Top Drivers of Global Laboratory Centrifuge Market

|

By LabMedica International staff writers Posted on 29 Jan 2018 |

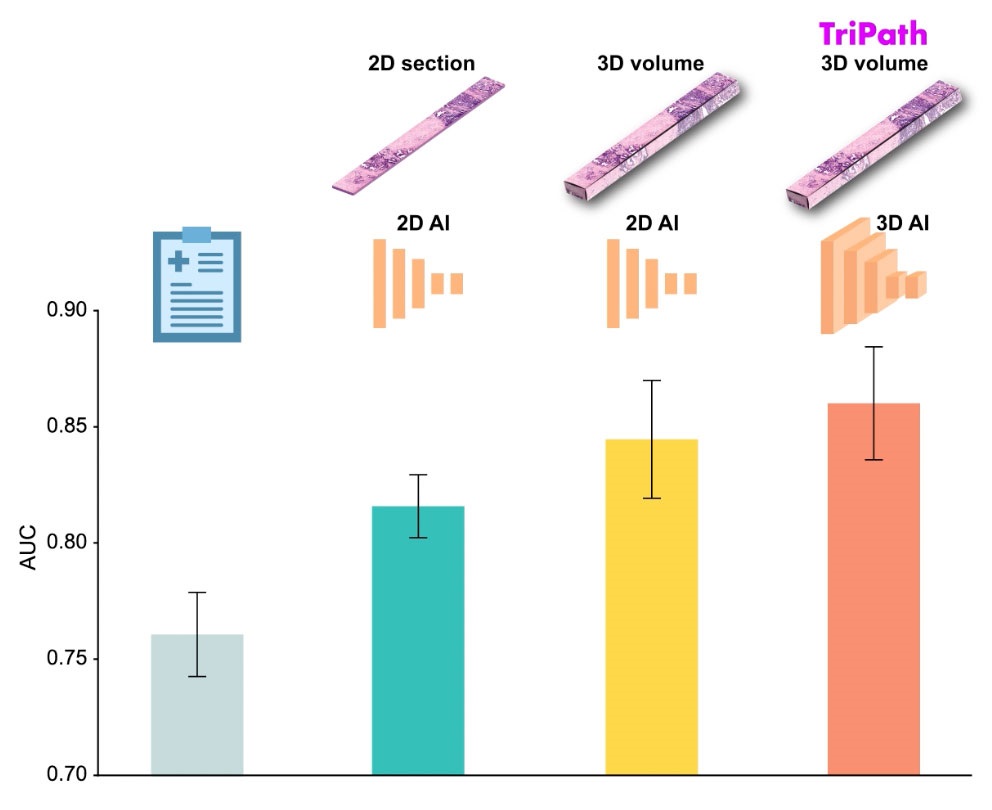

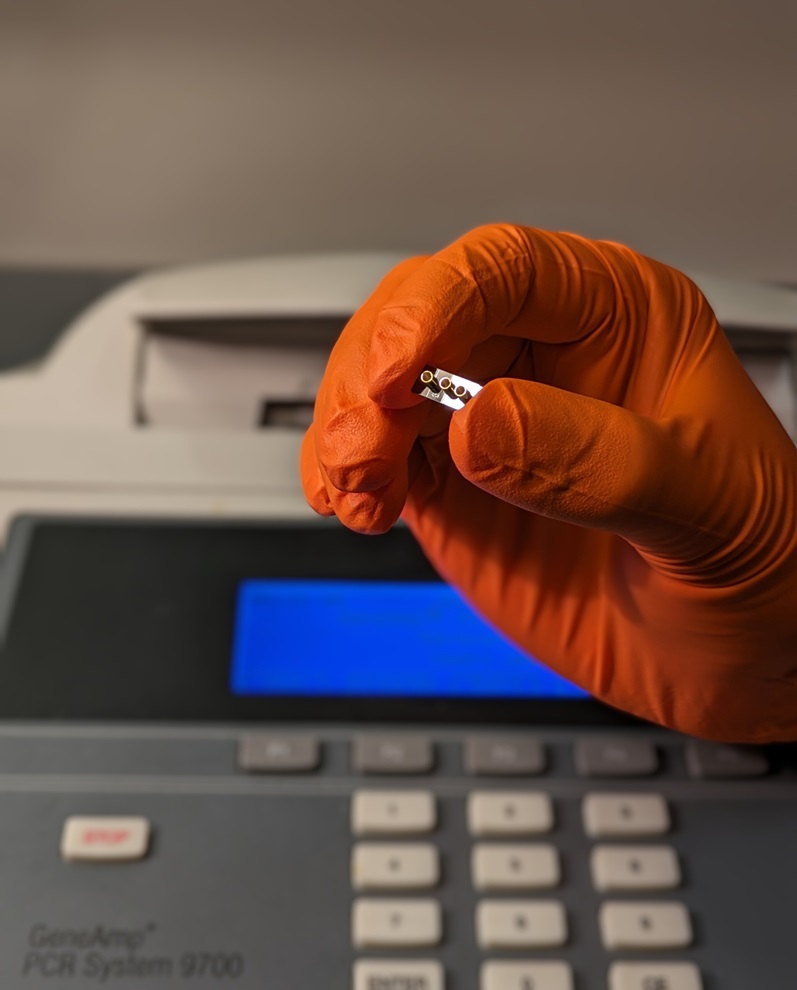

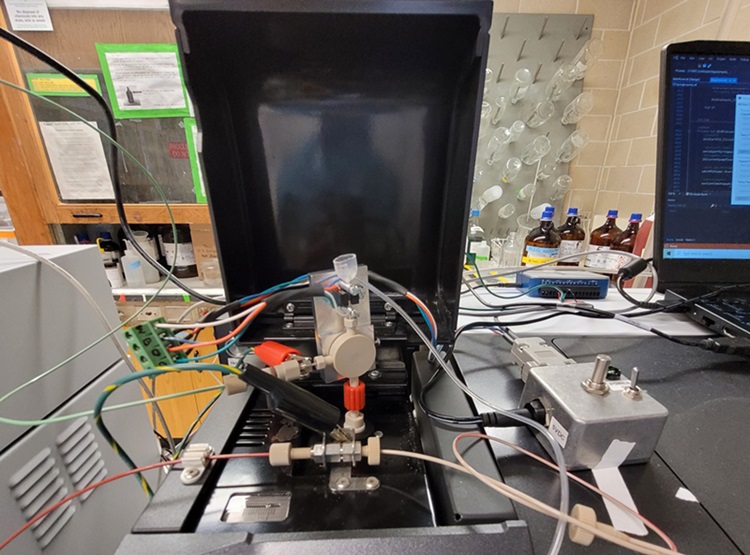

Image: The global laboratory centrifuge market is expected to grow steadily during the forecast period 2017-2022, driven by three main factors (Photo courtesy of Technavio Research).

The global laboratory centrifuge market is expected to grow steadily at a CAGR of more than 5% during the forecast period 2017-2022, driven mainly by the increasing number of biotechnology and pharmaceutical research studies, growing use of molecular diagnostics in hospitals, and technological advancements.

These are the latest findings of Technavio Research, (London, UK), a global technology research and advisory company.

Increasing number of biotechnology and pharmaceutical research studies

The biotechnology and pharmaceutical sector is being driven by a large unmet demand for the medical needs of the people. These industries are recording consistent growth owing to the advent of new diseases and continuous drug discovery. Since innovations require better treatments and product delivery, research in these sectors acts as a backbone for these industries.

Increasing use of molecular diagnostics in hospitals

There has been an increase in the treatment of diseases at the molecular level in hospitals in order to determine diseases elaborately and provide the complete profiling of diseases. Microcentrifuges and mini centrifuges are used in large-sized hospitals and diagnostics centers to separate body fluids. The high throughput and easy maintenance of laboratory centrifuges have propelled their demand among hospitals.

Technological advancements

Laboratory centrifuges are undergoing rapid technological transformations, including changes in design and material in their interiors and rotors. Centrifuges have also witnessed changes in their structure and function. Various types of benchtop and floor standing centrifuges are available, based on their speed and functions. For instance, microcentrifuges and ultra-centrifuges provide high speed and better resolution.

Over the next few years, next-generation centrifuge systems will gain traction in the laboratory centrifuge market. The emergence of Internet of Things (IoT) has led to the introduction of smart centrifuges known as next-generation centrifuge systems, which overcome the speed, space and volume limitations of conventional centrifuge systems. Next-generation centrifuge systems also provide indications and assistance to users, and come with automatic electric brakes, speed control mechanisms, and safety features.

In 2017, the benchtop centrifuges segment held the largest share of the medical centrifuge market, as their smaller footprint and cost-effectiveness makes them an ideal solution for laboratories and diagnostics centers with space and budget constraints. The Americas is expected to be the major revenue contributor to the global laboratory centrifuge market over the forecast period. The US and Canada dominate the region’s medical centrifuge market due to the presence of several laboratories and academic institutions, and a well-established healthcare industry in these countries. Additionally, growing research activities in the Latin American countries will also fuel the growth of the laboratory centrifuge market in this region.

The laboratory centrifuge market is fragmented due to the presence of several players. A majority of the market share is held by the key players who compete with each other on the basis of price, quality, and new innovations. These players are investing heavily in R&D in order to remain competitive in the medical centrifuge market.

Related Links:

Technavio Research

These are the latest findings of Technavio Research, (London, UK), a global technology research and advisory company.

Increasing number of biotechnology and pharmaceutical research studies

The biotechnology and pharmaceutical sector is being driven by a large unmet demand for the medical needs of the people. These industries are recording consistent growth owing to the advent of new diseases and continuous drug discovery. Since innovations require better treatments and product delivery, research in these sectors acts as a backbone for these industries.

Increasing use of molecular diagnostics in hospitals

There has been an increase in the treatment of diseases at the molecular level in hospitals in order to determine diseases elaborately and provide the complete profiling of diseases. Microcentrifuges and mini centrifuges are used in large-sized hospitals and diagnostics centers to separate body fluids. The high throughput and easy maintenance of laboratory centrifuges have propelled their demand among hospitals.

Technological advancements

Laboratory centrifuges are undergoing rapid technological transformations, including changes in design and material in their interiors and rotors. Centrifuges have also witnessed changes in their structure and function. Various types of benchtop and floor standing centrifuges are available, based on their speed and functions. For instance, microcentrifuges and ultra-centrifuges provide high speed and better resolution.

Over the next few years, next-generation centrifuge systems will gain traction in the laboratory centrifuge market. The emergence of Internet of Things (IoT) has led to the introduction of smart centrifuges known as next-generation centrifuge systems, which overcome the speed, space and volume limitations of conventional centrifuge systems. Next-generation centrifuge systems also provide indications and assistance to users, and come with automatic electric brakes, speed control mechanisms, and safety features.

In 2017, the benchtop centrifuges segment held the largest share of the medical centrifuge market, as their smaller footprint and cost-effectiveness makes them an ideal solution for laboratories and diagnostics centers with space and budget constraints. The Americas is expected to be the major revenue contributor to the global laboratory centrifuge market over the forecast period. The US and Canada dominate the region’s medical centrifuge market due to the presence of several laboratories and academic institutions, and a well-established healthcare industry in these countries. Additionally, growing research activities in the Latin American countries will also fuel the growth of the laboratory centrifuge market in this region.

The laboratory centrifuge market is fragmented due to the presence of several players. A majority of the market share is held by the key players who compete with each other on the basis of price, quality, and new innovations. These players are investing heavily in R&D in order to remain competitive in the medical centrifuge market.

Related Links:

Technavio Research

Latest Industry News

- Danaher and Johns Hopkins University Collaborate to Improve Neurological Diagnosis

- Beckman Coulter and MeMed Expand Host Immune Response Diagnostics Partnership

- Thermo Fisher and Bio-Techne Enter Into Strategic Distribution Agreement for Europe

- ECCMID Congress Name Changes to ESCMID Global

- Bosch and Randox Partner to Make Strategic Investment in Vivalytic Analysis Platform

- Siemens to Close Fast Track Diagnostics Business

- Beckman Coulter and Fujirebio Expand Partnership on Neurodegenerative Disease Diagnostics

- Sysmex and Hitachi Collaborate on Development of New Genetic Testing Systems

- Sysmex and CellaVision Expand Collaboration to Advance Hematology Solutions

- BD and Techcyte Collaborate on AI-Based Digital Cervical Cytology System for Pap Testing

- Medlab Middle East 2024 to Address Transformative Potential of Artificial Intelligence

- Seegene and Microsoft Collaborate to Realize a World Free from All Diseases and Future Pandemics

- Medlab Middle East 2024 to Highlight Importance of Sustainability in Laboratories

- Fujirebio and Agappe Collaborate on CLIA-Based Immunoassay

- Medlab Middle East 2024 to Highlight Groundbreaking NextGen Medicine

- bioMérieux Acquires Software Company LUMED to Support Fight against Antimicrobial Resistance

Channels

Clinical Chemistry

view channel

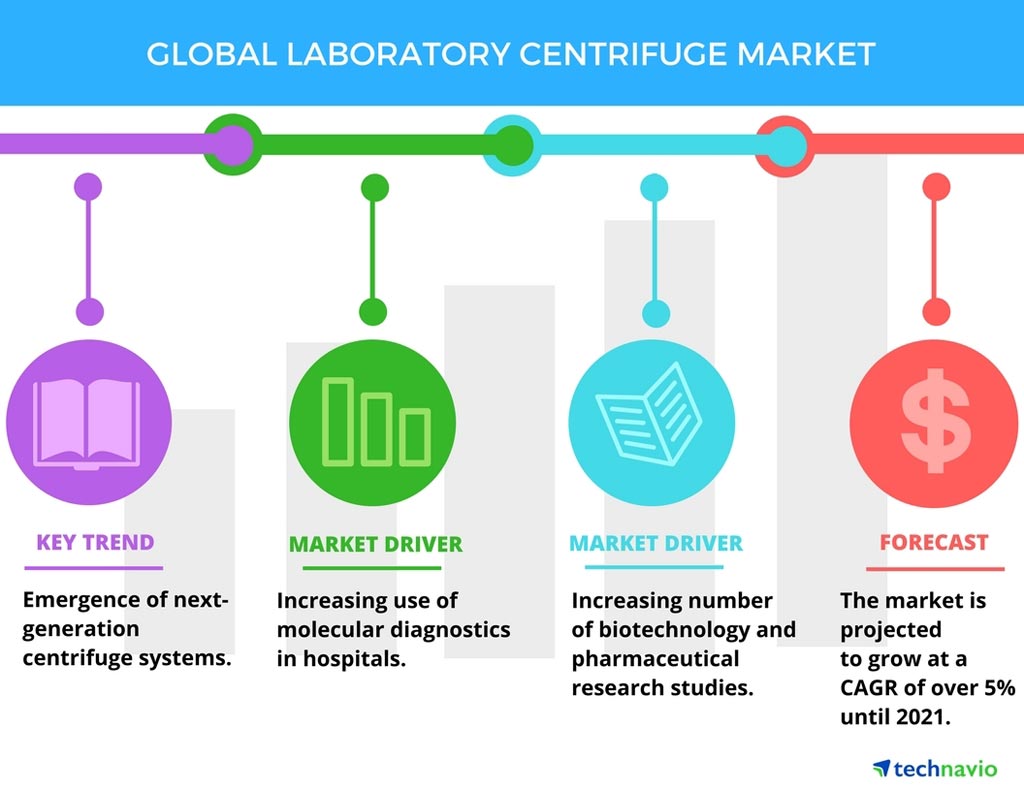

3D Printed Point-Of-Care Mass Spectrometer Outperforms State-Of-The-Art Models

Mass spectrometry is a precise technique for identifying the chemical components of a sample and has significant potential for monitoring chronic illness health states, such as measuring hormone levels... Read more.jpg)

POC Biomedical Test Spins Water Droplet Using Sound Waves for Cancer Detection

Exosomes, tiny cellular bioparticles carrying a specific set of proteins, lipids, and genetic materials, play a crucial role in cell communication and hold promise for non-invasive diagnostics.... Read more

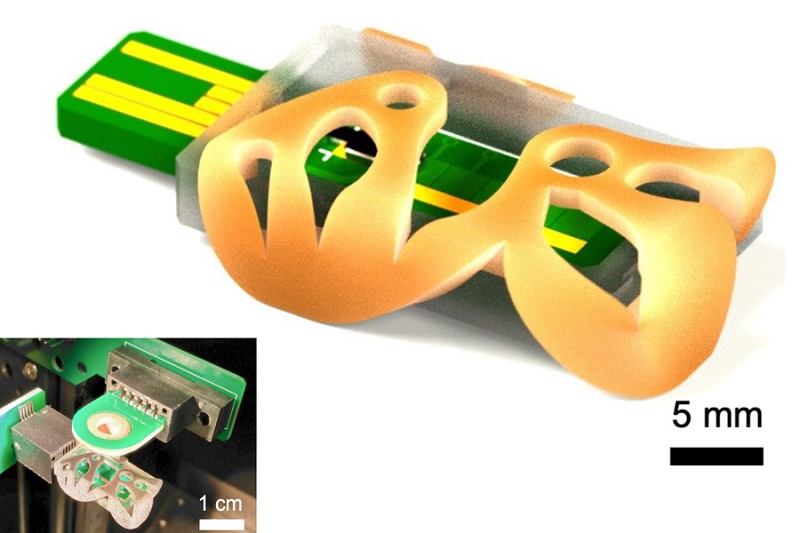

Highly Reliable Cell-Based Assay Enables Accurate Diagnosis of Endocrine Diseases

The conventional methods for measuring free cortisol, the body's stress hormone, from blood or saliva are quite demanding and require sample processing. The most common method, therefore, involves collecting... Read moreMolecular Diagnostics

view channelBlood Proteins Could Warn of Cancer Seven Years before Diagnosis

Two studies have identified proteins in the blood that could potentially alert individuals to the presence of cancer more than seven years before the disease is clinically diagnosed. Researchers found... Read moreUltrasound-Aided Blood Testing Detects Cancer Biomarkers from Cells

Ultrasound imaging serves as a noninvasive method to locate and monitor cancerous tumors effectively. However, crucial details about the cancer, such as the specific types of cells and genetic mutations... Read moreHematology

view channel

Next Generation Instrument Screens for Hemoglobin Disorders in Newborns

Hemoglobinopathies, the most widespread inherited conditions globally, affect about 7% of the population as carriers, with 2.7% of newborns being born with these conditions. The spectrum of clinical manifestations... Read more

First 4-in-1 Nucleic Acid Test for Arbovirus Screening to Reduce Risk of Transfusion-Transmitted Infections

Arboviruses represent an emerging global health threat, exacerbated by climate change and increased international travel that is facilitating their spread across new regions. Chikungunya, dengue, West... Read more

POC Finger-Prick Blood Test Determines Risk of Neutropenic Sepsis in Patients Undergoing Chemotherapy

Neutropenia, a decrease in neutrophils (a type of white blood cell crucial for fighting infections), is a frequent side effect of certain cancer treatments. This condition elevates the risk of infections,... Read more

First Affordable and Rapid Test for Beta Thalassemia Demonstrates 99% Diagnostic Accuracy

Hemoglobin disorders rank as some of the most prevalent monogenic diseases globally. Among various hemoglobin disorders, beta thalassemia, a hereditary blood disorder, affects about 1.5% of the world's... Read moreImmunology

view channel.jpg)

AI Predicts Tumor-Killing Cells with High Accuracy

Cellular immunotherapy involves extracting immune cells from a patient's tumor, potentially enhancing their cancer-fighting capabilities through engineering, and then expanding and reintroducing them into the body.... Read more

Diagnostic Blood Test for Cellular Rejection after Organ Transplant Could Replace Surgical Biopsies

Transplanted organs constantly face the risk of being rejected by the recipient's immune system which differentiates self from non-self using T cells and B cells. T cells are commonly associated with acute... Read more

AI Tool Precisely Matches Cancer Drugs to Patients Using Information from Each Tumor Cell

Current strategies for matching cancer patients with specific treatments often depend on bulk sequencing of tumor DNA and RNA, which provides an average profile from all cells within a tumor sample.... Read more

Genetic Testing Combined With Personalized Drug Screening On Tumor Samples to Revolutionize Cancer Treatment

Cancer treatment typically adheres to a standard of care—established, statistically validated regimens that are effective for the majority of patients. However, the disease’s inherent variability means... Read moreMicrobiology

view channel

Integrated Solution Ushers New Era of Automated Tuberculosis Testing

Tuberculosis (TB) is responsible for 1.3 million deaths every year, positioning it as one of the top killers globally due to a single infectious agent. In 2022, around 10.6 million people were diagnosed... Read more

Automated Sepsis Test System Enables Rapid Diagnosis for Patients with Severe Bloodstream Infections

Sepsis affects up to 50 million people globally each year, with bacteraemia, formerly known as blood poisoning, being a major cause. In the United States alone, approximately two million individuals are... Read moreEnhanced Rapid Syndromic Molecular Diagnostic Solution Detects Broad Range of Infectious Diseases

GenMark Diagnostics (Carlsbad, CA, USA), a member of the Roche Group (Basel, Switzerland), has rebranded its ePlex® system as the cobas eplex system. This rebranding under the globally renowned cobas name... Read more

Clinical Decision Support Software a Game-Changer in Antimicrobial Resistance Battle

Antimicrobial resistance (AMR) is a serious global public health concern that claims millions of lives every year. It primarily results from the inappropriate and excessive use of antibiotics, which reduces... Read morePathology

view channel

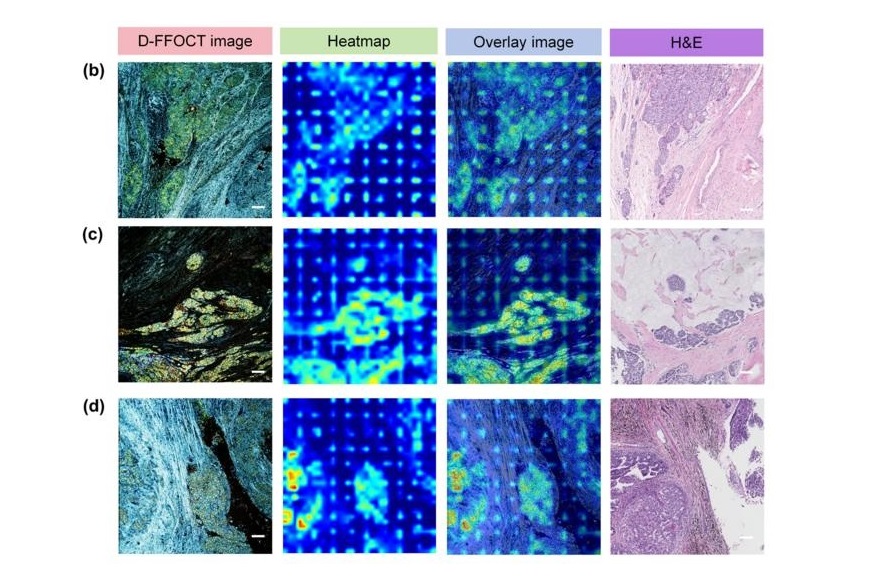

AI Integrated With Optical Imaging Technology Enables Rapid Intraoperative Diagnosis

Rapid and accurate intraoperative diagnosis is essential for tumor surgery as it guides surgical decisions with precision. Traditional intraoperative assessments, such as frozen sections based on H&E... Read more

HPV Self-Collection Solution Improves Access to Cervical Cancer Testing

Annually, over 604,000 women across the world are diagnosed with cervical cancer, and about 342,000 die from this disease, which is preventable and primarily caused by the Human Papillomavirus (HPV).... Read moreHyperspectral Dark-Field Microscopy Enables Rapid and Accurate Identification of Cancerous Tissues

Breast cancer remains a major cause of cancer-related mortality among women. Breast-conserving surgery (BCS), also known as lumpectomy, is the removal of the cancerous lump and a small margin of surrounding tissue.... Read moreTechnology

view channel

New Diagnostic System Achieves PCR Testing Accuracy

While PCR tests are the gold standard of accuracy for virology testing, they come with limitations such as complexity, the need for skilled lab operators, and longer result times. They also require complex... Read more

DNA Biosensor Enables Early Diagnosis of Cervical Cancer

Molybdenum disulfide (MoS2), recognized for its potential to form two-dimensional nanosheets like graphene, is a material that's increasingly catching the eye of the scientific community.... Read more

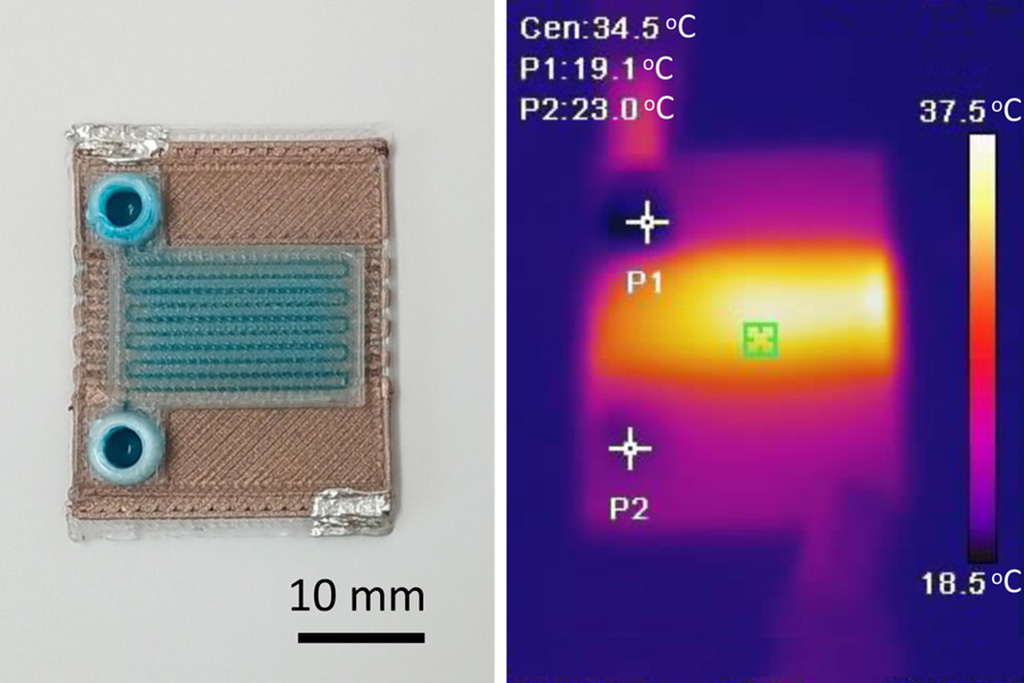

Self-Heating Microfluidic Devices Can Detect Diseases in Tiny Blood or Fluid Samples

Microfluidics, which are miniature devices that control the flow of liquids and facilitate chemical reactions, play a key role in disease detection from small samples of blood or other fluids.... Read more

_1.jpg)

.jpg)