Global POC Molecular Diagnostic Market Driven By Growing Demand for Near-Patient Testing

|

By LabMedica International staff writers Posted on 25 Apr 2023 |

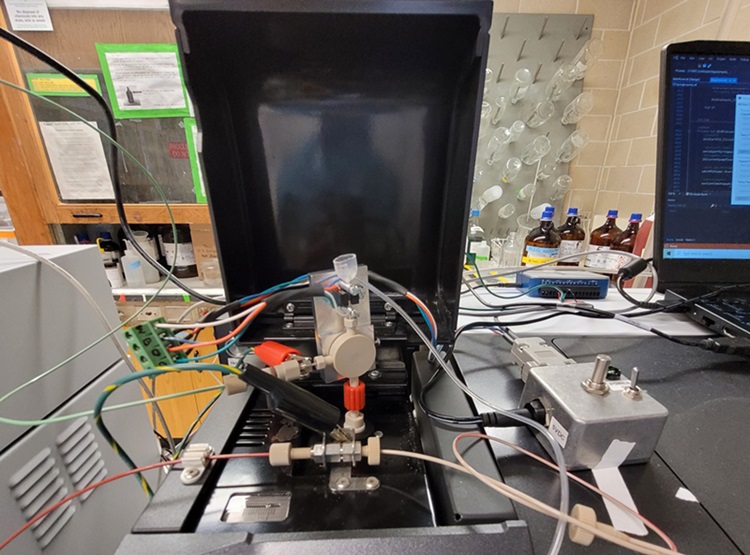

Molecular diagnostics have long been used by medical professionals in laboratories and healthcare settings. However, the high cost, time-consuming nature, and delayed results of these diagnostics have prompted the exploration of alternative methods. As a result, the market for point-of-care (POC) molecular diagnostics has gained prominence. POC molecular testing allows for quick and early diagnosis of illnesses in non-laboratory settings, typically near the patient. The increasing prevalence of infectious diseases and cancer, as well as the advantages and benefits of POC molecular diagnostics, are driving demand. Consequently, the global POC molecular diagnostics market is expected to grow at a CAGR of 8.5% between 2023 and 2031.

These are the latest findings of Research and Markets (Dublin, Ireland), a leading source for market research reports.

POC molecular diagnostics have gained significant traction in hospitals and research institutes due to their ability to reduce turnaround time and provide reliable results quickly. The market's growth is driven by the increasing adoption of POC molecular diagnostic solutions for early detection of various diseases, including respiratory diseases, cancer, sexually transmitted diseases, and gastrointestinal disorders. Additionally, recent advances in microfluidics and genetic sequencing, as well as the development of low-cost and fast POC molecular diagnostic platforms, will boost sales and market growth. The rising incidence of infectious diseases and cancer in both developed and emerging regions will also positively impact the market.

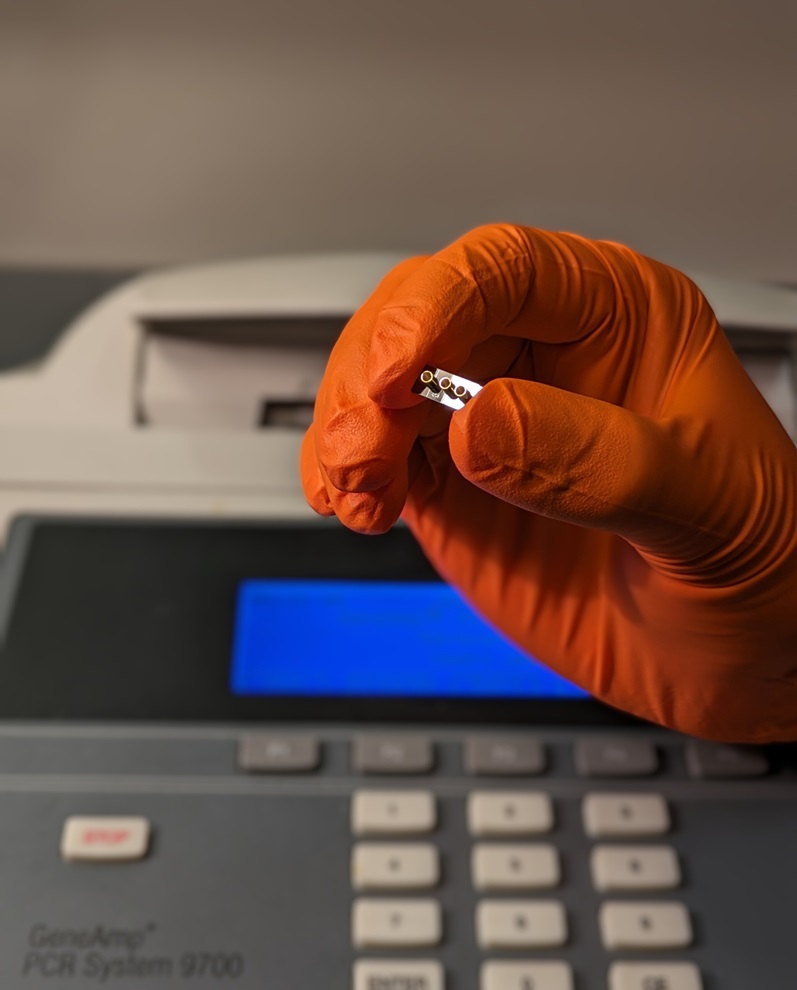

In terms of application, the infectious diseases segment accounted for the largest revenue share of the POC molecular diagnostics market in 2022, due to its ability to facilitate appropriate antibiotic therapy, faster disease management, better distribution of healthcare laboratory resources, and reductions in mortality and healthcare expenses. Based on technology, the PCR-based testing segment held the largest revenue share in 2022, driven by the commercialization of point-of-care diagnostics that provide accurate, rapid real-time PCR analysis for infectious diseases like H1N1 and influenza. Due to industry advancements, NGS-based molecular testing near patients is expected to experience significant growth during the forecast period, driven by innovative platform modifications that enable genetic sequencing and DNA data processing at the POC with high precision and rapid diagnosis. Rapid DNA analysis is also expected to see considerable growth in the coming years, thanks to ongoing innovation and R&D efforts by market leaders.

Regarding test site, Over-the-Counter (OTC) tests offer greater flexibility and portability than Proof-of-Concept (PoC) tests for use in homes and assisted care facilities. As most OTC users are untrained professionals and many of these testing instruments are CLIA-exempt, their use outside of laboratories is encouraged. Consequently, OTC tests are expected to generate higher revenue during the forecast period due to their usability, accessibility, and higher adoption rate. In terms of end-user, the decentralized laboratories segment accounted for the largest revenue share of the POC molecular diagnostics market in 2022, driven by the ability of these tests to provide fast and accurate molecular analysis with a significantly smaller physical footprint than central laboratory-based counterparts.

Emerging economies like India, South Korea, Brazil, and Mexico offer significant growth potential for the POC molecular diagnostics market due to low regulatory barriers, advancements in healthcare infrastructure, growing patient populations, increased prevalence of infectious diseases, and rising healthcare expenditures. Additionally, the regulatory policies in several of these countries are more flexible and business-friendly than those in developed nations. The POC molecular diagnostics market in Asia Pacific is expected to experience the highest growth rate during the forecast period, due to the lack of advanced central laboratory testing services, a larger population requiring clinical testing, and the potential for cost-effective implementation of PoC molecular assays. Meanwhile, the increasing need for rapid diagnosis and the introduction of innovative molecular diagnostic techniques for DNA analysis have positioned Europe as a significant market for POC molecular diagnostics.

Latest Industry News

- ECCMID Congress Name Changes to ESCMID Global

- Bosch and Randox Partner to Make Strategic Investment in Vivalytic Analysis Platform

- Siemens to Close Fast Track Diagnostics Business

- Beckman Coulter and Fujirebio Expand Partnership on Neurodegenerative Disease Diagnostics

- Sysmex and Hitachi Collaborate on Development of New Genetic Testing Systems

- Sysmex and CellaVision Expand Collaboration to Advance Hematology Solutions

- BD and Techcyte Collaborate on AI-Based Digital Cervical Cytology System for Pap Testing

- Medlab Middle East 2024 to Address Transformative Potential of Artificial Intelligence

- Seegene and Microsoft Collaborate to Realize a World Free from All Diseases and Future Pandemics

- Medlab Middle East 2024 to Highlight Importance of Sustainability in Laboratories

- Fujirebio and Agappe Collaborate on CLIA-Based Immunoassay

- Medlab Middle East 2024 to Highlight Groundbreaking NextGen Medicine

- bioMérieux Acquires Software Company LUMED to Support Fight against Antimicrobial Resistance

- Roche Acquires LumiraDx's Point of Care Technology for USD 295 Million

- Bruker Acquires IVD Manufacturer ELITech Group and Cell Imaging Company Phasefocus

- AMP Publishes Best Practice Guidance for Slice Testing Approach in Diagnostics

Channels

Clinical Chemistry

view channel

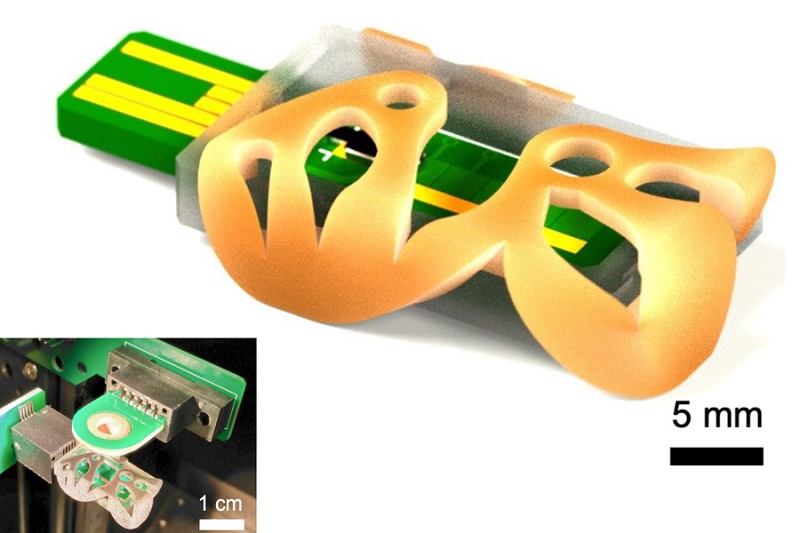

3D Printed Point-Of-Care Mass Spectrometer Outperforms State-Of-The-Art Models

Mass spectrometry is a precise technique for identifying the chemical components of a sample and has significant potential for monitoring chronic illness health states, such as measuring hormone levels... Read more.jpg)

POC Biomedical Test Spins Water Droplet Using Sound Waves for Cancer Detection

Exosomes, tiny cellular bioparticles carrying a specific set of proteins, lipids, and genetic materials, play a crucial role in cell communication and hold promise for non-invasive diagnostics.... Read more

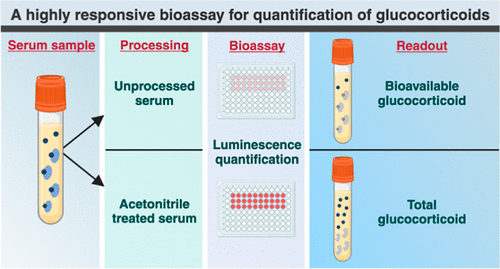

Highly Reliable Cell-Based Assay Enables Accurate Diagnosis of Endocrine Diseases

The conventional methods for measuring free cortisol, the body's stress hormone, from blood or saliva are quite demanding and require sample processing. The most common method, therefore, involves collecting... Read moreMolecular Diagnostics

view channel

Blood Test Accurately Predicts Lung Cancer Risk and Reduces Need for Scans

Lung cancer is extremely hard to detect early due to the limitations of current screening technologies, which are costly, sometimes inaccurate, and less commonly endorsed by healthcare professionals compared... Read more

Unique Autoantibody Signature to Help Diagnose Multiple Sclerosis Years before Symptom Onset

Autoimmune diseases such as multiple sclerosis (MS) are thought to occur partly due to unusual immune responses to common infections. Early MS symptoms, including dizziness, spasms, and fatigue, often... Read more

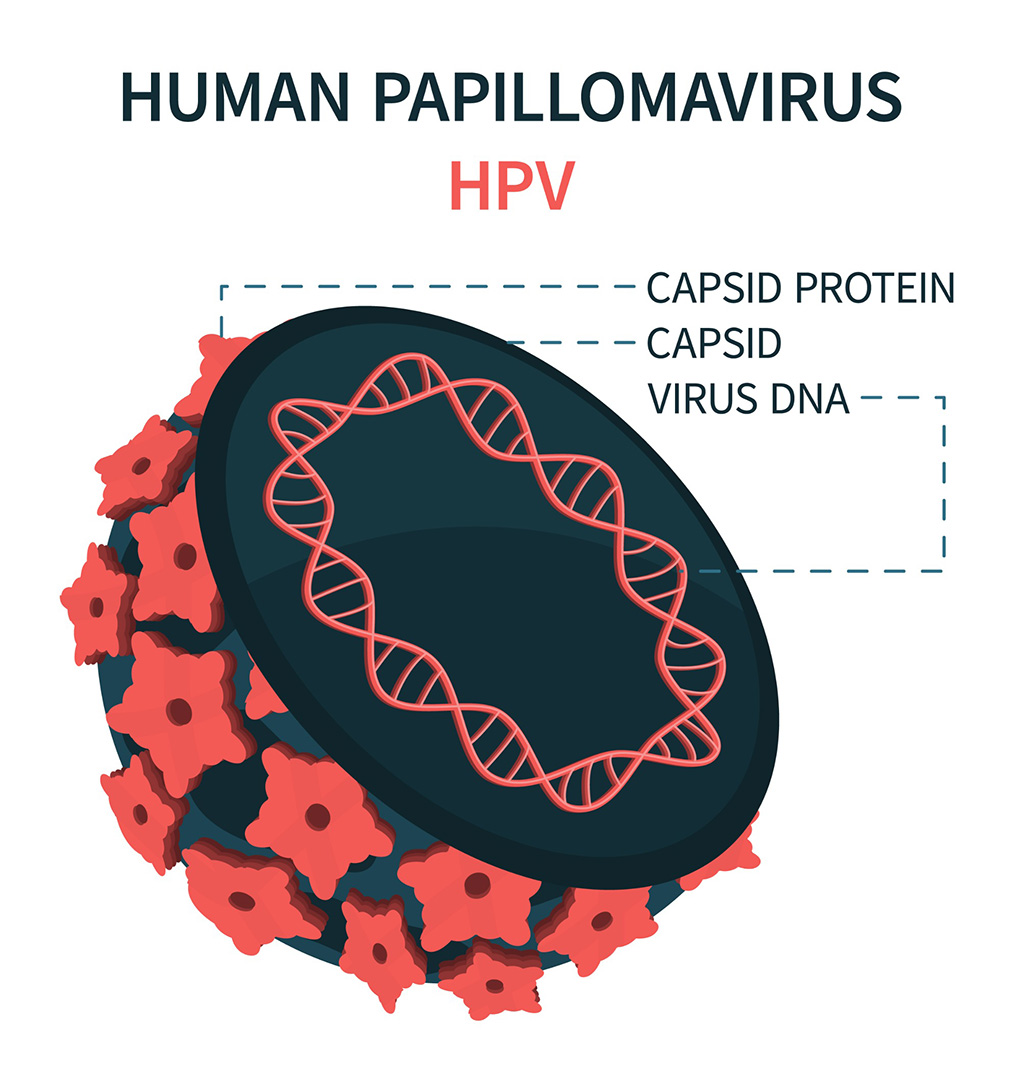

Blood Test Could Detect HPV-Associated Cancers 10 Years before Clinical Diagnosis

Human papilloma virus (HPV) is known to cause various cancers, including those of the genitals, anus, mouth, throat, and cervix. HPV-associated oropharyngeal cancer (HPV+OPSCC) is the most common HPV-associated... Read moreHematology

view channel

Next Generation Instrument Screens for Hemoglobin Disorders in Newborns

Hemoglobinopathies, the most widespread inherited conditions globally, affect about 7% of the population as carriers, with 2.7% of newborns being born with these conditions. The spectrum of clinical manifestations... Read more

First 4-in-1 Nucleic Acid Test for Arbovirus Screening to Reduce Risk of Transfusion-Transmitted Infections

Arboviruses represent an emerging global health threat, exacerbated by climate change and increased international travel that is facilitating their spread across new regions. Chikungunya, dengue, West... Read more

POC Finger-Prick Blood Test Determines Risk of Neutropenic Sepsis in Patients Undergoing Chemotherapy

Neutropenia, a decrease in neutrophils (a type of white blood cell crucial for fighting infections), is a frequent side effect of certain cancer treatments. This condition elevates the risk of infections,... Read more

First Affordable and Rapid Test for Beta Thalassemia Demonstrates 99% Diagnostic Accuracy

Hemoglobin disorders rank as some of the most prevalent monogenic diseases globally. Among various hemoglobin disorders, beta thalassemia, a hereditary blood disorder, affects about 1.5% of the world's... Read moreImmunology

view channel

Diagnostic Blood Test for Cellular Rejection after Organ Transplant Could Replace Surgical Biopsies

Transplanted organs constantly face the risk of being rejected by the recipient's immune system which differentiates self from non-self using T cells and B cells. T cells are commonly associated with acute... Read more

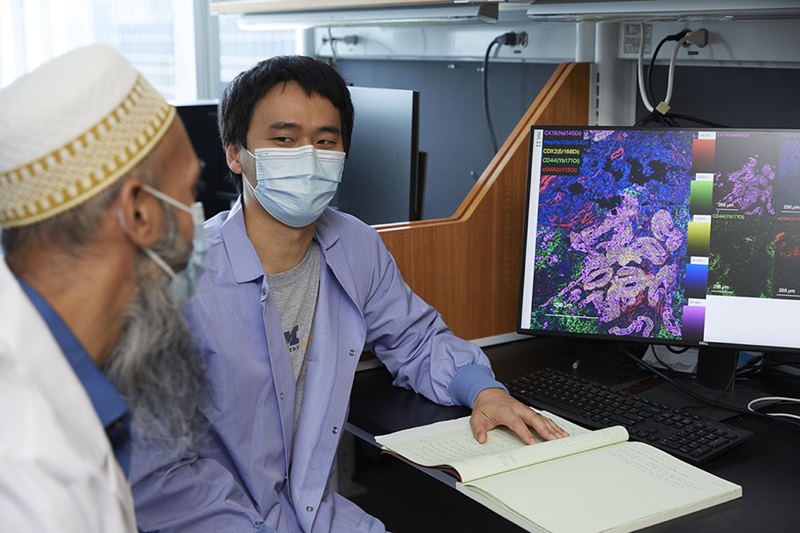

AI Tool Precisely Matches Cancer Drugs to Patients Using Information from Each Tumor Cell

Current strategies for matching cancer patients with specific treatments often depend on bulk sequencing of tumor DNA and RNA, which provides an average profile from all cells within a tumor sample.... Read more

Genetic Testing Combined With Personalized Drug Screening On Tumor Samples to Revolutionize Cancer Treatment

Cancer treatment typically adheres to a standard of care—established, statistically validated regimens that are effective for the majority of patients. However, the disease’s inherent variability means... Read moreMicrobiology

view channel

New CE-Marked Hepatitis Assays to Help Diagnose Infections Earlier

According to the World Health Organization (WHO), an estimated 354 million individuals globally are afflicted with chronic hepatitis B or C. These viruses are the leading causes of liver cirrhosis, liver... Read more

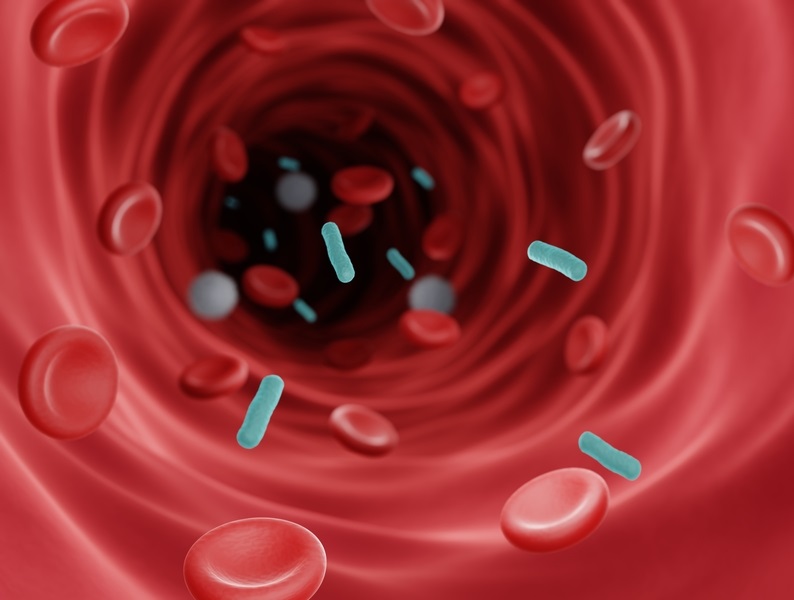

1 Hour, Direct-From-Blood Multiplex PCR Test Identifies 95% of Sepsis-Causing Pathogens

Sepsis contributes to one in every three hospital deaths in the US, and globally, septic shock carries a mortality rate of 30-40%. Diagnosing sepsis early is challenging due to its non-specific symptoms... Read morePathology

view channelAI-Powered Digital Imaging System to Revolutionize Cancer Diagnosis

The process of biopsy is important for confirming the presence of cancer. In the conventional histopathology technique, tissue is excised, sliced, stained, mounted on slides, and examined under a microscope... Read more

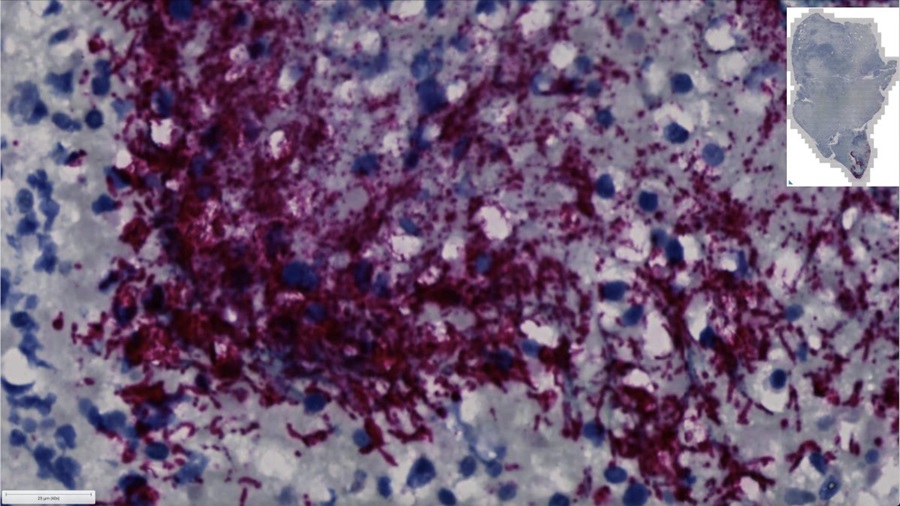

New Mycobacterium Tuberculosis Panel to Support Real-Time Surveillance and Combat Antimicrobial Resistance

Tuberculosis (TB), the leading cause of death from an infectious disease globally, is a contagious bacterial infection that primarily spreads through the coughing of patients with active pulmonary TB.... Read moreTechnology

view channel

New Diagnostic System Achieves PCR Testing Accuracy

While PCR tests are the gold standard of accuracy for virology testing, they come with limitations such as complexity, the need for skilled lab operators, and longer result times. They also require complex... Read more

DNA Biosensor Enables Early Diagnosis of Cervical Cancer

Molybdenum disulfide (MoS2), recognized for its potential to form two-dimensional nanosheets like graphene, is a material that's increasingly catching the eye of the scientific community.... Read more

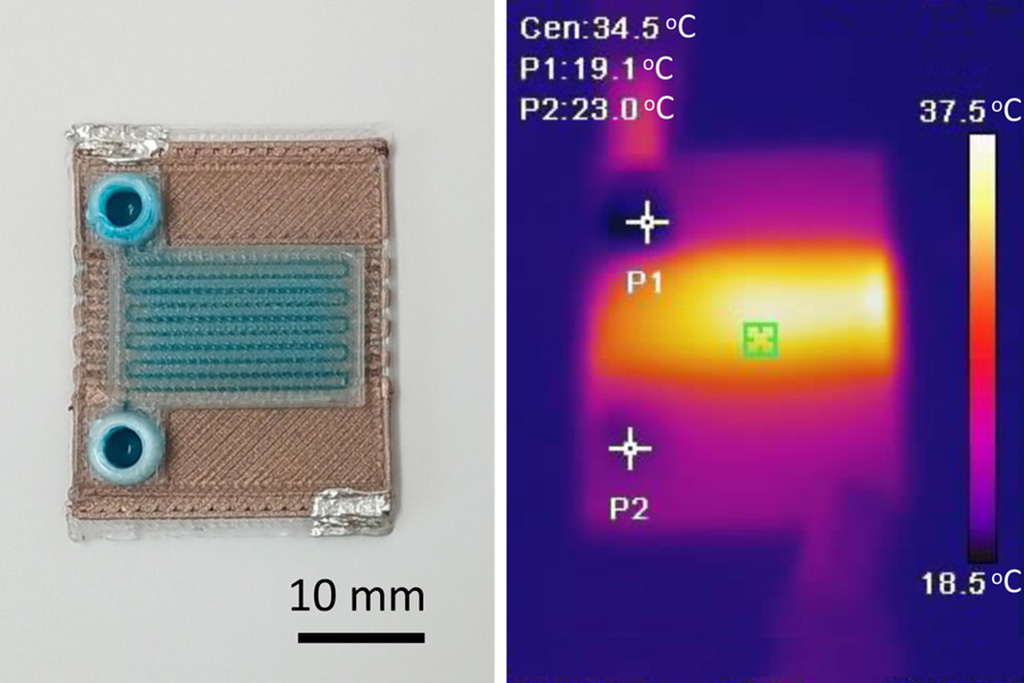

Self-Heating Microfluidic Devices Can Detect Diseases in Tiny Blood or Fluid Samples

Microfluidics, which are miniature devices that control the flow of liquids and facilitate chemical reactions, play a key role in disease detection from small samples of blood or other fluids.... Read more

Breakthrough in Diagnostic Technology Could Make On-The-Spot Testing Widely Accessible

Home testing gained significant importance during the COVID-19 pandemic, yet the availability of rapid tests is limited, and most of them can only drive one liquid across the strip, leading to continued... Read moreIndustry

view channel

ECCMID Congress Name Changes to ESCMID Global

Over the last few years, the European Society of Clinical Microbiology and Infectious Diseases (ESCMID, Basel, Switzerland) has evolved remarkably. The society is now stronger and broader than ever before... Read more

Bosch and Randox Partner to Make Strategic Investment in Vivalytic Analysis Platform

Given the presence of so many diseases, determining whether a patient is presenting the symptoms of a simple cold, the flu, or something as severe as life-threatening meningitis is usually only possible... Read more

Siemens to Close Fast Track Diagnostics Business

Siemens Healthineers (Erlangen, Germany) has announced its intention to close its Fast Track Diagnostics unit, a small collection of polymerase chain reaction (PCR) testing products that is part of the... Read more

.jpg)