Pharmaceutical Companies Rethink Emerging Market Potential

|

By LabMedica International staff writers Posted on 05 Sep 2012 |

Pharmaceutical companies, who have earlier been dispelling the increasing fears and worries of their investors regarding the seemingly inevitable reduction in revenues upon patent expiration, may want to slow down and avoid making unrealistic guarantees. They believe that by virtue of their rapid growth and industrialization, emerging markets, including China, India, Brazil, and Russia, are the ‘happening places in terms of counteracting revenue loss due to the introduction of generic variants, according to recent market research.

However, recent market reports indicate that actual drug sales in these countries could fall short of forecasts as a result of slowing economies, intense local competition, and tight government measures geared at controlling healthcare costs and supporting domestic companies.

GlobalData (London, UK), an international market research firm, believes the recent wave of austerity in Europe could also have contributed to this development as governments are now not willing to pay as much for pills. In some cases, new laws are insisting that companies to validate the effectiveness of their drugs or risk having them cut from the coverage list, or covered at a lower rate. Accordingly, this has a ripple effect on emerging markets as their governments refer to prices set in Europe to determine their own. Analysts believe that as much as a USD 47 billion disparity could exist between what drug makers expect to make in emerging markets, and the actual realizable revenue.

The key pharmaceutical players are increasingly pursuing other options outside of the developed markets for sales growth, according to GlobalData. The maturity of the US drug market, an increase of generic drug sales, and an uncertain regulatory environment have contributed to slower revenue growth from the top 25 pharmaceutical companies, increasing by only 2.6% in 2011 to USD 259 billion. Consequently, large pharmaceutical companies including Pfizer, Merck, Sanofi, and GSK currently depend on emerging markets for a substantial share of their revenue. These markets presently account for about one-third of GSK’s annual sales and the company has declared its intention to double its revenues from China and India within the next five years.

To accomplish this, it has been increasing its sales force in emerging markets and trimming sales teams in developed markets. Pfizer’s emerging-market business yielded USD 2.6 billion in revenues in Q2 2012, up 8% from Q1 2012. GlobalData believes that the recent investments by pharmaceutical companies in mergers, acquisitions, and collaborations with generic manufacturers in emerging markets is an indication of their willingness to focus on “low-hanging fruit” and strengthen their presence in those markets instead of relying on the “high-risk, high-return” epic model. In February 2012, Merck formed a joint venture with Supera Farma Laboratorios, a Brazilian pharmaceutical company, to market, distribute, and sell generic drugs solely in Brazil. In October 2010, Pfizer spent USD 240 million in buying a 40% stake in Brazilian generics manufacturer Laboratorio Teuto Brasileiro. Meanwhile, in April 2009, Sanofi acquired Medley Pharmaceuticals, Brazil’s largest domestic generics manufacturer, for USD 600 million, giving it a 12.0% market share in Brazil at the time.

GlobalData analysts believe that although marketing drugs in emerging markets could potentially be a way to exploit the huge growth potential of countries such as China, India, and Russia, pharmaceutical companies must proceed with caution by considering the present economic climate and being more realistic in their projections. Drug sales in emerging markets are susceptible to policy changes as most hospitals and health insurance are managed by the government. Moreover, it appears doubtful that pharmaceutical companies will be able to meet some of the conditions that have been laid down by countries such as Russia. One such condition is that foreign pharmaceutical companies construct local factories before receiving the government’s approval for sale and reimbursement.

Currently, some of the companies have been reexamining their forecasts and presenting more representative data regarding sales growth. Pfizer recently cut its growth projections in emerging markets to high single digits from the low double digits predicted in early 2011. In a similar development, Eli Lilly has declared that slower growth in China and pricing pressures in certain countries are affecting sales and could have an impact on its goal of doubling 2010 emerging market sales to USD 4.6 billion in 2015. Although China, India, and Russia might be unable to claim having the world’s largest pharmaceutical companies, their economies might yet determine the fate of pharmaceutical companies worldwide.

GlobalData is a global business intelligence provider offering analytics to help clients make better, more informed decisions. The company’s research and analysis is based on the expert knowledge of over 700 business analysts and 25,000 interviews conducted with industry insiders yearly.

Related Links:

GlobalData

However, recent market reports indicate that actual drug sales in these countries could fall short of forecasts as a result of slowing economies, intense local competition, and tight government measures geared at controlling healthcare costs and supporting domestic companies.

GlobalData (London, UK), an international market research firm, believes the recent wave of austerity in Europe could also have contributed to this development as governments are now not willing to pay as much for pills. In some cases, new laws are insisting that companies to validate the effectiveness of their drugs or risk having them cut from the coverage list, or covered at a lower rate. Accordingly, this has a ripple effect on emerging markets as their governments refer to prices set in Europe to determine their own. Analysts believe that as much as a USD 47 billion disparity could exist between what drug makers expect to make in emerging markets, and the actual realizable revenue.

The key pharmaceutical players are increasingly pursuing other options outside of the developed markets for sales growth, according to GlobalData. The maturity of the US drug market, an increase of generic drug sales, and an uncertain regulatory environment have contributed to slower revenue growth from the top 25 pharmaceutical companies, increasing by only 2.6% in 2011 to USD 259 billion. Consequently, large pharmaceutical companies including Pfizer, Merck, Sanofi, and GSK currently depend on emerging markets for a substantial share of their revenue. These markets presently account for about one-third of GSK’s annual sales and the company has declared its intention to double its revenues from China and India within the next five years.

To accomplish this, it has been increasing its sales force in emerging markets and trimming sales teams in developed markets. Pfizer’s emerging-market business yielded USD 2.6 billion in revenues in Q2 2012, up 8% from Q1 2012. GlobalData believes that the recent investments by pharmaceutical companies in mergers, acquisitions, and collaborations with generic manufacturers in emerging markets is an indication of their willingness to focus on “low-hanging fruit” and strengthen their presence in those markets instead of relying on the “high-risk, high-return” epic model. In February 2012, Merck formed a joint venture with Supera Farma Laboratorios, a Brazilian pharmaceutical company, to market, distribute, and sell generic drugs solely in Brazil. In October 2010, Pfizer spent USD 240 million in buying a 40% stake in Brazilian generics manufacturer Laboratorio Teuto Brasileiro. Meanwhile, in April 2009, Sanofi acquired Medley Pharmaceuticals, Brazil’s largest domestic generics manufacturer, for USD 600 million, giving it a 12.0% market share in Brazil at the time.

GlobalData analysts believe that although marketing drugs in emerging markets could potentially be a way to exploit the huge growth potential of countries such as China, India, and Russia, pharmaceutical companies must proceed with caution by considering the present economic climate and being more realistic in their projections. Drug sales in emerging markets are susceptible to policy changes as most hospitals and health insurance are managed by the government. Moreover, it appears doubtful that pharmaceutical companies will be able to meet some of the conditions that have been laid down by countries such as Russia. One such condition is that foreign pharmaceutical companies construct local factories before receiving the government’s approval for sale and reimbursement.

Currently, some of the companies have been reexamining their forecasts and presenting more representative data regarding sales growth. Pfizer recently cut its growth projections in emerging markets to high single digits from the low double digits predicted in early 2011. In a similar development, Eli Lilly has declared that slower growth in China and pricing pressures in certain countries are affecting sales and could have an impact on its goal of doubling 2010 emerging market sales to USD 4.6 billion in 2015. Although China, India, and Russia might be unable to claim having the world’s largest pharmaceutical companies, their economies might yet determine the fate of pharmaceutical companies worldwide.

GlobalData is a global business intelligence provider offering analytics to help clients make better, more informed decisions. The company’s research and analysis is based on the expert knowledge of over 700 business analysts and 25,000 interviews conducted with industry insiders yearly.

Related Links:

GlobalData

Latest BioResearch News

- Genome Analysis Predicts Likelihood of Neurodisability in Oxygen-Deprived Newborns

- Gene Panel Predicts Disease Progession for Patients with B-cell Lymphoma

- New Method Simplifies Preparation of Tumor Genomic DNA Libraries

- New Tool Developed for Diagnosis of Chronic HBV Infection

- Panel of Genetic Loci Accurately Predicts Risk of Developing Gout

- Disrupted TGFB Signaling Linked to Increased Cancer-Related Bacteria

- Gene Fusion Protein Proposed as Prostate Cancer Biomarker

- NIV Test to Diagnose and Monitor Vascular Complications in Diabetes

- Semen Exosome MicroRNA Proves Biomarker for Prostate Cancer

- Genetic Loci Link Plasma Lipid Levels to CVD Risk

- Newly Identified Gene Network Aids in Early Diagnosis of Autism Spectrum Disorder

- Link Confirmed between Living in Poverty and Developing Diseases

- Genomic Study Identifies Kidney Disease Loci in Type I Diabetes Patients

- Liquid Biopsy More Effective for Analyzing Tumor Drug Resistance Mutations

- New Liquid Biopsy Assay Reveals Host-Pathogen Interactions

- Method Developed for Enriching Trophoblast Population in Samples

Channels

Clinical Chemistry

view channel

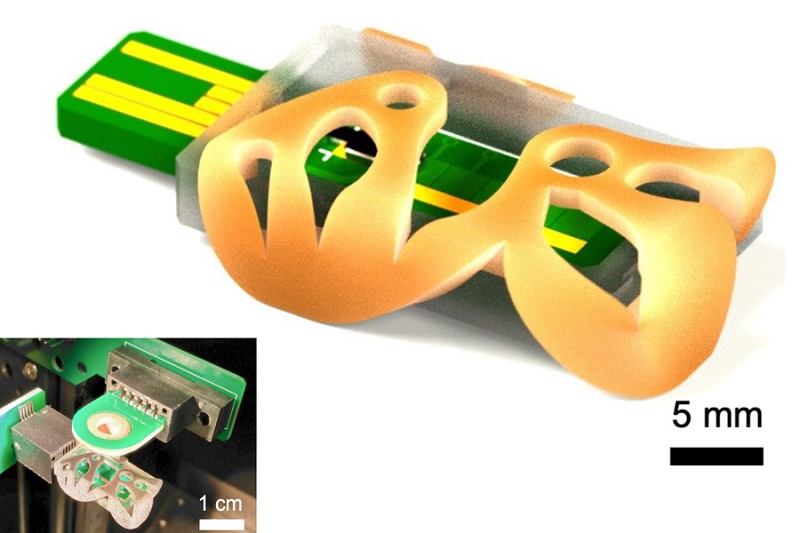

3D Printed Point-Of-Care Mass Spectrometer Outperforms State-Of-The-Art Models

Mass spectrometry is a precise technique for identifying the chemical components of a sample and has significant potential for monitoring chronic illness health states, such as measuring hormone levels... Read more.jpg)

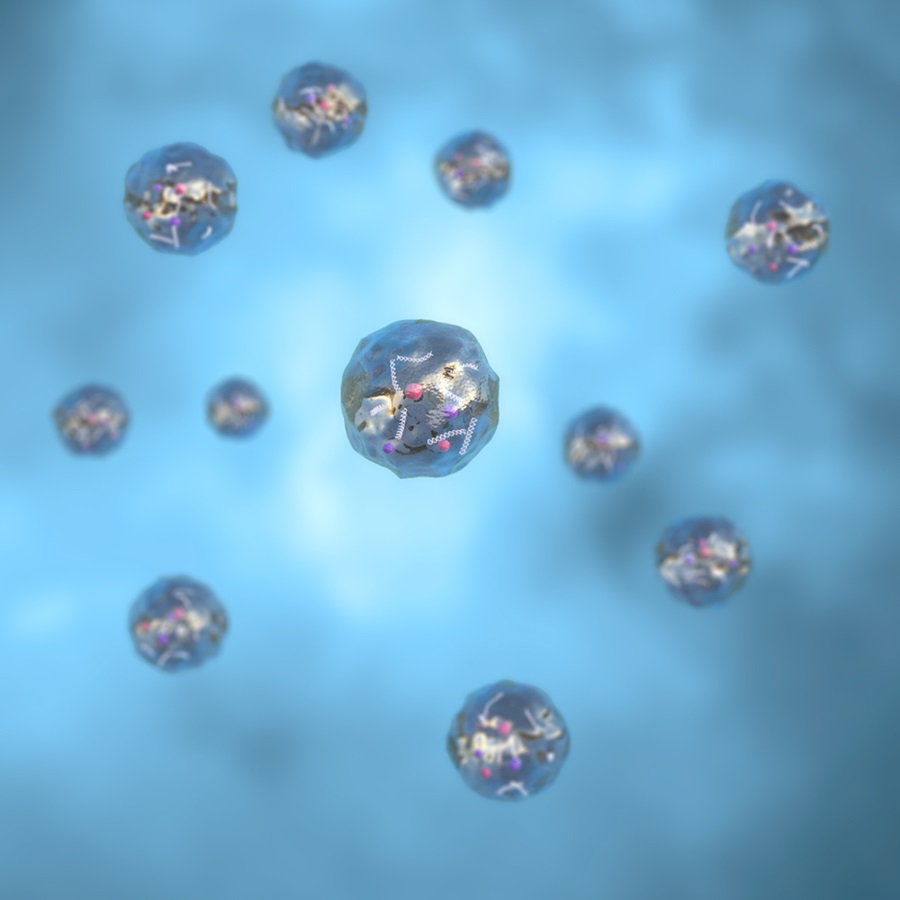

POC Biomedical Test Spins Water Droplet Using Sound Waves for Cancer Detection

Exosomes, tiny cellular bioparticles carrying a specific set of proteins, lipids, and genetic materials, play a crucial role in cell communication and hold promise for non-invasive diagnostics.... Read more

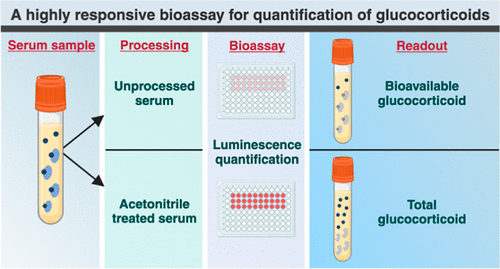

Highly Reliable Cell-Based Assay Enables Accurate Diagnosis of Endocrine Diseases

The conventional methods for measuring free cortisol, the body's stress hormone, from blood or saliva are quite demanding and require sample processing. The most common method, therefore, involves collecting... Read moreMolecular Diagnostics

view channelBlood Proteins Could Warn of Cancer Seven Years before Diagnosis

Two studies have identified proteins in the blood that could potentially alert individuals to the presence of cancer more than seven years before the disease is clinically diagnosed. Researchers found... Read moreUltrasound-Aided Blood Testing Detects Cancer Biomarkers from Cells

Ultrasound imaging serves as a noninvasive method to locate and monitor cancerous tumors effectively. However, crucial details about the cancer, such as the specific types of cells and genetic mutations... Read moreHematology

view channel

Next Generation Instrument Screens for Hemoglobin Disorders in Newborns

Hemoglobinopathies, the most widespread inherited conditions globally, affect about 7% of the population as carriers, with 2.7% of newborns being born with these conditions. The spectrum of clinical manifestations... Read more

First 4-in-1 Nucleic Acid Test for Arbovirus Screening to Reduce Risk of Transfusion-Transmitted Infections

Arboviruses represent an emerging global health threat, exacerbated by climate change and increased international travel that is facilitating their spread across new regions. Chikungunya, dengue, West... Read more

POC Finger-Prick Blood Test Determines Risk of Neutropenic Sepsis in Patients Undergoing Chemotherapy

Neutropenia, a decrease in neutrophils (a type of white blood cell crucial for fighting infections), is a frequent side effect of certain cancer treatments. This condition elevates the risk of infections,... Read more

First Affordable and Rapid Test for Beta Thalassemia Demonstrates 99% Diagnostic Accuracy

Hemoglobin disorders rank as some of the most prevalent monogenic diseases globally. Among various hemoglobin disorders, beta thalassemia, a hereditary blood disorder, affects about 1.5% of the world's... Read moreImmunology

view channel.jpg)

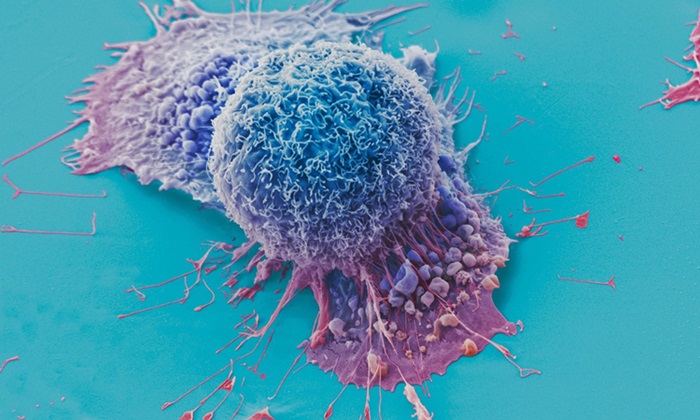

AI Predicts Tumor-Killing Cells with High Accuracy

Cellular immunotherapy involves extracting immune cells from a patient's tumor, potentially enhancing their cancer-fighting capabilities through engineering, and then expanding and reintroducing them into the body.... Read more

Diagnostic Blood Test for Cellular Rejection after Organ Transplant Could Replace Surgical Biopsies

Transplanted organs constantly face the risk of being rejected by the recipient's immune system which differentiates self from non-self using T cells and B cells. T cells are commonly associated with acute... Read more

AI Tool Precisely Matches Cancer Drugs to Patients Using Information from Each Tumor Cell

Current strategies for matching cancer patients with specific treatments often depend on bulk sequencing of tumor DNA and RNA, which provides an average profile from all cells within a tumor sample.... Read more

Genetic Testing Combined With Personalized Drug Screening On Tumor Samples to Revolutionize Cancer Treatment

Cancer treatment typically adheres to a standard of care—established, statistically validated regimens that are effective for the majority of patients. However, the disease’s inherent variability means... Read moreMicrobiology

view channel

Integrated Solution Ushers New Era of Automated Tuberculosis Testing

Tuberculosis (TB) is responsible for 1.3 million deaths every year, positioning it as one of the top killers globally due to a single infectious agent. In 2022, around 10.6 million people were diagnosed... Read more

Automated Sepsis Test System Enables Rapid Diagnosis for Patients with Severe Bloodstream Infections

Sepsis affects up to 50 million people globally each year, with bacteraemia, formerly known as blood poisoning, being a major cause. In the United States alone, approximately two million individuals are... Read moreEnhanced Rapid Syndromic Molecular Diagnostic Solution Detects Broad Range of Infectious Diseases

GenMark Diagnostics (Carlsbad, CA, USA), a member of the Roche Group (Basel, Switzerland), has rebranded its ePlex® system as the cobas eplex system. This rebranding under the globally renowned cobas name... Read more

Clinical Decision Support Software a Game-Changer in Antimicrobial Resistance Battle

Antimicrobial resistance (AMR) is a serious global public health concern that claims millions of lives every year. It primarily results from the inappropriate and excessive use of antibiotics, which reduces... Read morePathology

view channelHyperspectral Dark-Field Microscopy Enables Rapid and Accurate Identification of Cancerous Tissues

Breast cancer remains a major cause of cancer-related mortality among women. Breast-conserving surgery (BCS), also known as lumpectomy, is the removal of the cancerous lump and a small margin of surrounding tissue.... Read more

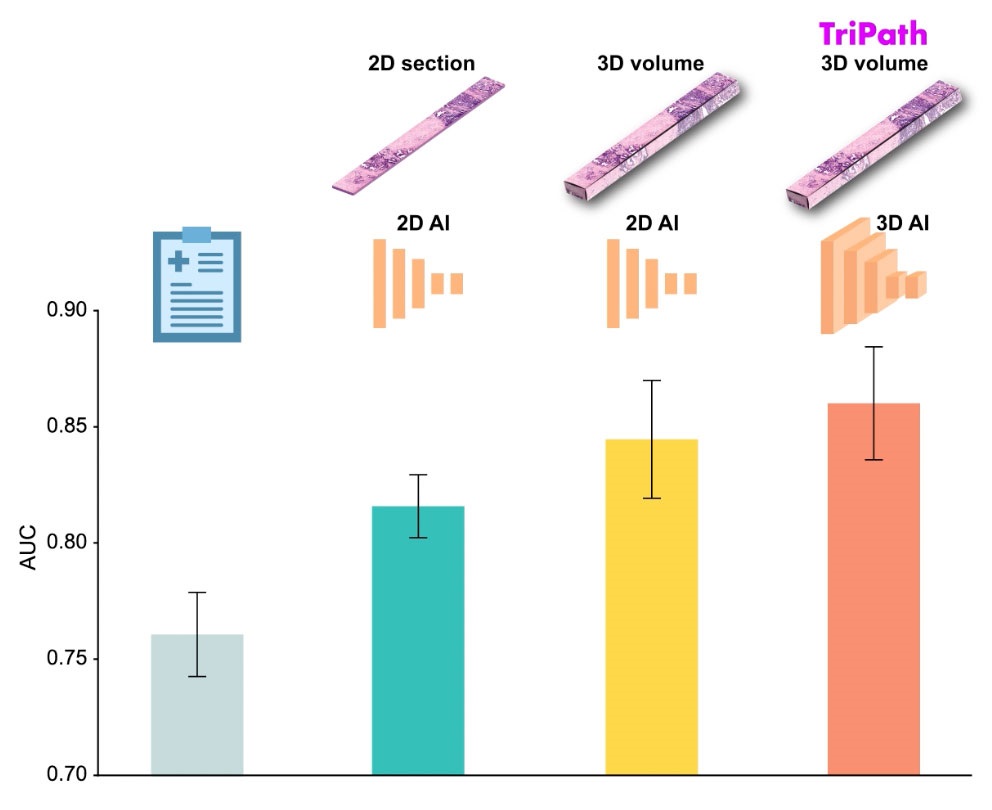

AI Advancements Enable Leap into 3D Pathology

Human tissue is complex, intricate, and naturally three-dimensional. However, the thin two-dimensional tissue slices commonly used by pathologists to diagnose diseases provide only a limited view of the... Read more

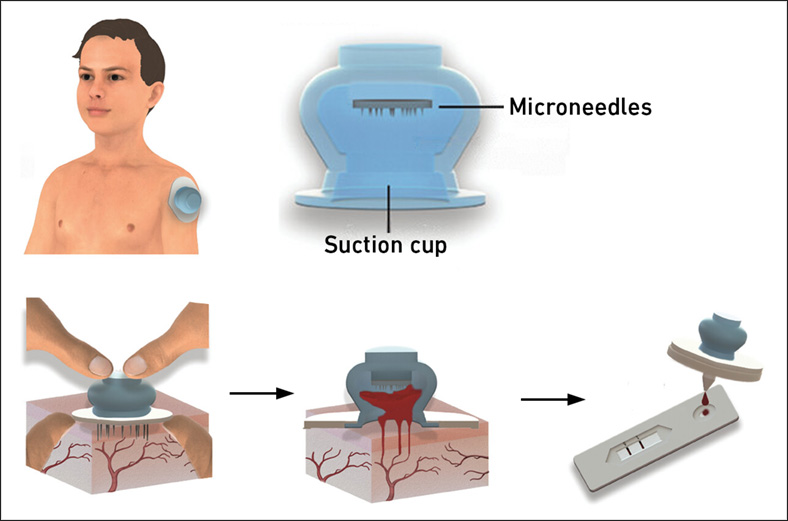

New Blood Test Device Modeled on Leeches to Help Diagnose Malaria

Many individuals have a fear of needles, making the experience of having blood drawn from their arm particularly distressing. An alternative method involves taking blood from the fingertip or earlobe,... Read more

Robotic Blood Drawing Device to Revolutionize Sample Collection for Diagnostic Testing

Blood drawing is performed billions of times each year worldwide, playing a critical role in diagnostic procedures. Despite its importance, clinical laboratories are dealing with significant staff shortages,... Read moreTechnology

view channel

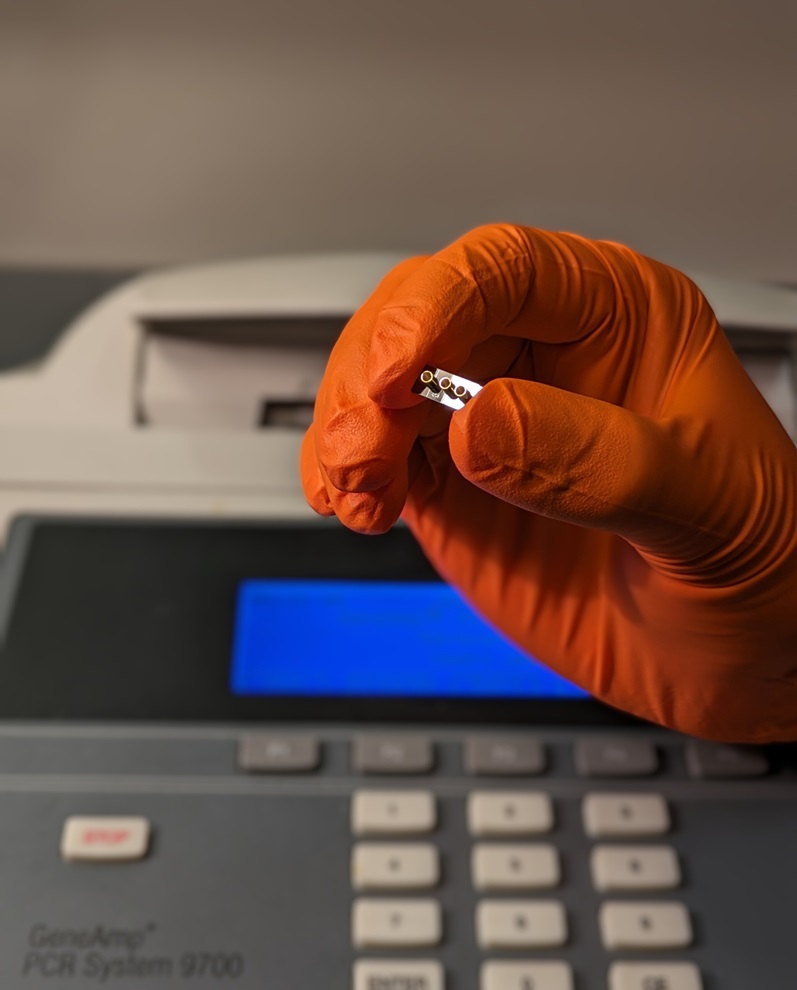

New Diagnostic System Achieves PCR Testing Accuracy

While PCR tests are the gold standard of accuracy for virology testing, they come with limitations such as complexity, the need for skilled lab operators, and longer result times. They also require complex... Read more

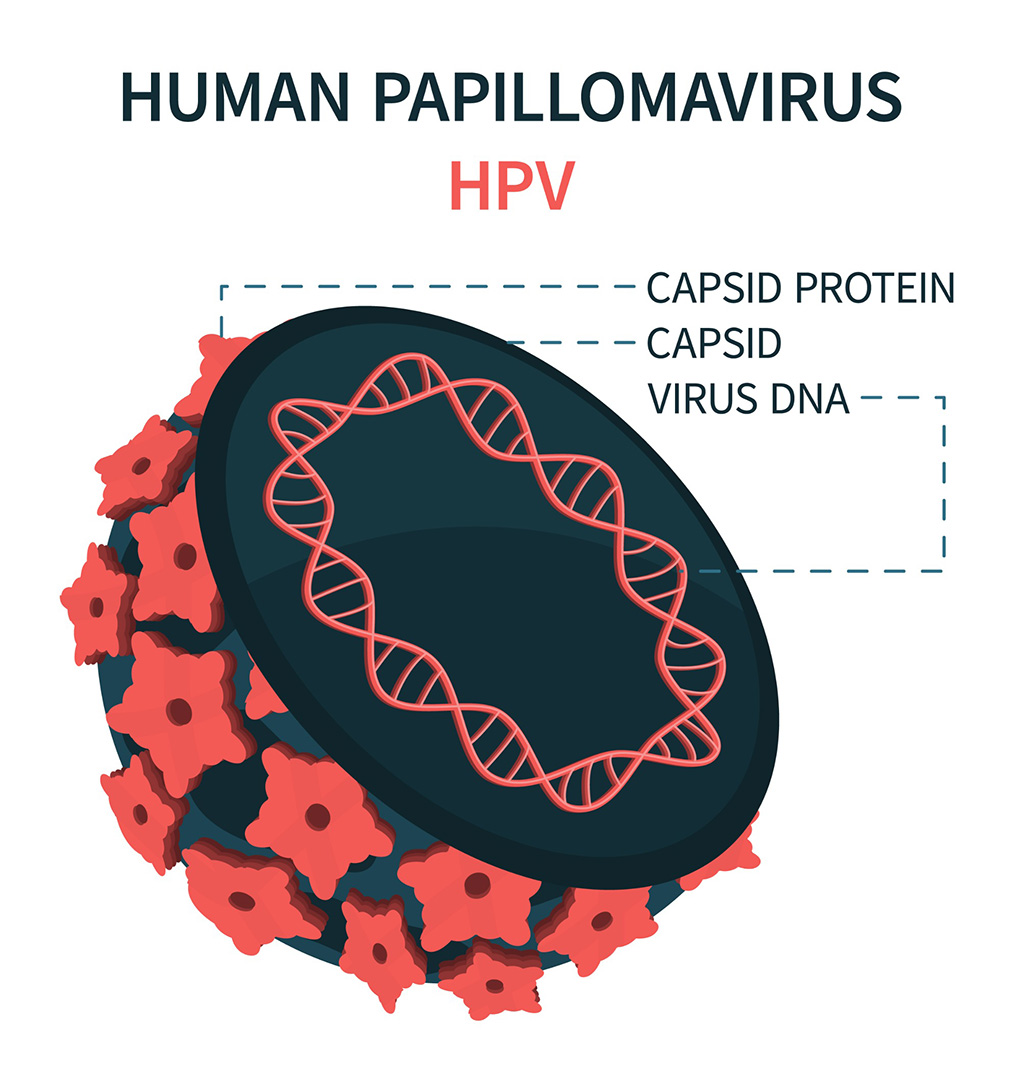

DNA Biosensor Enables Early Diagnosis of Cervical Cancer

Molybdenum disulfide (MoS2), recognized for its potential to form two-dimensional nanosheets like graphene, is a material that's increasingly catching the eye of the scientific community.... Read more

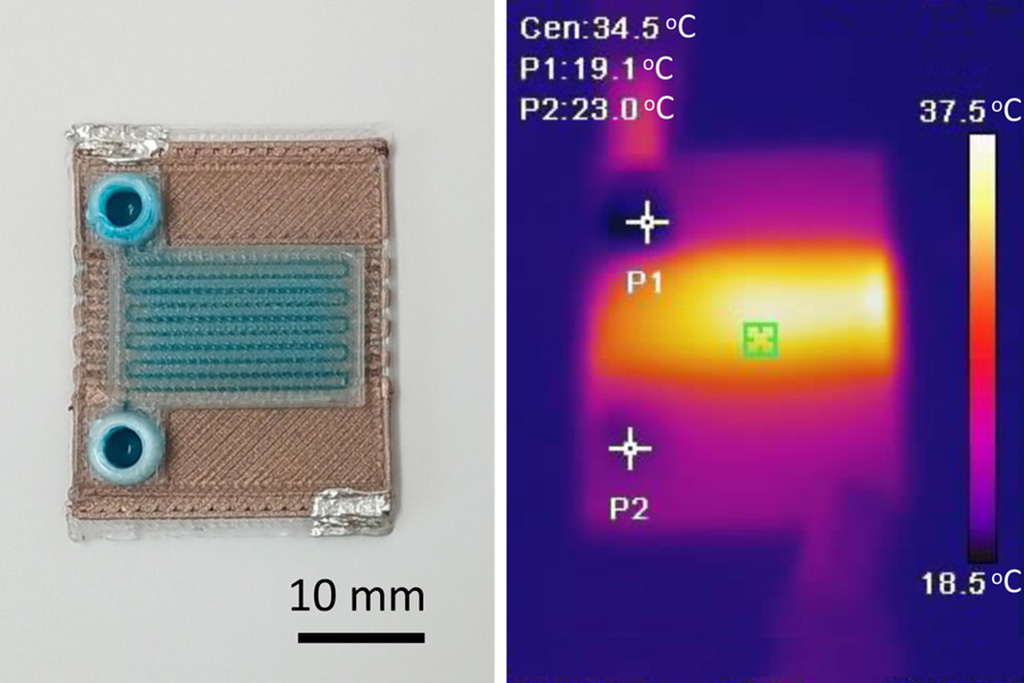

Self-Heating Microfluidic Devices Can Detect Diseases in Tiny Blood or Fluid Samples

Microfluidics, which are miniature devices that control the flow of liquids and facilitate chemical reactions, play a key role in disease detection from small samples of blood or other fluids.... Read more

Breakthrough in Diagnostic Technology Could Make On-The-Spot Testing Widely Accessible

Home testing gained significant importance during the COVID-19 pandemic, yet the availability of rapid tests is limited, and most of them can only drive one liquid across the strip, leading to continued... Read moreIndustry

view channel

Danaher and Johns Hopkins University Collaborate to Improve Neurological Diagnosis

Unlike severe traumatic brain injury (TBI), mild TBI often does not show clear correlations with abnormalities detected through head computed tomography (CT) scans. Consequently, there is a pressing need... Read more

Beckman Coulter and MeMed Expand Host Immune Response Diagnostics Partnership

Beckman Coulter Diagnostics (Brea, CA, USA) and MeMed BV (Haifa, Israel) have expanded their host immune response diagnostics partnership. Beckman Coulter is now an authorized distributor of the MeMed... Read more_1.jpg)

_1.jpg)

.jpg)