Proteomics Products May Reach $1.7 Billion by 2006

By Biotechdaily staff writers

Posted on 20 May 2002

By 2006, total revenues of proteomics-related products are forecast to approach US$1.7 billion, according to a new report from Business Communications Co. (Proteomics: An Assessment of Technology and Commercial Potential, BCI, Inc., Norwalk, CT, USA). Since revenues for selected proteomics products totaled $720 million in 2001, the 2006 forecast would represent an average annual growth rate (AAGR) of just over 18%. This growth is largely due to a boom in scientific discoveries stemming from the human genome project and from advances in high-throughput technologies for protein studies. Other contributing factors are increases in funding for research and an increased interest in drug discovery from pharmaceutical and biotechnology companies. Posted on 20 May 2002

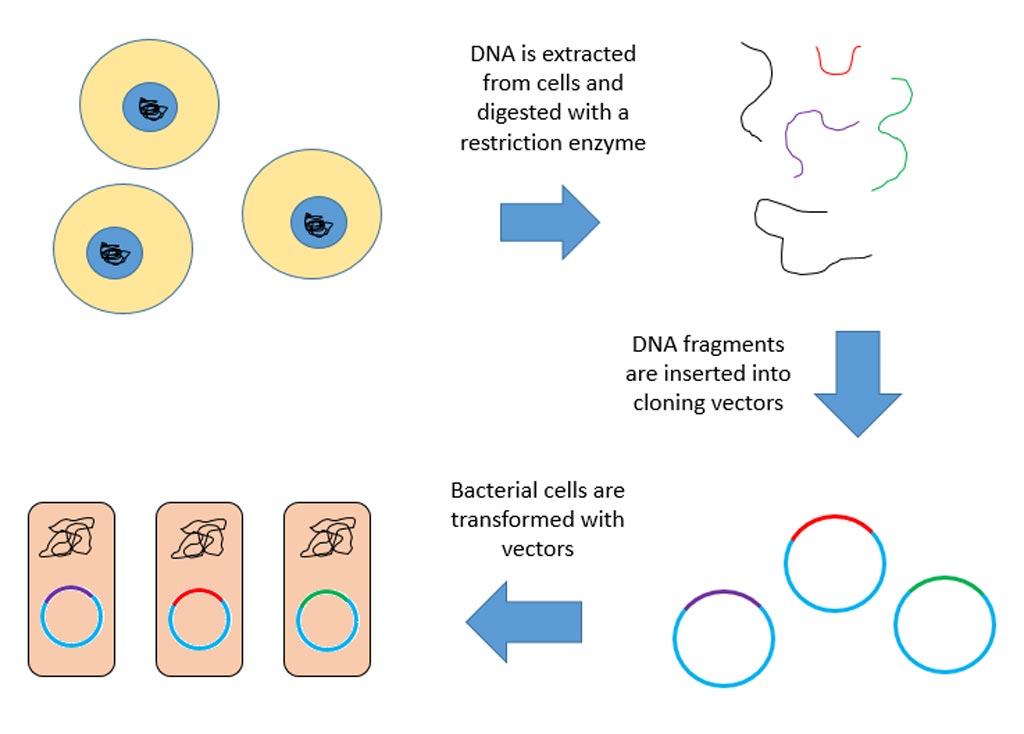

Today, researchers can analyze protein expression in an entire cell rather than studying individual proteins, notes the report. Newer techniques allow scientists to isolate proteins and identify them more quickly. The development of new technologies for studying proteins has led to a rapid growth in industries supplying instruments and reagents for proteomics studies. In turn, this had made a variety of products easily available from companies eager to compete in the new market.

The market for mass spectroscopy for proteomics represents more than 40% of the total market and is forecast to double in five years, from $300 million in 2001 to $603 million by 2006. The nascent market for protein chips and bioinformatics is expected to rise from $114 million in 2001 to $275 million in 2006. Two-dimensional electrophoresis will see lower growth (11%), while capillary electrophoresis will rise at an AAGR of over 15% during the period.

Factors influencing the growth of the market for drug delivery instruments and services include the continuing investments of national governments into technology-based companies and technology-based not-for-profit research, the push by big pharmaceutical companies to fill their blockbuster pipelines, and efforts by small biotechnology companies to become bigger companies. As all of these groups continue their efforts, says BCC, they will in turn drive the development of new instruments and new technologies.

Related Links:

BCC