-cost generic versions of its HIV drug, Emtriva (emtricitabine).

Clearly, drug makers have to walk a fine line while attempting to please both investors and the public--two parties with contrasting expectations and demands. In spite of the efforts of companies like Gilead and Roche at running “access” programs, which aim to make their drugs affordable for developing countries, the public still winces at the massive profits announced by these drug makers every quarter. How profitable should pharmaceutical companies be in order to satisfy both sides? Should there be a limit to their profitability, keeping in mind the expensive, long, and risky drug development process? How do pharmaceutical companies validate that they care about patients if the very life-saving treatments they develop are too cost-prohibitive by those who need them the most? How involved should patient advocacy be in drug pricing, bearing in mind that with every “victory” they get, they come back with even more aggressive demands?

These are some of the imperative questions begging to be answered. Regardless of the enthusiasm shown during the launch of a new drug or vaccine, it all comes down to one thing in the end: pricing. Will pharmaceutical companies stand their ground or will they yield to the demands of the public? Sanofi has chosen the former, according to GlobalData, at least for now.

GlobalData is a global business intelligence provider. The company’s research and analysis is based on the expert knowledge of over 700 business analysts and 25,000 interviews conducted with industry insiders yearly.

Related Links:

GlobalData

Latest BioResearch News

- Genome Analysis Predicts Likelihood of Neurodisability in Oxygen-Deprived Newborns

- Gene Panel Predicts Disease Progession for Patients with B-cell Lymphoma

- New Method Simplifies Preparation of Tumor Genomic DNA Libraries

- New Tool Developed for Diagnosis of Chronic HBV Infection

- Panel of Genetic Loci Accurately Predicts Risk of Developing Gout

- Disrupted TGFB Signaling Linked to Increased Cancer-Related Bacteria

- Gene Fusion Protein Proposed as Prostate Cancer Biomarker

- NIV Test to Diagnose and Monitor Vascular Complications in Diabetes

- Semen Exosome MicroRNA Proves Biomarker for Prostate Cancer

- Genetic Loci Link Plasma Lipid Levels to CVD Risk

- Newly Identified Gene Network Aids in Early Diagnosis of Autism Spectrum Disorder

- Link Confirmed between Living in Poverty and Developing Diseases

- Genomic Study Identifies Kidney Disease Loci in Type I Diabetes Patients

- Liquid Biopsy More Effective for Analyzing Tumor Drug Resistance Mutations

- New Liquid Biopsy Assay Reveals Host-Pathogen Interactions

- Method Developed for Enriching Trophoblast Population in Samples

Channels

Clinical Chemistry

view channel

New PSA-Based Prognostic Model Improves Prostate Cancer Risk Assessment

Prostate cancer is the second-leading cause of cancer death among American men, and about one in eight will be diagnosed in their lifetime. Screening relies on blood levels of prostate-specific antigen... Read more

Extracellular Vesicles Linked to Heart Failure Risk in CKD Patients

Chronic kidney disease (CKD) affects more than 1 in 7 Americans and is strongly associated with cardiovascular complications, which account for more than half of deaths among people with CKD.... Read moreMolecular Diagnostics

view channel

Diagnostic Device Predicts Treatment Response for Brain Tumors Via Blood Test

Glioblastoma is one of the deadliest forms of brain cancer, largely because doctors have no reliable way to determine whether treatments are working in real time. Assessing therapeutic response currently... Read more

Blood Test Detects Early-Stage Cancers by Measuring Epigenetic Instability

Early-stage cancers are notoriously difficult to detect because molecular changes are subtle and often missed by existing screening tools. Many liquid biopsies rely on measuring absolute DNA methylation... Read more

“Lab-On-A-Disc” Device Paves Way for More Automated Liquid Biopsies

Extracellular vesicles (EVs) are tiny particles released by cells into the bloodstream that carry molecular information about a cell’s condition, including whether it is cancerous. However, EVs are highly... Read more

Blood Test Identifies Inflammatory Breast Cancer Patients at Increased Risk of Brain Metastasis

Brain metastasis is a frequent and devastating complication in patients with inflammatory breast cancer, an aggressive subtype with limited treatment options. Despite its high incidence, the biological... Read moreHematology

view channel

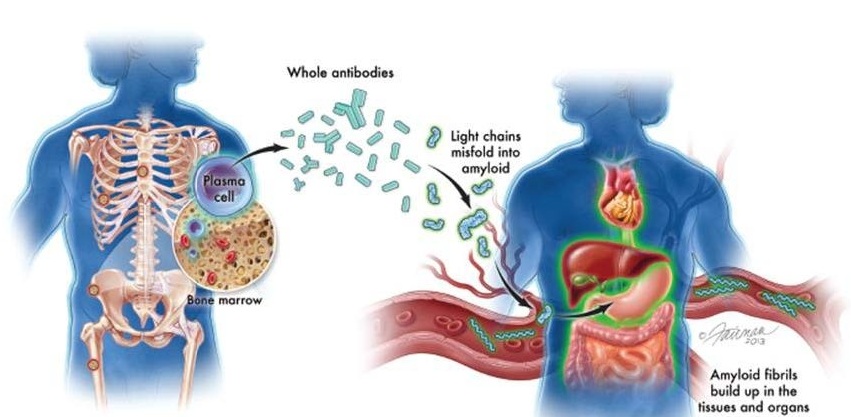

New Guidelines Aim to Improve AL Amyloidosis Diagnosis

Light chain (AL) amyloidosis is a rare, life-threatening bone marrow disorder in which abnormal amyloid proteins accumulate in organs. Approximately 3,260 people in the United States are diagnosed... Read more

Fast and Easy Test Could Revolutionize Blood Transfusions

Blood transfusions are a cornerstone of modern medicine, yet red blood cells can deteriorate quietly while sitting in cold storage for weeks. Although blood units have a fixed expiration date, cells from... Read more

Automated Hemostasis System Helps Labs of All Sizes Optimize Workflow

High-volume hemostasis sections must sustain rapid turnaround while managing reruns and reflex testing. Manual tube handling and preanalytical checks can strain staff time and increase opportunities for error.... Read more

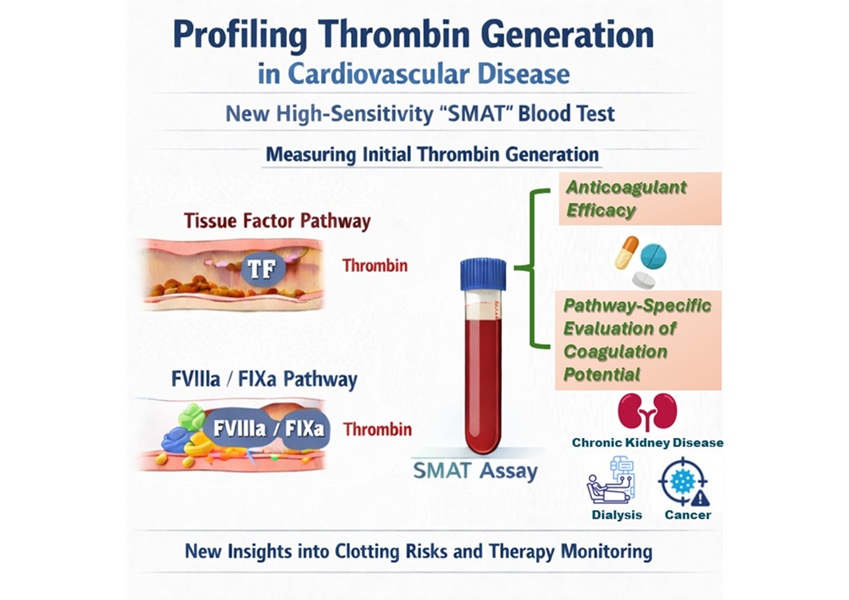

High-Sensitivity Blood Test Improves Assessment of Clotting Risk in Heart Disease Patients

Blood clotting is essential for preventing bleeding, but even small imbalances can lead to serious conditions such as thrombosis or dangerous hemorrhage. In cardiovascular disease, clinicians often struggle... Read moreImmunology

view channelBlood Test Identifies Lung Cancer Patients Who Can Benefit from Immunotherapy Drug

Small cell lung cancer (SCLC) is an aggressive disease with limited treatment options, and even newly approved immunotherapies do not benefit all patients. While immunotherapy can extend survival for some,... Read more

Whole-Genome Sequencing Approach Identifies Cancer Patients Benefitting From PARP-Inhibitor Treatment

Targeted cancer therapies such as PARP inhibitors can be highly effective, but only for patients whose tumors carry specific DNA repair defects. Identifying these patients accurately remains challenging,... Read more

Ultrasensitive Liquid Biopsy Demonstrates Efficacy in Predicting Immunotherapy Response

Immunotherapy has transformed cancer treatment, but only a small proportion of patients experience lasting benefit, with response rates often remaining between 10% and 20%. Clinicians currently lack reliable... Read moreMicrobiology

view channel

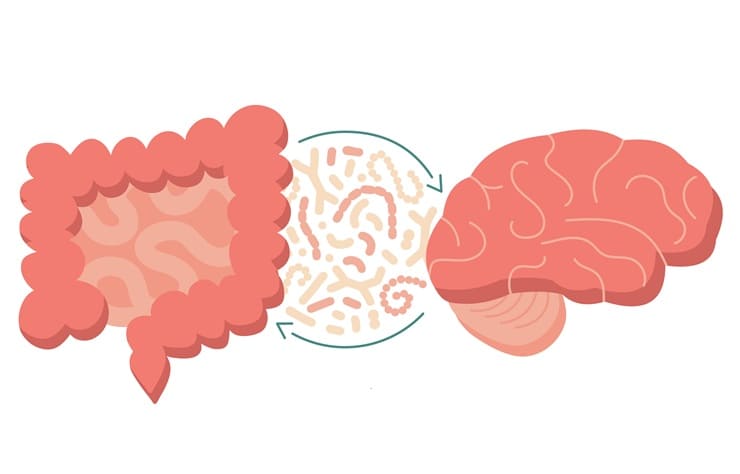

Comprehensive Review Identifies Gut Microbiome Signatures Associated With Alzheimer’s Disease

Alzheimer’s disease affects approximately 6.7 million people in the United States and nearly 50 million worldwide, yet early cognitive decline remains difficult to characterize. Increasing evidence suggests... Read moreAI-Powered Platform Enables Rapid Detection of Drug-Resistant C. Auris Pathogens

Infections caused by the pathogenic yeast Candida auris pose a significant threat to hospitalized patients, particularly those with weakened immune systems or those who have invasive medical devices.... Read morePathology

view channel

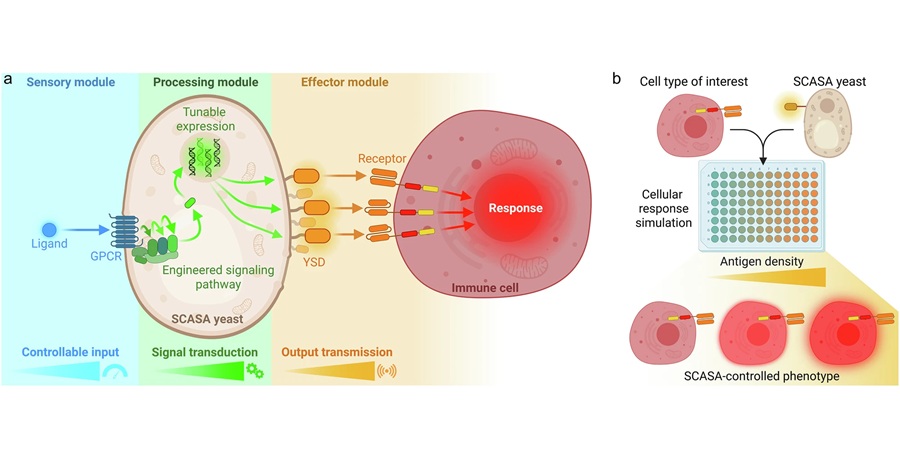

Engineered Yeast Cells Enable Rapid Testing of Cancer Immunotherapy

Developing new cancer immunotherapies is a slow, costly, and high-risk process, particularly for CAR T cell treatments that must precisely recognize cancer-specific antigens. Small differences in tumor... Read more

First-Of-Its-Kind Test Identifies Autism Risk at Birth

Autism spectrum disorder is treatable, and extensive research shows that early intervention can significantly improve cognitive, social, and behavioral outcomes. Yet in the United States, the average age... Read moreTechnology

view channel

Robotic Technology Unveiled for Automated Diagnostic Blood Draws

Routine diagnostic blood collection is a high‑volume task that can strain staffing and introduce human‑dependent variability, with downstream implications for sample quality and patient experience.... Read more

ADLM Launches First-of-Its-Kind Data Science Program for Laboratory Medicine Professionals

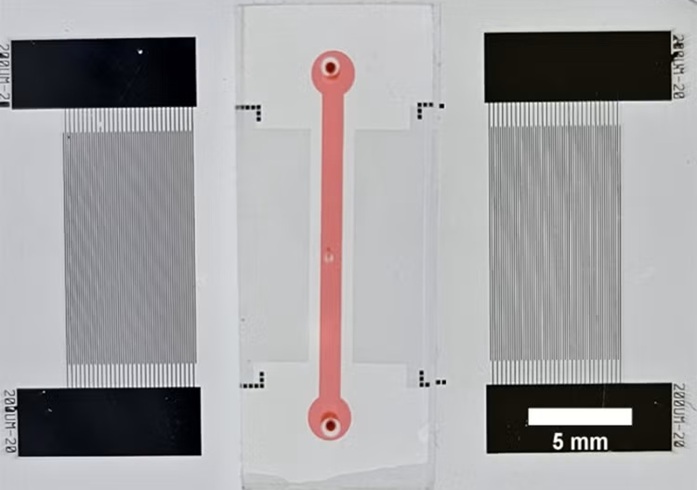

Clinical laboratories generate billions of test results each year, creating a treasure trove of data with the potential to support more personalized testing, improve operational efficiency, and enhance patient care.... Read moreAptamer Biosensor Technology to Transform Virus Detection

Rapid and reliable virus detection is essential for controlling outbreaks, from seasonal influenza to global pandemics such as COVID-19. Conventional diagnostic methods, including cell culture, antigen... Read more

AI Models Could Predict Pre-Eclampsia and Anemia Earlier Using Routine Blood Tests

Pre-eclampsia and anemia are major contributors to maternal and child mortality worldwide, together accounting for more than half a million deaths each year and leaving millions with long-term health complications.... Read moreIndustry

view channelNew Collaboration Brings Automated Mass Spectrometry to Routine Laboratory Testing

Mass spectrometry is a powerful analytical technique that identifies and quantifies molecules based on their mass and electrical charge. Its high selectivity, sensitivity, and accuracy make it indispensable... Read more

AI-Powered Cervical Cancer Test Set for Major Rollout in Latin America

Noul Co., a Korean company specializing in AI-based blood and cancer diagnostics, announced it will supply its intelligence (AI)-based miLab CER cervical cancer diagnostic solution to Mexico under a multi‑year... Read more

Diasorin and Fisher Scientific Enter into US Distribution Agreement for Molecular POC Platform

Diasorin (Saluggia, Italy) has entered into an exclusive distribution agreement with Fisher Scientific, part of Thermo Fisher Scientific (Waltham, MA, USA), for the LIAISON NES molecular point-of-care... Read more

(3) (1).png)