Clinical Lab Services Industry Endeavors to Overcome Reimbursement Cuts

|

By LabMedica International staff writers Posted on 27 Jan 2014 |

The world market for clinical laboratory services grew just over one percent in the past five years, according to healthcare market research publisher Kalorama Information (New York, NY, USA). The market was estimated at USD 99.1 billion for 2013, up 1.3% from the estimated value in 2008 of USD 92.7 billion in its new report.

Kalorama reported that there are a number of drivers for this market such as aging populations, a growing incidence of chronic diseases, increasing emphasis on diagnosis and disease monitoring, and a growth in advanced testing technologies and practices. However, there are also a number of inhibitors to growth such as the increasing effort to reduce health costs and uncertain economic conditions, and these are dampening growth.

“Today, clinical laboratories are improving a physician’s ability to treat patients like never before,” said Melissa Elder, analyst for Kalorama Information and the author of the report. “ There is a shift in healthcare utilization primarily due to reducing healthcare spending which makes the laboratory an even more valuable part of the treatment plan. But cost-cutting measures mean tests may not see the benefits of hospital-stay reducing factors.”

In the United States, the US Congress ultimately has the responsibility to adjust the Medicare fee schedule according to economic factors, including controlling costs, monitoring utilization, and ensuring adequate delivery of health care services. The passing of the Patient Protection and Affordable Care Act generated a number of provisions on laboratory fee schedules, mostly in the direction of reductions. These reductions were effective starting 2011 and will continue to be adjusted through 2015. Medicare slashed reimbursement amounts for many common tests such as Vitamin B12, triglycerides, and glucose nearly six percent between 2009 and 2013. Some tests, such as total iron or aluminum tests have been cut 19% and 30% respectively during that period. “As the world’s largest healthcare market, the US cuts are affecting the larger global market,” Melissa Elder noted.

Leaders in the industry include Bio-Reference Labs, Quest, Lab Corp, Myriad, and Spectra. Quest Diagnostics and LabCorp have advantages in the market due to the wide exposure, large number of locations, and greater financial positions. Smaller, independent laboratories could find it difficult to keep up with the fast changing industry largely due to limited financial abilities to invest in new technologies and testing services. Some laboratories, such as Bio-Reference Labs have found success in operating on a regional basis while companies such as Myriad Genetics and Genomic Health remain competitive by focusing on more specialized genetic-based testing. The new report includes more information on these markets including segment estimates and corporate profiles.

Kalorama Information is a division of MarketResearch dot com. It supplies the latest in independent medical market research in diagnostics, biotech, pharmaceuticals, medical devices, and healthcare. It also provides a full range of custom research services. In addition, the publishing company routinely assists the media with healthcare topics.

Related Links:

Kalorama Information

Kalorama reported that there are a number of drivers for this market such as aging populations, a growing incidence of chronic diseases, increasing emphasis on diagnosis and disease monitoring, and a growth in advanced testing technologies and practices. However, there are also a number of inhibitors to growth such as the increasing effort to reduce health costs and uncertain economic conditions, and these are dampening growth.

“Today, clinical laboratories are improving a physician’s ability to treat patients like never before,” said Melissa Elder, analyst for Kalorama Information and the author of the report. “ There is a shift in healthcare utilization primarily due to reducing healthcare spending which makes the laboratory an even more valuable part of the treatment plan. But cost-cutting measures mean tests may not see the benefits of hospital-stay reducing factors.”

In the United States, the US Congress ultimately has the responsibility to adjust the Medicare fee schedule according to economic factors, including controlling costs, monitoring utilization, and ensuring adequate delivery of health care services. The passing of the Patient Protection and Affordable Care Act generated a number of provisions on laboratory fee schedules, mostly in the direction of reductions. These reductions were effective starting 2011 and will continue to be adjusted through 2015. Medicare slashed reimbursement amounts for many common tests such as Vitamin B12, triglycerides, and glucose nearly six percent between 2009 and 2013. Some tests, such as total iron or aluminum tests have been cut 19% and 30% respectively during that period. “As the world’s largest healthcare market, the US cuts are affecting the larger global market,” Melissa Elder noted.

Leaders in the industry include Bio-Reference Labs, Quest, Lab Corp, Myriad, and Spectra. Quest Diagnostics and LabCorp have advantages in the market due to the wide exposure, large number of locations, and greater financial positions. Smaller, independent laboratories could find it difficult to keep up with the fast changing industry largely due to limited financial abilities to invest in new technologies and testing services. Some laboratories, such as Bio-Reference Labs have found success in operating on a regional basis while companies such as Myriad Genetics and Genomic Health remain competitive by focusing on more specialized genetic-based testing. The new report includes more information on these markets including segment estimates and corporate profiles.

Kalorama Information is a division of MarketResearch dot com. It supplies the latest in independent medical market research in diagnostics, biotech, pharmaceuticals, medical devices, and healthcare. It also provides a full range of custom research services. In addition, the publishing company routinely assists the media with healthcare topics.

Related Links:

Kalorama Information

Latest Industry News

- AI-Powered Cervical Cancer Test Set for Major Rollout in Latin America

- New Collaboration Brings Automated Mass Spectrometry to Routine Laboratory Testing

- Diasorin and Fisher Scientific Enter into US Distribution Agreement for Molecular POC Platform

- WHX Labs Dubai to Gather Global Experts in Antimicrobial Resistance at Inaugural AMR Leaders’ Summit

- BD and Penn Institute Collaborate to Advance Immunotherapy through Flow Cytometry

- Abbott Acquires Cancer-Screening Company Exact Sciences

- Roche and Freenome Collaborate to Develop Cancer Screening Tests

- Co-Diagnostics Forms New Business Unit to Develop AI-Powered Diagnostics

- Qiagen Acquires Single-Cell Omics Firm Parse Biosciences

- Puritan Medical Products Showcasing Innovation at AMP2025 in Boston

- Advanced Instruments Merged Under Nova Biomedical Name

- Bio-Rad and Biodesix Partner to Develop Droplet Digital PCR High Complexity Assays

- Hologic to be Acquired by Blackstone and TPG

- Bio-Techne and Oxford Nanopore to Accelerate Development of Genetics Portfolio

- Terumo BCT and Hemex Health Collaborate to Improve Access to Testing for Hemoglobin Disorders

- Revvity and Sanofi Collaborate on Program to Revolutionize Early Detection of Type 1 Diabetes

Channels

Clinical Chemistry

view channel

New PSA-Based Prognostic Model Improves Prostate Cancer Risk Assessment

Prostate cancer is the second-leading cause of cancer death among American men, and about one in eight will be diagnosed in their lifetime. Screening relies on blood levels of prostate-specific antigen... Read more

Extracellular Vesicles Linked to Heart Failure Risk in CKD Patients

Chronic kidney disease (CKD) affects more than 1 in 7 Americans and is strongly associated with cardiovascular complications, which account for more than half of deaths among people with CKD.... Read moreMolecular Diagnostics

view channel

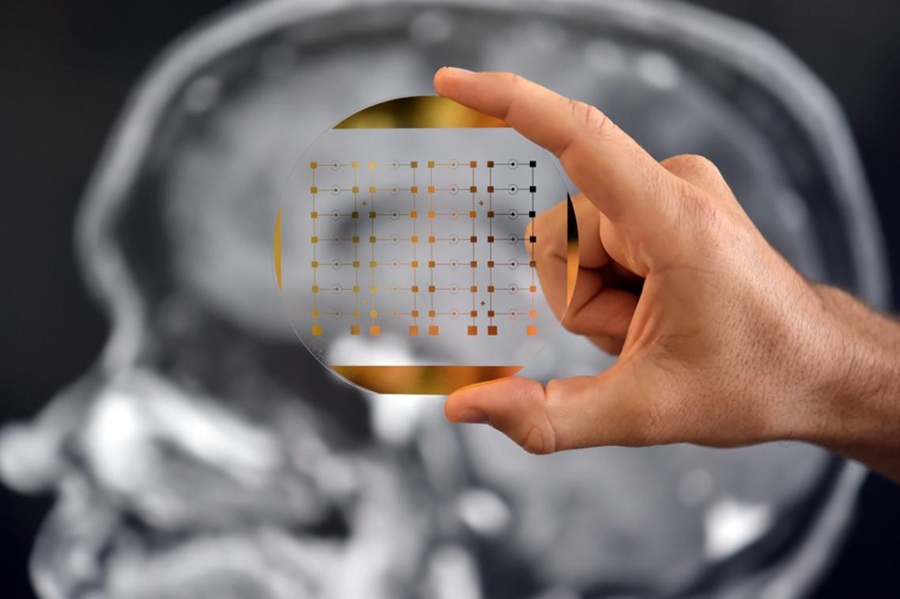

Diagnostic Device Predicts Treatment Response for Brain Tumors Via Blood Test

Glioblastoma is one of the deadliest forms of brain cancer, largely because doctors have no reliable way to determine whether treatments are working in real time. Assessing therapeutic response currently... Read more

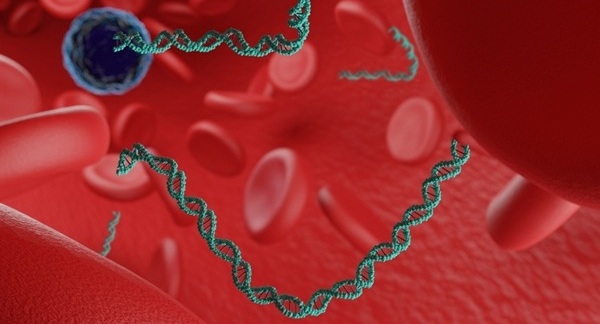

Blood Test Detects Early-Stage Cancers by Measuring Epigenetic Instability

Early-stage cancers are notoriously difficult to detect because molecular changes are subtle and often missed by existing screening tools. Many liquid biopsies rely on measuring absolute DNA methylation... Read more

“Lab-On-A-Disc” Device Paves Way for More Automated Liquid Biopsies

Extracellular vesicles (EVs) are tiny particles released by cells into the bloodstream that carry molecular information about a cell’s condition, including whether it is cancerous. However, EVs are highly... Read more

Blood Test Identifies Inflammatory Breast Cancer Patients at Increased Risk of Brain Metastasis

Brain metastasis is a frequent and devastating complication in patients with inflammatory breast cancer, an aggressive subtype with limited treatment options. Despite its high incidence, the biological... Read moreHematology

view channel

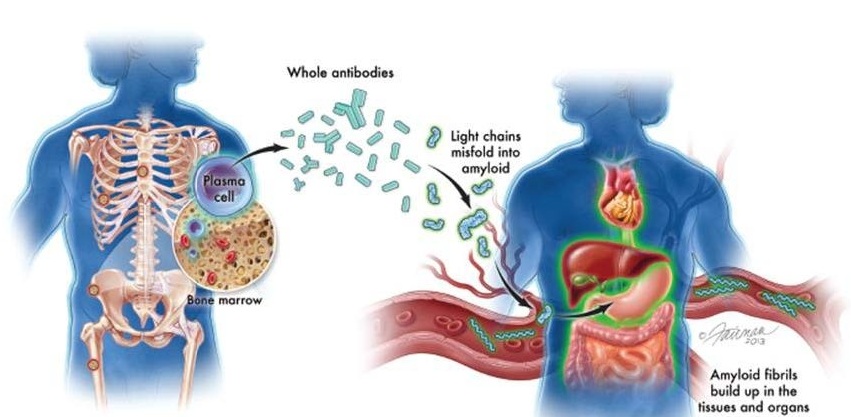

New Guidelines Aim to Improve AL Amyloidosis Diagnosis

Light chain (AL) amyloidosis is a rare, life-threatening bone marrow disorder in which abnormal amyloid proteins accumulate in organs. Approximately 3,260 people in the United States are diagnosed... Read more

Fast and Easy Test Could Revolutionize Blood Transfusions

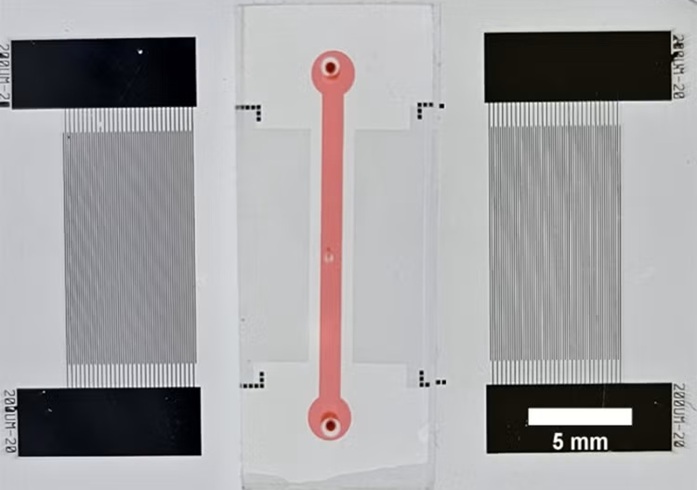

Blood transfusions are a cornerstone of modern medicine, yet red blood cells can deteriorate quietly while sitting in cold storage for weeks. Although blood units have a fixed expiration date, cells from... Read more

Automated Hemostasis System Helps Labs of All Sizes Optimize Workflow

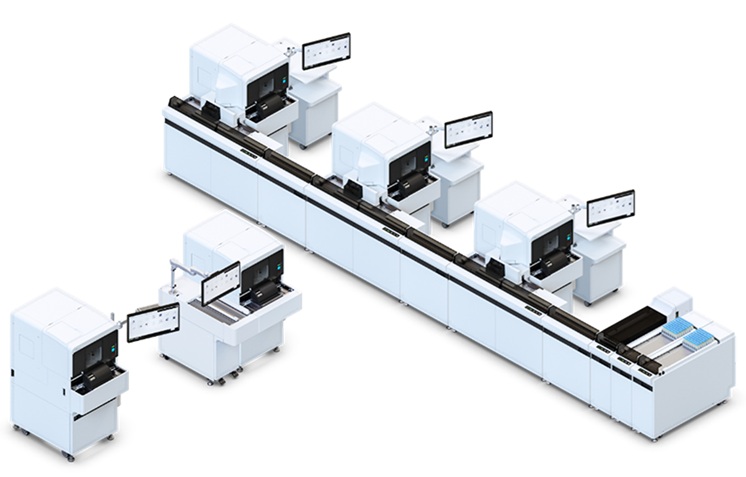

High-volume hemostasis sections must sustain rapid turnaround while managing reruns and reflex testing. Manual tube handling and preanalytical checks can strain staff time and increase opportunities for error.... Read more

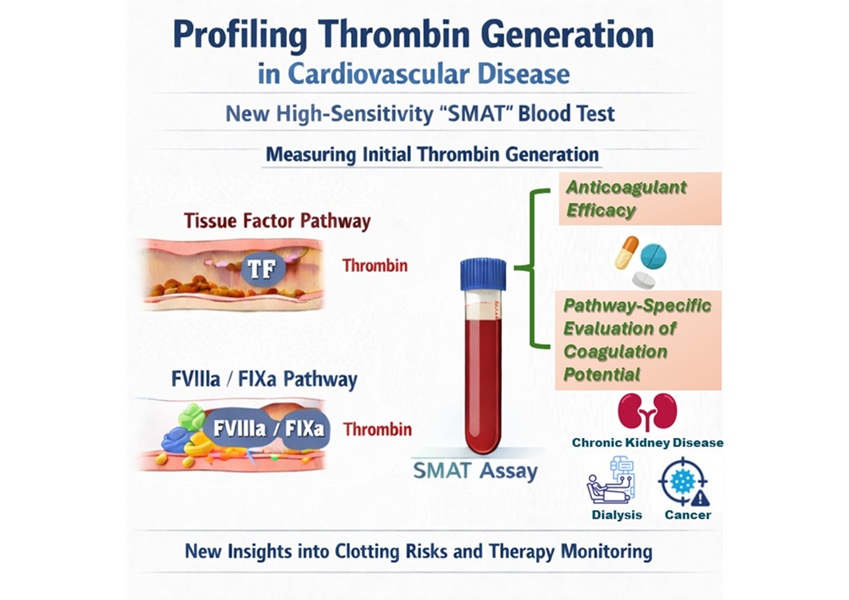

High-Sensitivity Blood Test Improves Assessment of Clotting Risk in Heart Disease Patients

Blood clotting is essential for preventing bleeding, but even small imbalances can lead to serious conditions such as thrombosis or dangerous hemorrhage. In cardiovascular disease, clinicians often struggle... Read moreImmunology

view channelBlood Test Identifies Lung Cancer Patients Who Can Benefit from Immunotherapy Drug

Small cell lung cancer (SCLC) is an aggressive disease with limited treatment options, and even newly approved immunotherapies do not benefit all patients. While immunotherapy can extend survival for some,... Read more

Whole-Genome Sequencing Approach Identifies Cancer Patients Benefitting From PARP-Inhibitor Treatment

Targeted cancer therapies such as PARP inhibitors can be highly effective, but only for patients whose tumors carry specific DNA repair defects. Identifying these patients accurately remains challenging,... Read more

Ultrasensitive Liquid Biopsy Demonstrates Efficacy in Predicting Immunotherapy Response

Immunotherapy has transformed cancer treatment, but only a small proportion of patients experience lasting benefit, with response rates often remaining between 10% and 20%. Clinicians currently lack reliable... Read moreMicrobiology

view channel

Comprehensive Review Identifies Gut Microbiome Signatures Associated With Alzheimer’s Disease

Alzheimer’s disease affects approximately 6.7 million people in the United States and nearly 50 million worldwide, yet early cognitive decline remains difficult to characterize. Increasing evidence suggests... Read moreAI-Powered Platform Enables Rapid Detection of Drug-Resistant C. Auris Pathogens

Infections caused by the pathogenic yeast Candida auris pose a significant threat to hospitalized patients, particularly those with weakened immune systems or those who have invasive medical devices.... Read morePathology

view channel

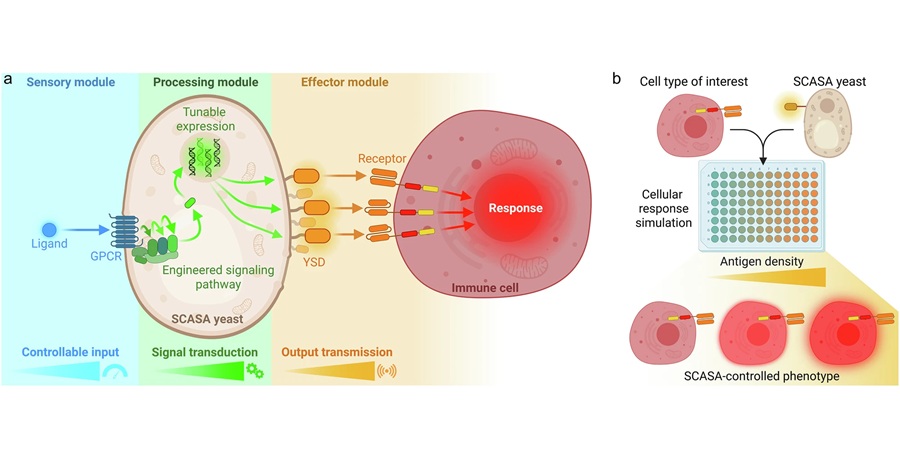

Engineered Yeast Cells Enable Rapid Testing of Cancer Immunotherapy

Developing new cancer immunotherapies is a slow, costly, and high-risk process, particularly for CAR T cell treatments that must precisely recognize cancer-specific antigens. Small differences in tumor... Read more

First-Of-Its-Kind Test Identifies Autism Risk at Birth

Autism spectrum disorder is treatable, and extensive research shows that early intervention can significantly improve cognitive, social, and behavioral outcomes. Yet in the United States, the average age... Read moreTechnology

view channel

Robotic Technology Unveiled for Automated Diagnostic Blood Draws

Routine diagnostic blood collection is a high‑volume task that can strain staffing and introduce human‑dependent variability, with downstream implications for sample quality and patient experience.... Read more

ADLM Launches First-of-Its-Kind Data Science Program for Laboratory Medicine Professionals

Clinical laboratories generate billions of test results each year, creating a treasure trove of data with the potential to support more personalized testing, improve operational efficiency, and enhance patient care.... Read moreAptamer Biosensor Technology to Transform Virus Detection

Rapid and reliable virus detection is essential for controlling outbreaks, from seasonal influenza to global pandemics such as COVID-19. Conventional diagnostic methods, including cell culture, antigen... Read more