COVID-19 Transformation to Help Global qPCR and dPCR Instrumentation Market Reach USD 9.2 Billion by 2026

|

By LabMedica International staff writers Posted on 04 Jun 2021 |

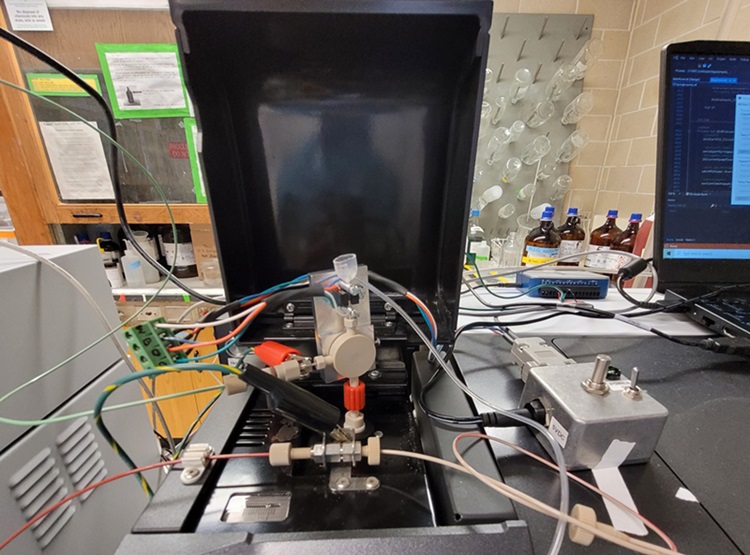

Illustration

The global market for quantitative PCR (qPCR) and digital PCR (dPCR) instrumentation estimated at USD 5.2 billion in 2020 is projected to grow at a CAGR of 9.8% to reach USD 9.2 billion by 2026, driven by opportunities and challenges in a significantly transformed post COVID-19 marketplace.

These are the latest findings of Global Industry Analysts Inc., (San Jose, CA, USA), a market research company.

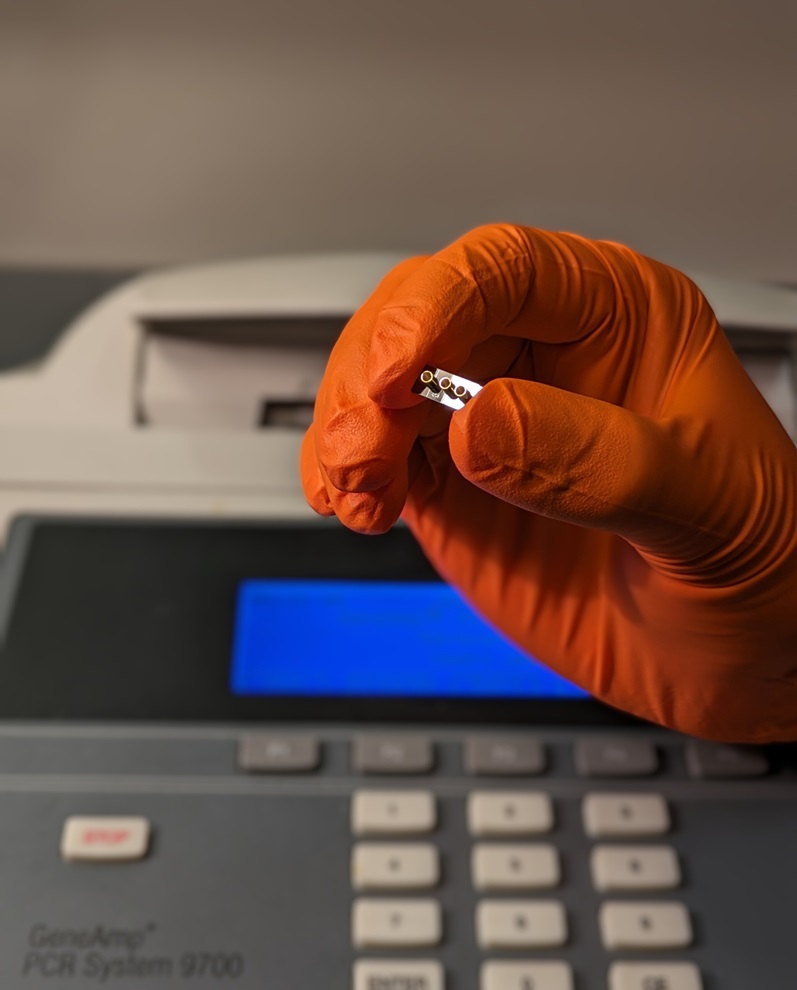

Real-Time Polymerase Chain Reaction (PCR) also referred to as qPCR analysis, is a modification of the traditional PCR technique. In traditional PCR, the amplified DNA product or amplicon is detected in an end-point analysis by visualization of the DNA product on an agarose gel subsequent to completion of the reaction, which comprises a specified number of amplification cycles. In real-time PCR, however, the accumulation of amplification product is evaluated simultaneously with the progress of the reaction. Product quantification is carried out in real time, after every cycle.

dPCR is an improvement of traditional PCR methods and is utilized to directly quantify as well as clonally amplify nucleic acids such as DNA, RNA, cDNA or methylated DNA. However, digital PCR is at an early stage. The main difference between conventional PCR and dPCR lies in the method used to measure amounts of nucleic acids. Sensitivity of dPCR is high in comparison to qPCR, hence, the technology is particularly used in applications wherein there is a low amount of target sequence. For instance, mutation genes that are found on a very low scale in rare diseases, and HIV DNA that are present in 1,000-10,000 in number within the cell of a patient can be easily detected through the technology.

Amid the COVID-19 crisis, the qPCR segment is projected to grow at a CAGR of 9.3% to USD 8.4 billion, while the dPCR segment is expected to record a CAGR of 13% over the next 7-year period. The dPCR segment currently accounts for a 12.5% share of the global qPCR and dPCR instrumentation market.

Geographically, the US qPCR and dPCR instrumentation market which currently holds a share of 30.8% in the global market was estimated to reach USD 1.9 billion in 2021. The Chinese qPCR and dPCR instrumentation market is projected to grow at a CAGR of 12.2% through the analysis period to reach USD 0.742 billion in 2026. Among the other noteworthy geographies the qPCR and dPCR instrumentation market in Japan and Canada are projected to grow at a CAGR of 8.1% and 8.6%, respectively over the analysis period. Within Europe, Germany is forecasted to grow at a CAGR of approximately 9.1% while Rest of European market is expected to reach USD 0.81 billion by 2026.

While Europe is another large market for qPCR and dPCR instrumentation, the global market growth is expected to be spearheaded by Asia-Pacific. In terms of concentration, a large number of leading companies are located in the US and Europe. However, increasing competition in the markets over the last few years has been driving various players to shift their attention to other promising regions, including Latin America and Asia-Pacific. In Asia-Pacific, the growth of the qPCR and dPCR instrumentation market is being led by the increased use of qPCR in blood donor testing & screening and diagnosis of infectious diseases and tropical diseases such as malaria.

Increasing geriatric population and the resulting incidents of chronic medical conditions such as cancer, coupled with broader application of PCR to study mutations and gene anomalies related to these diseases, are driving the adoption of qPCR and dPCR instrumentation in the Asia-Pacific region. Additionally, the falling cost of nucleic acid detection, quantification, and amplification techniques will also encourage the adoption of qPCR and dPCR instrumentation in research and diagnosis, particularly in the region’s developing, resource poor countries. PCR solution suppliers in Asia-Pacific have been increasingly focusing on establishing or expanding their production and sales network in the region. In recent years, various vendors have shifted their manufacturing units to the region in order to enjoy cost benefits and access the domestic markets, which in turn, is increasing awareness about the technology in the region, thereby contributing to its market growth.

Related Links:

Global Industry Analysts Inc.

These are the latest findings of Global Industry Analysts Inc., (San Jose, CA, USA), a market research company.

Real-Time Polymerase Chain Reaction (PCR) also referred to as qPCR analysis, is a modification of the traditional PCR technique. In traditional PCR, the amplified DNA product or amplicon is detected in an end-point analysis by visualization of the DNA product on an agarose gel subsequent to completion of the reaction, which comprises a specified number of amplification cycles. In real-time PCR, however, the accumulation of amplification product is evaluated simultaneously with the progress of the reaction. Product quantification is carried out in real time, after every cycle.

dPCR is an improvement of traditional PCR methods and is utilized to directly quantify as well as clonally amplify nucleic acids such as DNA, RNA, cDNA or methylated DNA. However, digital PCR is at an early stage. The main difference between conventional PCR and dPCR lies in the method used to measure amounts of nucleic acids. Sensitivity of dPCR is high in comparison to qPCR, hence, the technology is particularly used in applications wherein there is a low amount of target sequence. For instance, mutation genes that are found on a very low scale in rare diseases, and HIV DNA that are present in 1,000-10,000 in number within the cell of a patient can be easily detected through the technology.

Amid the COVID-19 crisis, the qPCR segment is projected to grow at a CAGR of 9.3% to USD 8.4 billion, while the dPCR segment is expected to record a CAGR of 13% over the next 7-year period. The dPCR segment currently accounts for a 12.5% share of the global qPCR and dPCR instrumentation market.

Geographically, the US qPCR and dPCR instrumentation market which currently holds a share of 30.8% in the global market was estimated to reach USD 1.9 billion in 2021. The Chinese qPCR and dPCR instrumentation market is projected to grow at a CAGR of 12.2% through the analysis period to reach USD 0.742 billion in 2026. Among the other noteworthy geographies the qPCR and dPCR instrumentation market in Japan and Canada are projected to grow at a CAGR of 8.1% and 8.6%, respectively over the analysis period. Within Europe, Germany is forecasted to grow at a CAGR of approximately 9.1% while Rest of European market is expected to reach USD 0.81 billion by 2026.

While Europe is another large market for qPCR and dPCR instrumentation, the global market growth is expected to be spearheaded by Asia-Pacific. In terms of concentration, a large number of leading companies are located in the US and Europe. However, increasing competition in the markets over the last few years has been driving various players to shift their attention to other promising regions, including Latin America and Asia-Pacific. In Asia-Pacific, the growth of the qPCR and dPCR instrumentation market is being led by the increased use of qPCR in blood donor testing & screening and diagnosis of infectious diseases and tropical diseases such as malaria.

Increasing geriatric population and the resulting incidents of chronic medical conditions such as cancer, coupled with broader application of PCR to study mutations and gene anomalies related to these diseases, are driving the adoption of qPCR and dPCR instrumentation in the Asia-Pacific region. Additionally, the falling cost of nucleic acid detection, quantification, and amplification techniques will also encourage the adoption of qPCR and dPCR instrumentation in research and diagnosis, particularly in the region’s developing, resource poor countries. PCR solution suppliers in Asia-Pacific have been increasingly focusing on establishing or expanding their production and sales network in the region. In recent years, various vendors have shifted their manufacturing units to the region in order to enjoy cost benefits and access the domestic markets, which in turn, is increasing awareness about the technology in the region, thereby contributing to its market growth.

Related Links:

Global Industry Analysts Inc.

Latest COVID-19 News

- New Immunosensor Paves Way to Rapid POC Testing for COVID-19 and Emerging Infectious Diseases

- Long COVID Etiologies Found in Acute Infection Blood Samples

- Novel Device Detects COVID-19 Antibodies in Five Minutes

- CRISPR-Powered COVID-19 Test Detects SARS-CoV-2 in 30 Minutes Using Gene Scissors

- Gut Microbiome Dysbiosis Linked to COVID-19

- Novel SARS CoV-2 Rapid Antigen Test Validated for Diagnostic Accuracy

- New COVID + Flu + R.S.V. Test to Help Prepare for `Tripledemic`

- AI Takes Guesswork Out Of Lateral Flow Testing

- Fastest Ever SARS-CoV-2 Antigen Test Designed for Non-Invasive COVID-19 Testing in Any Setting

- Rapid Antigen Tests Detect Omicron, Delta SARS-CoV-2 Variants

- Health Care Professionals Showed Increased Interest in POC Technologies During Pandemic, Finds Study

- Set Up Reserve Lab Capacity Now for Faster Response to Next Pandemic, Say Researchers

- Blood Test Performed During Initial Infection Predicts Long COVID Risk

- Low-Cost COVID-19 Testing Platform Combines Sensitivity of PCR and Speed of Antigen Tests

- Finger-Prick Blood Test Identifies Immunity to COVID-19

- Quick Test Kit Determines Immunity Against COVID-19 and Its Variants

Channels

Clinical Chemistry

view channel

3D Printed Point-Of-Care Mass Spectrometer Outperforms State-Of-The-Art Models

Mass spectrometry is a precise technique for identifying the chemical components of a sample and has significant potential for monitoring chronic illness health states, such as measuring hormone levels... Read more.jpg)

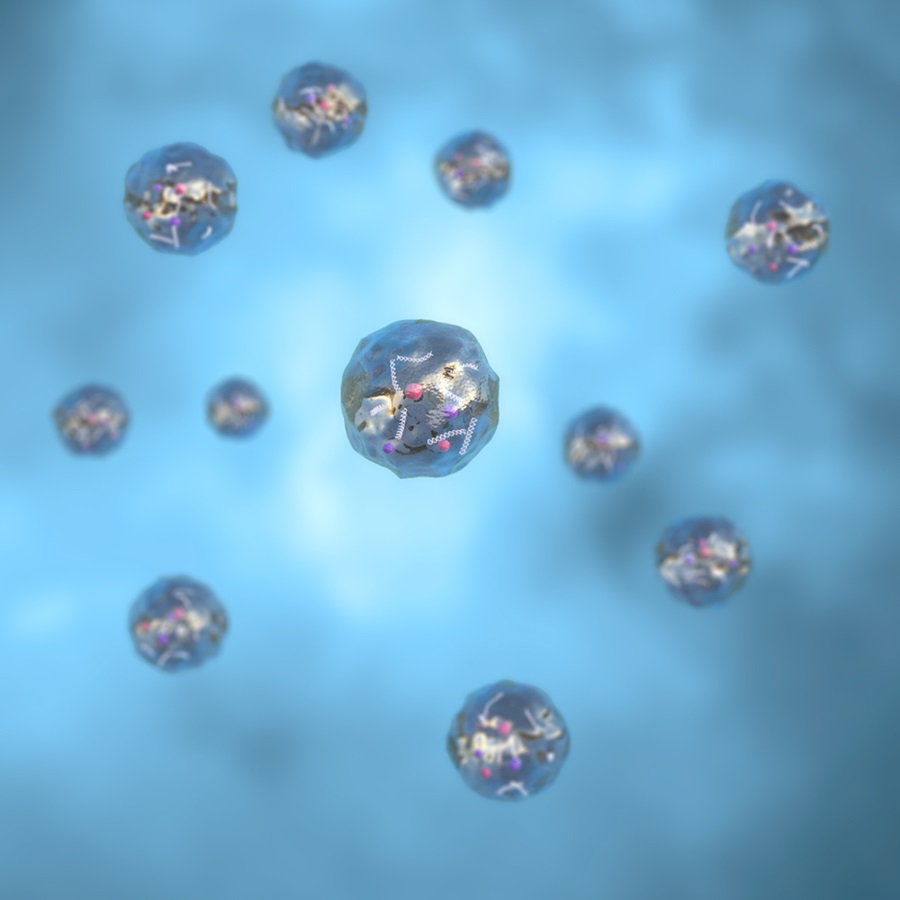

POC Biomedical Test Spins Water Droplet Using Sound Waves for Cancer Detection

Exosomes, tiny cellular bioparticles carrying a specific set of proteins, lipids, and genetic materials, play a crucial role in cell communication and hold promise for non-invasive diagnostics.... Read more

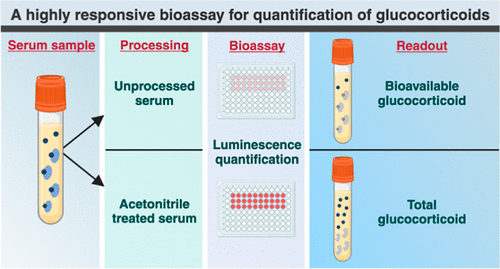

Highly Reliable Cell-Based Assay Enables Accurate Diagnosis of Endocrine Diseases

The conventional methods for measuring free cortisol, the body's stress hormone, from blood or saliva are quite demanding and require sample processing. The most common method, therefore, involves collecting... Read moreMolecular Diagnostics

view channel

Simple Blood Test Could Enable First Quantitative Assessments for Future Cerebrovascular Disease

Cerebral small vessel disease is a common cause of stroke and cognitive decline, particularly in the elderly. Presently, assessing the risk for cerebral vascular diseases involves using a mix of diagnostic... Read more

New Genetic Testing Procedure Combined With Ultrasound Detects High Cardiovascular Risk

A key interest area in cardiovascular research today is the impact of clonal hematopoiesis on cardiovascular diseases. Clonal hematopoiesis results from mutations in hematopoietic stem cells and may lead... Read moreHematology

view channel

Next Generation Instrument Screens for Hemoglobin Disorders in Newborns

Hemoglobinopathies, the most widespread inherited conditions globally, affect about 7% of the population as carriers, with 2.7% of newborns being born with these conditions. The spectrum of clinical manifestations... Read more

First 4-in-1 Nucleic Acid Test for Arbovirus Screening to Reduce Risk of Transfusion-Transmitted Infections

Arboviruses represent an emerging global health threat, exacerbated by climate change and increased international travel that is facilitating their spread across new regions. Chikungunya, dengue, West... Read more

POC Finger-Prick Blood Test Determines Risk of Neutropenic Sepsis in Patients Undergoing Chemotherapy

Neutropenia, a decrease in neutrophils (a type of white blood cell crucial for fighting infections), is a frequent side effect of certain cancer treatments. This condition elevates the risk of infections,... Read more

First Affordable and Rapid Test for Beta Thalassemia Demonstrates 99% Diagnostic Accuracy

Hemoglobin disorders rank as some of the most prevalent monogenic diseases globally. Among various hemoglobin disorders, beta thalassemia, a hereditary blood disorder, affects about 1.5% of the world's... Read moreImmunology

view channel

Diagnostic Blood Test for Cellular Rejection after Organ Transplant Could Replace Surgical Biopsies

Transplanted organs constantly face the risk of being rejected by the recipient's immune system which differentiates self from non-self using T cells and B cells. T cells are commonly associated with acute... Read more

AI Tool Precisely Matches Cancer Drugs to Patients Using Information from Each Tumor Cell

Current strategies for matching cancer patients with specific treatments often depend on bulk sequencing of tumor DNA and RNA, which provides an average profile from all cells within a tumor sample.... Read more

Genetic Testing Combined With Personalized Drug Screening On Tumor Samples to Revolutionize Cancer Treatment

Cancer treatment typically adheres to a standard of care—established, statistically validated regimens that are effective for the majority of patients. However, the disease’s inherent variability means... Read moreMicrobiology

view channelEnhanced Rapid Syndromic Molecular Diagnostic Solution Detects Broad Range of Infectious Diseases

GenMark Diagnostics (Carlsbad, CA, USA), a member of the Roche Group (Basel, Switzerland), has rebranded its ePlex® system as the cobas eplex system. This rebranding under the globally renowned cobas name... Read more

Clinical Decision Support Software a Game-Changer in Antimicrobial Resistance Battle

Antimicrobial resistance (AMR) is a serious global public health concern that claims millions of lives every year. It primarily results from the inappropriate and excessive use of antibiotics, which reduces... Read more

New CE-Marked Hepatitis Assays to Help Diagnose Infections Earlier

According to the World Health Organization (WHO), an estimated 354 million individuals globally are afflicted with chronic hepatitis B or C. These viruses are the leading causes of liver cirrhosis, liver... Read more

1 Hour, Direct-From-Blood Multiplex PCR Test Identifies 95% of Sepsis-Causing Pathogens

Sepsis contributes to one in every three hospital deaths in the US, and globally, septic shock carries a mortality rate of 30-40%. Diagnosing sepsis early is challenging due to its non-specific symptoms... Read morePathology

view channel.jpg)

Use of DICOM Images for Pathology Diagnostics Marks Significant Step towards Standardization

Digital pathology is rapidly becoming a key aspect of modern healthcare, transforming the practice of pathology as laboratories worldwide adopt this advanced technology. Digital pathology systems allow... Read more

First of Its Kind Universal Tool to Revolutionize Sample Collection for Diagnostic Tests

The COVID pandemic has dramatically reshaped the perception of diagnostics. Post the pandemic, a groundbreaking device that combines sample collection and processing into a single, easy-to-use disposable... Read moreAI-Powered Digital Imaging System to Revolutionize Cancer Diagnosis

The process of biopsy is important for confirming the presence of cancer. In the conventional histopathology technique, tissue is excised, sliced, stained, mounted on slides, and examined under a microscope... Read more

New Mycobacterium Tuberculosis Panel to Support Real-Time Surveillance and Combat Antimicrobial Resistance

Tuberculosis (TB), the leading cause of death from an infectious disease globally, is a contagious bacterial infection that primarily spreads through the coughing of patients with active pulmonary TB.... Read moreTechnology

view channel

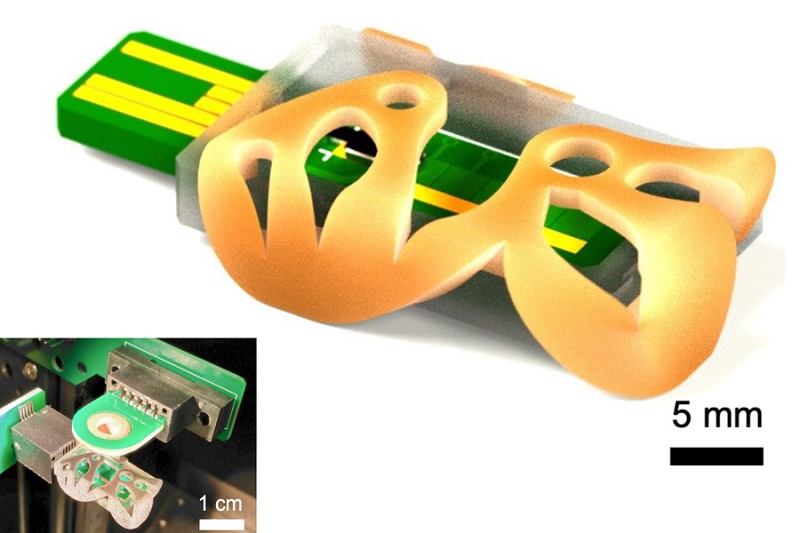

New Diagnostic System Achieves PCR Testing Accuracy

While PCR tests are the gold standard of accuracy for virology testing, they come with limitations such as complexity, the need for skilled lab operators, and longer result times. They also require complex... Read more

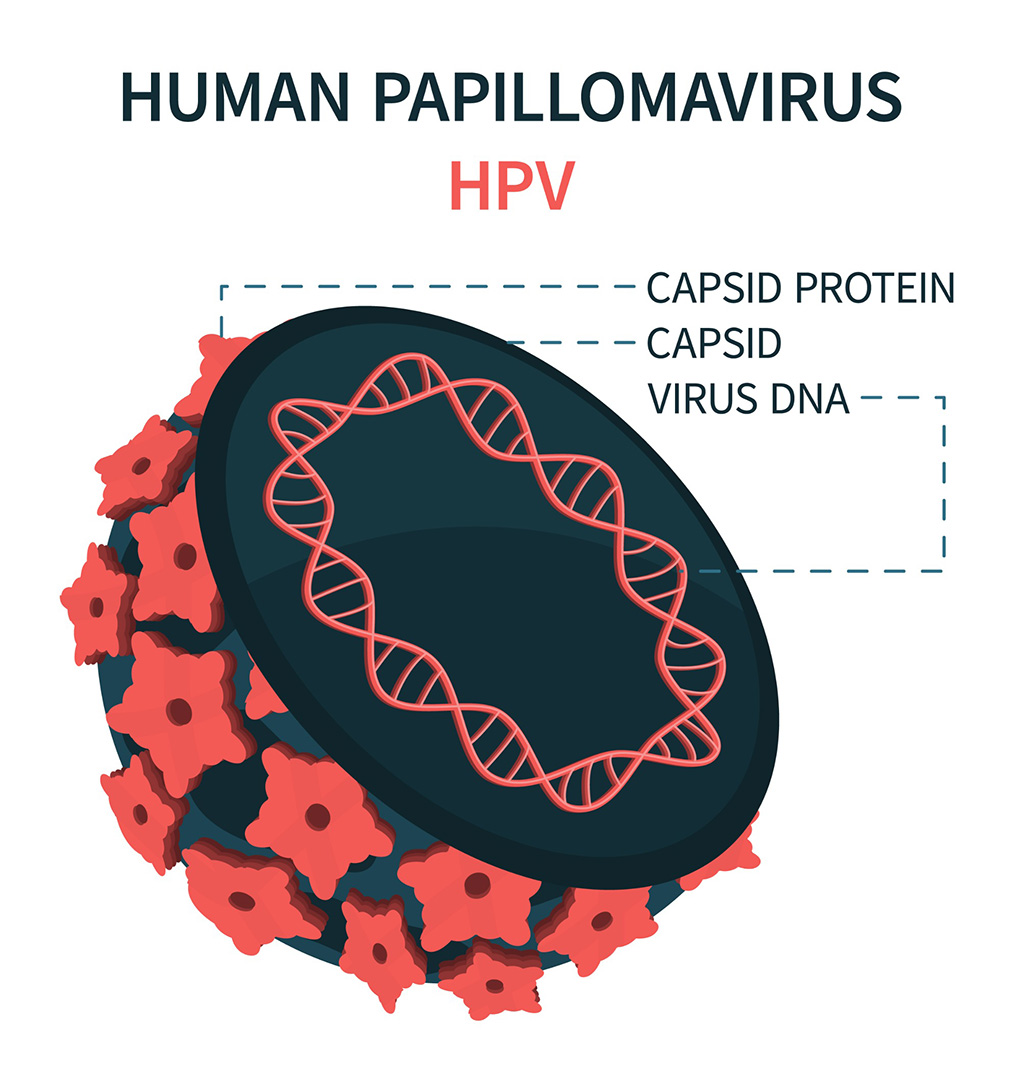

DNA Biosensor Enables Early Diagnosis of Cervical Cancer

Molybdenum disulfide (MoS2), recognized for its potential to form two-dimensional nanosheets like graphene, is a material that's increasingly catching the eye of the scientific community.... Read more

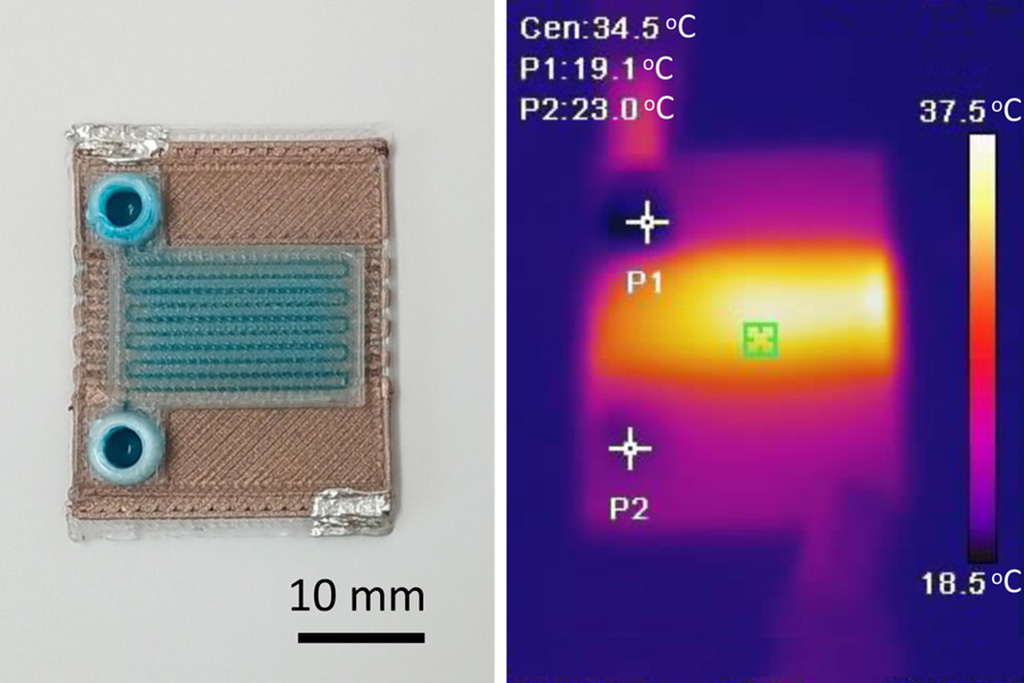

Self-Heating Microfluidic Devices Can Detect Diseases in Tiny Blood or Fluid Samples

Microfluidics, which are miniature devices that control the flow of liquids and facilitate chemical reactions, play a key role in disease detection from small samples of blood or other fluids.... Read more

Breakthrough in Diagnostic Technology Could Make On-The-Spot Testing Widely Accessible

Home testing gained significant importance during the COVID-19 pandemic, yet the availability of rapid tests is limited, and most of them can only drive one liquid across the strip, leading to continued... Read moreIndustry

view channel_1.jpg)

Thermo Fisher and Bio-Techne Enter Into Strategic Distribution Agreement for Europe

Thermo Fisher Scientific (Waltham, MA USA) has entered into a strategic distribution agreement with Bio-Techne Corporation (Minneapolis, MN, USA), resulting in a significant collaboration between two industry... Read more

ECCMID Congress Name Changes to ESCMID Global

Over the last few years, the European Society of Clinical Microbiology and Infectious Diseases (ESCMID, Basel, Switzerland) has evolved remarkably. The society is now stronger and broader than ever before... Read more