Rethinking Innovation in the Core Lab – the future of clinical chemistry

By Julie Kirkwood

Posted on 29 Jul 2019

When it comes to the latest innovations in diagnostic tests, new technologies such as mass spectrometry and next-generation sequencing get a lot of attention. Traditional clinical chemistry assays? Not so much. Many of the assays in core chemistry laboratories are fundamentally the same as they have been for decades.Posted on 29 Jul 2019

“To some extent, traditional chemistry has settled in,” said Jonathan Genzen, MD, PhD, section chief of chemistry and medical director of the automated core laboratory at ARUP Laboratories. He is also an associate professor of pathology at the University of Utah School of Medicine in Salt Lake City.

Yet experts agree there still is plenty of room for innovation in clinical chemistry. From harnessing the power of data to the discovery of new biomarkers, this field is advancing rapidly, and vendors are still investing heavily in the latest technologies.

“You’re seeing new platforms coming out constantly,” said Susan Evans, PhD, FAACC, principal and founder of BioDecisions Consulting in Los Gatos, California. These systems are becoming more interactive, efficient, and flexible, and they are able to meet the changing needs of core laboratories for smaller sample volumes, more data integration, and quality management.

“It’s not like [in vitro diagnostics] companies are sitting around saying, ‘Oh, my mainstream core lab instrument is good enough. It’s going to last for another 10 years because the chemistries are not changing,’” Evans said. “The companies understand that there is a need for continuous change, including the addition of new features and capabilities.”

The worldwide clinical chemistry market (including instruments, service, and reagents) amounts to nearly $8 billion and is one of the largest segments within the $60 billion in vitro diagnostics market, according to Greg Stutman, director of global solutions at IQVIA (BBC IVD Solutions). If heterogeneous immunoassay reagents are included, the total immunochemistry market triples.

“Clinical chemistry is typically the largest volume category of a laboratory and is expected to remain so in the future,” he said. “While novel menu launches in clinical chemistry may not be developing at the same pace as heterogeneous immunoassay, molecular, or next-generation sequencing, companies continue to invest material research and development funds into product line enhancements, such as more scalable and automated solutions, enhanced connectivity with other platforms, and improved [information technology] offerings.”

NEW CHEMISTRY ASSAYS

When it comes to test menus for clinical chemistry and related areas, several new assays and new biomarkers are in development, noted James Nichols, PhD, DABCC, FAACC, medical director of clinical chemistry and point-of-care testing at Vanderbilt University School of Medicine in Nashville. “Certainly, there are new tests that are always innovating in terms of the core laboratory,” Nichols said.

For example, high-sensitivity troponin assays for diagnosing myocardial infarction are now becoming available to laboratories in the United States, he said. New biomarkers may soon be available for diagnosing and monitoring traumatic brain injury, and encouraging research is emerging for tests for Alzheimer’s disease.

Evans noted developments in multi-analyte markers to screen for cancer and the use of artificial intelligence and machine learning to find combinations of physiological markers that correlate with disease states. For example, multi-analyte markers related to immune response to infection, perhaps in conjunction with molecular techniques, could help diagnose and predict the severity of infectious diseases, such as the outcome of a patient presenting with the early signs of sepsis.

Promising research also is underway involving biomarkers for ischemic stroke and for kidney disease, Evans commented. “There’s never a shortage of researchers looking for new markers, especially in the world of immunoassays.”

In addition to new assays, innovations are leading to improved performance of existing assays and in core laboratory instruments, she said. Automated platforms are being designed to handle a wider variety of sample types and smaller sample volumes.

Nichols also noted that radioactive and toxic components of many assays are being replaced with safer materials, and there are innovations in electrical technologies and biosensors.

FORMING NEW CONNECTIONS

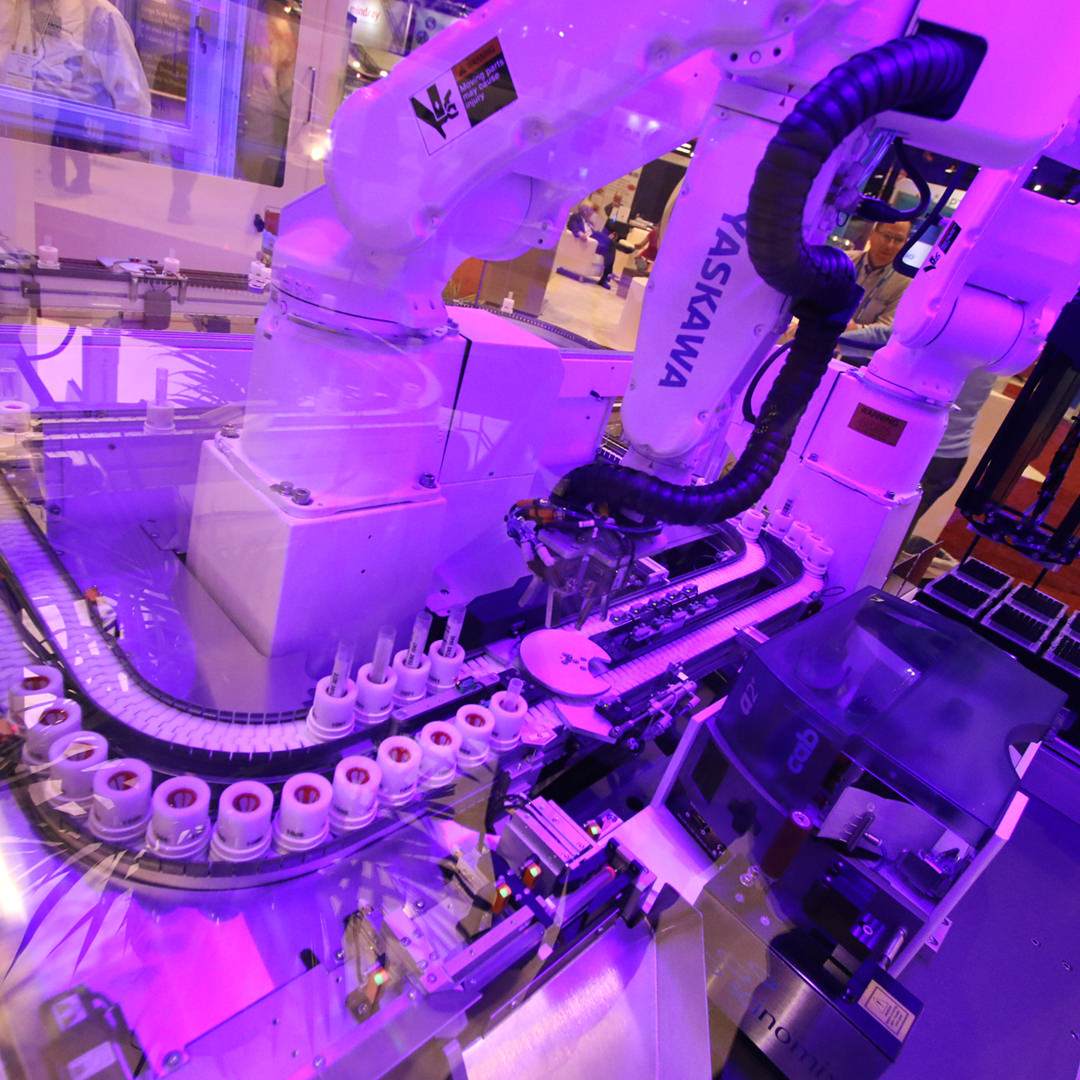

Beyond new and improved assays, innovation is underway in how clinical chemistry connects through automation to other areas of clinical laboratories. This is a continuation of a trend that has been happening over the past few decades, as core laboratories have grown to encompass disciplines spanning chemistry, immunoassay, hematology, and hemostasis, among other categories, Stutman said.

“Going forward, more novel technologies once reserved for specialized settings, such as molecular/virology, may increasingly migrate into the core laboratory,” he observed.

Efforts are underway to connect both mass spectrometry and molecular diagnostics instruments to clinical chemistry systems, Nichols said. If mass spectrometry could be connected to chemistry and immunoassay analyzers on the same platform, drugs of abuse testing could be done in real time, with samples moving directly from immunoassay screening to confirmatory testing.

Likewise, if molecular diagnostics instruments were to connect to core laboratories, chemistry and immunoassay testing could be combined for diagnosing and monitoring infectious diseases, with follow-up molecular confirmation using the same sample on the same track, said Nichols.

The risk of contamination for molecular diagnostics tests has been a barrier in the past, but companies are coming up with new ways to manage this risk, he added.

INNOVATING WITH DATA

Meanwhile, advances in information technology (IT) and data analysis are impacting every area of clinical laboratories, including clinical chemistry. Diagnostics companies have improved the IT components of their products, Genzen said, incorporating dashboards and access to real-time analytics.

“It’s no longer an afterthought, but an active component of most major diagnostic companies in the clinical laboratory space to offer IT solutions that provide better access to viewing data in a way that’s meaningful,” Genzen said. “… I think it’s clearly going to grow and will hopefully become even more useful.”

With these tools, clinical chemists can use data to improve laboratory performance. For example, they can monitor turnaround time for STAT tests with color codes and alerts. They can review patient medians for drifts or shifts that might indicate a calibration issue. Clinical chemistry labs also are using laboratory-generated data in a research context, looking for patterns that may be predictive of health conditions or that might guide decisions on reflexive testing or add-on tests, Genzen added.

“Because we are used to working with a large number of analytes and substantive data sets, I think chemists in particular are in a good position to play that role and to participate in more [electronic medical record]-based patient care initiatives using all of that laboratory data,” Genzen said.

MINIATURIZING THE CORE LAB?

Looking farther into the future, Genzen and Nichols both speculated that the trends that have allowed many clinical chemistry assays to move to the point of care could ultimately influence the size of core laboratories, as well.

“Automation systems and chemistry instrumentation, oddly enough, have gotten a little bit bigger over time,” Genzen said. “With advances in technology and microfluidics, things should at some point start getting smaller.”

Right now, most core laboratories are optimized for economies of scale and high-volume testing based on traditionally sized collection tubes, he said, and cost per test on these platforms is much lower than on small devices at the point of care. Yet if microfluidic technologies were to become less expensive, this calculation could change.

“At some point in the future, the technology will catch up and things in a core clinical laboratory will start getting smaller, because I know a lot of labs are facing space pressures,” Genzen said. “You’ve got testing that’s growing but you don’t necessarily have the available space to grow into support of that testing. So at some point that momentum has to shift.”

In the meantime, clinical chemistry innovation will remain largely in the realms of developing new biomarkers, improving existing technologies, and connecting clinical chemistry with other areas of clinical laboratories. “If you think of the numbers of patients and volume of testing, this is still the core and the heart of clinical diagnostics,” Evans said. “… There’s still lots of fun things happening for the core lab.”

Julie Kirkwood is a freelance journalist who lives in Rochester, New York. +Email: julkirkwood@gmail.com

Learn more about these breakthrough innovations shaping the future of clinical testing and patient care at the AACC 71st Annual Scientific Meeting & Clinical Lab Expo. Discover new products by visiting over 800 exhibitors at the Clinical Lab Expo and explore the cutting edge of lab medicine inside the new AACC Innovation Zone.

(3) (1).png)