COVID-19 Transformation to Help Global qPCR and dPCR Instrumentation Market Reach USD 9.2 Billion by 2026

|

By LabMedica International staff writers Posted on 04 Jun 2021 |

Illustration

The global market for quantitative PCR (qPCR) and digital PCR (dPCR) instrumentation estimated at USD 5.2 billion in 2020 is projected to grow at a CAGR of 9.8% to reach USD 9.2 billion by 2026, driven by opportunities and challenges in a significantly transformed post COVID-19 marketplace.

These are the latest findings of Global Industry Analysts Inc., (San Jose, CA, USA), a market research company.

Real-Time Polymerase Chain Reaction (PCR) also referred to as qPCR analysis, is a modification of the traditional PCR technique. In traditional PCR, the amplified DNA product or amplicon is detected in an end-point analysis by visualization of the DNA product on an agarose gel subsequent to completion of the reaction, which comprises a specified number of amplification cycles. In real-time PCR, however, the accumulation of amplification product is evaluated simultaneously with the progress of the reaction. Product quantification is carried out in real time, after every cycle.

dPCR is an improvement of traditional PCR methods and is utilized to directly quantify as well as clonally amplify nucleic acids such as DNA, RNA, cDNA or methylated DNA. However, digital PCR is at an early stage. The main difference between conventional PCR and dPCR lies in the method used to measure amounts of nucleic acids. Sensitivity of dPCR is high in comparison to qPCR, hence, the technology is particularly used in applications wherein there is a low amount of target sequence. For instance, mutation genes that are found on a very low scale in rare diseases, and HIV DNA that are present in 1,000-10,000 in number within the cell of a patient can be easily detected through the technology.

Amid the COVID-19 crisis, the qPCR segment is projected to grow at a CAGR of 9.3% to USD 8.4 billion, while the dPCR segment is expected to record a CAGR of 13% over the next 7-year period. The dPCR segment currently accounts for a 12.5% share of the global qPCR and dPCR instrumentation market.

Geographically, the US qPCR and dPCR instrumentation market which currently holds a share of 30.8% in the global market was estimated to reach USD 1.9 billion in 2021. The Chinese qPCR and dPCR instrumentation market is projected to grow at a CAGR of 12.2% through the analysis period to reach USD 0.742 billion in 2026. Among the other noteworthy geographies the qPCR and dPCR instrumentation market in Japan and Canada are projected to grow at a CAGR of 8.1% and 8.6%, respectively over the analysis period. Within Europe, Germany is forecasted to grow at a CAGR of approximately 9.1% while Rest of European market is expected to reach USD 0.81 billion by 2026.

While Europe is another large market for qPCR and dPCR instrumentation, the global market growth is expected to be spearheaded by Asia-Pacific. In terms of concentration, a large number of leading companies are located in the US and Europe. However, increasing competition in the markets over the last few years has been driving various players to shift their attention to other promising regions, including Latin America and Asia-Pacific. In Asia-Pacific, the growth of the qPCR and dPCR instrumentation market is being led by the increased use of qPCR in blood donor testing & screening and diagnosis of infectious diseases and tropical diseases such as malaria.

Increasing geriatric population and the resulting incidents of chronic medical conditions such as cancer, coupled with broader application of PCR to study mutations and gene anomalies related to these diseases, are driving the adoption of qPCR and dPCR instrumentation in the Asia-Pacific region. Additionally, the falling cost of nucleic acid detection, quantification, and amplification techniques will also encourage the adoption of qPCR and dPCR instrumentation in research and diagnosis, particularly in the region’s developing, resource poor countries. PCR solution suppliers in Asia-Pacific have been increasingly focusing on establishing or expanding their production and sales network in the region. In recent years, various vendors have shifted their manufacturing units to the region in order to enjoy cost benefits and access the domestic markets, which in turn, is increasing awareness about the technology in the region, thereby contributing to its market growth.

Related Links:

Global Industry Analysts Inc.

These are the latest findings of Global Industry Analysts Inc., (San Jose, CA, USA), a market research company.

Real-Time Polymerase Chain Reaction (PCR) also referred to as qPCR analysis, is a modification of the traditional PCR technique. In traditional PCR, the amplified DNA product or amplicon is detected in an end-point analysis by visualization of the DNA product on an agarose gel subsequent to completion of the reaction, which comprises a specified number of amplification cycles. In real-time PCR, however, the accumulation of amplification product is evaluated simultaneously with the progress of the reaction. Product quantification is carried out in real time, after every cycle.

dPCR is an improvement of traditional PCR methods and is utilized to directly quantify as well as clonally amplify nucleic acids such as DNA, RNA, cDNA or methylated DNA. However, digital PCR is at an early stage. The main difference between conventional PCR and dPCR lies in the method used to measure amounts of nucleic acids. Sensitivity of dPCR is high in comparison to qPCR, hence, the technology is particularly used in applications wherein there is a low amount of target sequence. For instance, mutation genes that are found on a very low scale in rare diseases, and HIV DNA that are present in 1,000-10,000 in number within the cell of a patient can be easily detected through the technology.

Amid the COVID-19 crisis, the qPCR segment is projected to grow at a CAGR of 9.3% to USD 8.4 billion, while the dPCR segment is expected to record a CAGR of 13% over the next 7-year period. The dPCR segment currently accounts for a 12.5% share of the global qPCR and dPCR instrumentation market.

Geographically, the US qPCR and dPCR instrumentation market which currently holds a share of 30.8% in the global market was estimated to reach USD 1.9 billion in 2021. The Chinese qPCR and dPCR instrumentation market is projected to grow at a CAGR of 12.2% through the analysis period to reach USD 0.742 billion in 2026. Among the other noteworthy geographies the qPCR and dPCR instrumentation market in Japan and Canada are projected to grow at a CAGR of 8.1% and 8.6%, respectively over the analysis period. Within Europe, Germany is forecasted to grow at a CAGR of approximately 9.1% while Rest of European market is expected to reach USD 0.81 billion by 2026.

While Europe is another large market for qPCR and dPCR instrumentation, the global market growth is expected to be spearheaded by Asia-Pacific. In terms of concentration, a large number of leading companies are located in the US and Europe. However, increasing competition in the markets over the last few years has been driving various players to shift their attention to other promising regions, including Latin America and Asia-Pacific. In Asia-Pacific, the growth of the qPCR and dPCR instrumentation market is being led by the increased use of qPCR in blood donor testing & screening and diagnosis of infectious diseases and tropical diseases such as malaria.

Increasing geriatric population and the resulting incidents of chronic medical conditions such as cancer, coupled with broader application of PCR to study mutations and gene anomalies related to these diseases, are driving the adoption of qPCR and dPCR instrumentation in the Asia-Pacific region. Additionally, the falling cost of nucleic acid detection, quantification, and amplification techniques will also encourage the adoption of qPCR and dPCR instrumentation in research and diagnosis, particularly in the region’s developing, resource poor countries. PCR solution suppliers in Asia-Pacific have been increasingly focusing on establishing or expanding their production and sales network in the region. In recent years, various vendors have shifted their manufacturing units to the region in order to enjoy cost benefits and access the domestic markets, which in turn, is increasing awareness about the technology in the region, thereby contributing to its market growth.

Related Links:

Global Industry Analysts Inc.

Latest COVID-19 News

- New Immunosensor Paves Way to Rapid POC Testing for COVID-19 and Emerging Infectious Diseases

- Long COVID Etiologies Found in Acute Infection Blood Samples

- Novel Device Detects COVID-19 Antibodies in Five Minutes

- CRISPR-Powered COVID-19 Test Detects SARS-CoV-2 in 30 Minutes Using Gene Scissors

- Gut Microbiome Dysbiosis Linked to COVID-19

- Novel SARS CoV-2 Rapid Antigen Test Validated for Diagnostic Accuracy

- New COVID + Flu + R.S.V. Test to Help Prepare for `Tripledemic`

- AI Takes Guesswork Out Of Lateral Flow Testing

- Fastest Ever SARS-CoV-2 Antigen Test Designed for Non-Invasive COVID-19 Testing in Any Setting

- Rapid Antigen Tests Detect Omicron, Delta SARS-CoV-2 Variants

- Health Care Professionals Showed Increased Interest in POC Technologies During Pandemic, Finds Study

- Set Up Reserve Lab Capacity Now for Faster Response to Next Pandemic, Say Researchers

- Blood Test Performed During Initial Infection Predicts Long COVID Risk

- Low-Cost COVID-19 Testing Platform Combines Sensitivity of PCR and Speed of Antigen Tests

- Finger-Prick Blood Test Identifies Immunity to COVID-19

- Quick Test Kit Determines Immunity Against COVID-19 and Its Variants

Channels

Clinical Chemistry

view channel

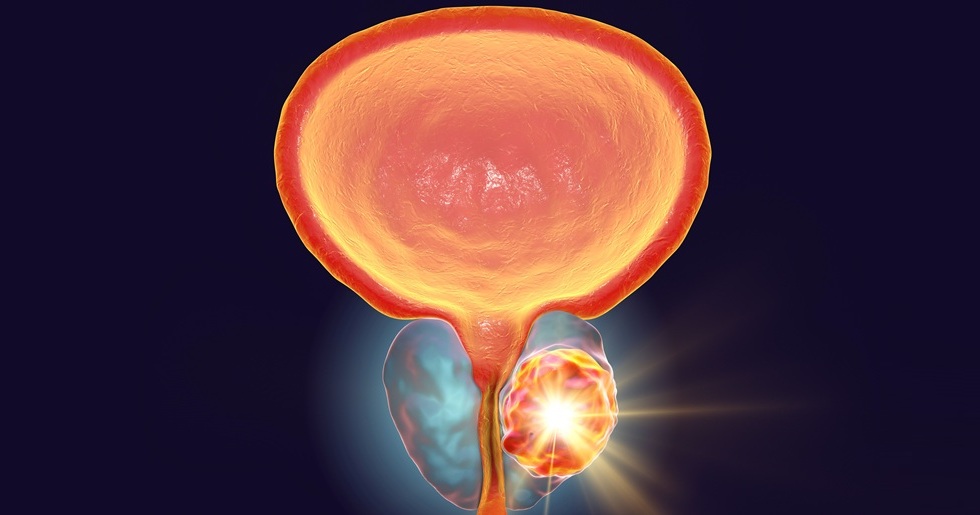

New PSA-Based Prognostic Model Improves Prostate Cancer Risk Assessment

Prostate cancer is the second-leading cause of cancer death among American men, and about one in eight will be diagnosed in their lifetime. Screening relies on blood levels of prostate-specific antigen... Read more

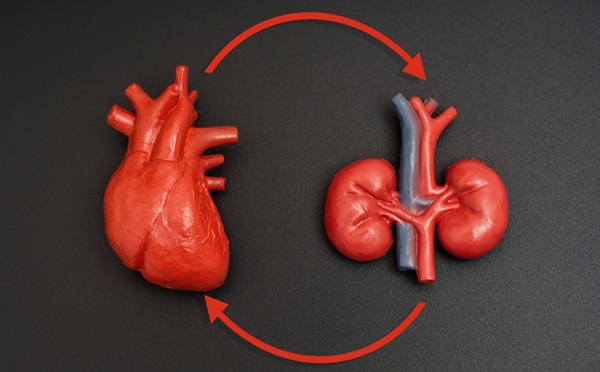

Extracellular Vesicles Linked to Heart Failure Risk in CKD Patients

Chronic kidney disease (CKD) affects more than 1 in 7 Americans and is strongly associated with cardiovascular complications, which account for more than half of deaths among people with CKD.... Read moreMolecular Diagnostics

view channel

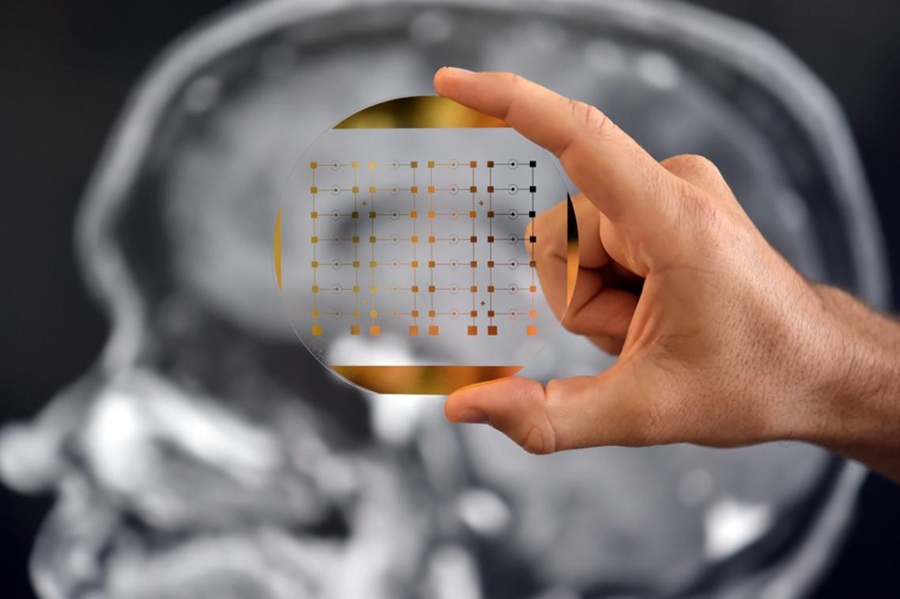

Diagnostic Device Predicts Treatment Response for Brain Tumors Via Blood Test

Glioblastoma is one of the deadliest forms of brain cancer, largely because doctors have no reliable way to determine whether treatments are working in real time. Assessing therapeutic response currently... Read more

Blood Test Detects Early-Stage Cancers by Measuring Epigenetic Instability

Early-stage cancers are notoriously difficult to detect because molecular changes are subtle and often missed by existing screening tools. Many liquid biopsies rely on measuring absolute DNA methylation... Read more

“Lab-On-A-Disc” Device Paves Way for More Automated Liquid Biopsies

Extracellular vesicles (EVs) are tiny particles released by cells into the bloodstream that carry molecular information about a cell’s condition, including whether it is cancerous. However, EVs are highly... Read more

Blood Test Identifies Inflammatory Breast Cancer Patients at Increased Risk of Brain Metastasis

Brain metastasis is a frequent and devastating complication in patients with inflammatory breast cancer, an aggressive subtype with limited treatment options. Despite its high incidence, the biological... Read moreHematology

view channel

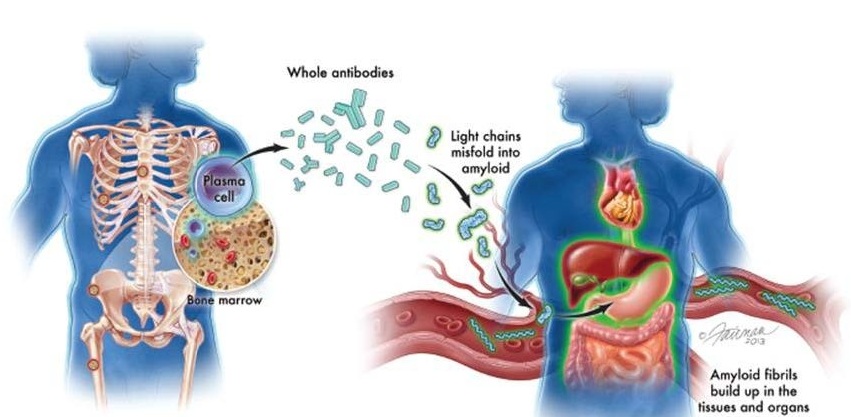

New Guidelines Aim to Improve AL Amyloidosis Diagnosis

Light chain (AL) amyloidosis is a rare, life-threatening bone marrow disorder in which abnormal amyloid proteins accumulate in organs. Approximately 3,260 people in the United States are diagnosed... Read more

Fast and Easy Test Could Revolutionize Blood Transfusions

Blood transfusions are a cornerstone of modern medicine, yet red blood cells can deteriorate quietly while sitting in cold storage for weeks. Although blood units have a fixed expiration date, cells from... Read more

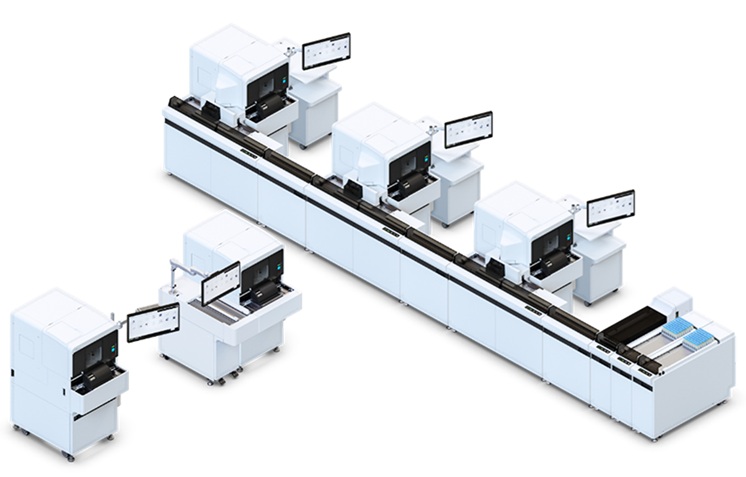

Automated Hemostasis System Helps Labs of All Sizes Optimize Workflow

High-volume hemostasis sections must sustain rapid turnaround while managing reruns and reflex testing. Manual tube handling and preanalytical checks can strain staff time and increase opportunities for error.... Read more

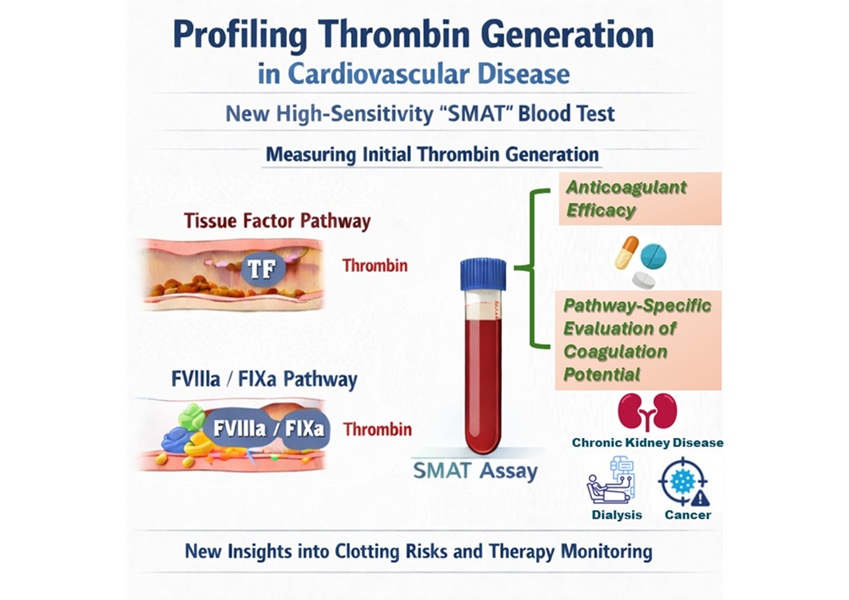

High-Sensitivity Blood Test Improves Assessment of Clotting Risk in Heart Disease Patients

Blood clotting is essential for preventing bleeding, but even small imbalances can lead to serious conditions such as thrombosis or dangerous hemorrhage. In cardiovascular disease, clinicians often struggle... Read moreImmunology

view channelBlood Test Identifies Lung Cancer Patients Who Can Benefit from Immunotherapy Drug

Small cell lung cancer (SCLC) is an aggressive disease with limited treatment options, and even newly approved immunotherapies do not benefit all patients. While immunotherapy can extend survival for some,... Read more

Whole-Genome Sequencing Approach Identifies Cancer Patients Benefitting From PARP-Inhibitor Treatment

Targeted cancer therapies such as PARP inhibitors can be highly effective, but only for patients whose tumors carry specific DNA repair defects. Identifying these patients accurately remains challenging,... Read more

Ultrasensitive Liquid Biopsy Demonstrates Efficacy in Predicting Immunotherapy Response

Immunotherapy has transformed cancer treatment, but only a small proportion of patients experience lasting benefit, with response rates often remaining between 10% and 20%. Clinicians currently lack reliable... Read moreMicrobiology

view channel

Comprehensive Review Identifies Gut Microbiome Signatures Associated With Alzheimer’s Disease

Alzheimer’s disease affects approximately 6.7 million people in the United States and nearly 50 million worldwide, yet early cognitive decline remains difficult to characterize. Increasing evidence suggests... Read moreAI-Powered Platform Enables Rapid Detection of Drug-Resistant C. Auris Pathogens

Infections caused by the pathogenic yeast Candida auris pose a significant threat to hospitalized patients, particularly those with weakened immune systems or those who have invasive medical devices.... Read morePathology

view channel

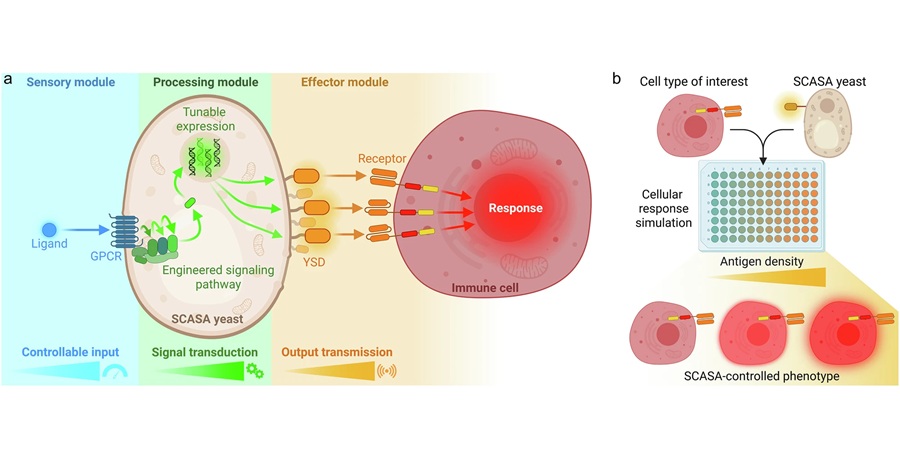

Engineered Yeast Cells Enable Rapid Testing of Cancer Immunotherapy

Developing new cancer immunotherapies is a slow, costly, and high-risk process, particularly for CAR T cell treatments that must precisely recognize cancer-specific antigens. Small differences in tumor... Read more

First-Of-Its-Kind Test Identifies Autism Risk at Birth

Autism spectrum disorder is treatable, and extensive research shows that early intervention can significantly improve cognitive, social, and behavioral outcomes. Yet in the United States, the average age... Read moreTechnology

view channel

Robotic Technology Unveiled for Automated Diagnostic Blood Draws

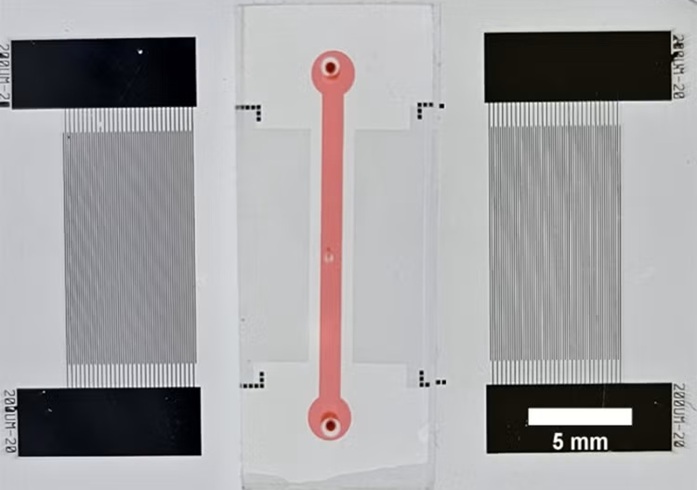

Routine diagnostic blood collection is a high‑volume task that can strain staffing and introduce human‑dependent variability, with downstream implications for sample quality and patient experience.... Read more

ADLM Launches First-of-Its-Kind Data Science Program for Laboratory Medicine Professionals

Clinical laboratories generate billions of test results each year, creating a treasure trove of data with the potential to support more personalized testing, improve operational efficiency, and enhance patient care.... Read moreAptamer Biosensor Technology to Transform Virus Detection

Rapid and reliable virus detection is essential for controlling outbreaks, from seasonal influenza to global pandemics such as COVID-19. Conventional diagnostic methods, including cell culture, antigen... Read more

AI Models Could Predict Pre-Eclampsia and Anemia Earlier Using Routine Blood Tests

Pre-eclampsia and anemia are major contributors to maternal and child mortality worldwide, together accounting for more than half a million deaths each year and leaving millions with long-term health complications.... Read moreIndustry

view channelNew Collaboration Brings Automated Mass Spectrometry to Routine Laboratory Testing

Mass spectrometry is a powerful analytical technique that identifies and quantifies molecules based on their mass and electrical charge. Its high selectivity, sensitivity, and accuracy make it indispensable... Read more

AI-Powered Cervical Cancer Test Set for Major Rollout in Latin America

Noul Co., a Korean company specializing in AI-based blood and cancer diagnostics, announced it will supply its intelligence (AI)-based miLab CER cervical cancer diagnostic solution to Mexico under a multi‑year... Read more

Diasorin and Fisher Scientific Enter into US Distribution Agreement for Molecular POC Platform

Diasorin (Saluggia, Italy) has entered into an exclusive distribution agreement with Fisher Scientific, part of Thermo Fisher Scientific (Waltham, MA, USA), for the LIAISON NES molecular point-of-care... Read more