Top Five In Vitro Diagnostic Trends of 2016

|

By LabMedica International staff writers Posted on 20 Dec 2016 |

Image: Research has identified the top five IVD market trends for 2016 (Photo courtesy of Slidestoc).

Companies in the global in vitro diagnostic (IVD) market which is currently worth USD 60.5 billion are being affected by various trends such as hospital consolidation, China’s increasingly important role in product launch decisions, service test markets, new small clinic targets, and mergers & acquisitions.

These are the latest findings of Kalorama Information, (New York, NY, USA), an independent medical market research firm, which has identified the top five trends in the global IVD market for 2016.

The global IVD market is responding to the trend of healthcare consolidation with a renewed approach to core lab markets and automation systems aimed at the big accounts. Integrated health networks are increasingly demanding greater centralization of diagnostic testing to streamline workflows and direct better healthcare information to professionals.

Meanwhile, in the last five years, China has strengthened its position as an IVD market close behind the US, European Union, and Japan. Apart from obtaining the US Food and Drug Administration’s (FDA) approval or European CE marking, receiving approval from the China FDA (CFDA) has now become the next significant milestone in product development for a number of IVD companies. What is particularly interesting about the significant growth of the Chinese IVD market is the growing importance of its cancer diagnostics space. Although advanced cancer testing is generally not associated with middle-income countries, China’s strong research abilities in sequencing and globally significant patient populations in the urban markets have given rise to huge opportunities for overseas IVD companies. Within the Chinese cancer diagnostics market, the highest activity is being seen in the area of next-generation sequencing (NGS), driven mainly by demand for non-invasive prenatal testing (NIPT). China’s clinical sequencer base currently includes over 40 hospitals in the region and other testing institutions catering to about 70 other hospitals and clinical clients. Cancer testing is the second-largest clinical application of NGS in China.

Another emerging trend affecting the global IVD market is the increasing penetration of major cancer-focused US LDT companies in the EU market. However, the rising profile of LDTs in the EU could restrict the growth opportunities for the region’s molecular cancer diagnostics market. The increased availability of CE-marked molecular cancer kits has failed to translate into a strong growth in the IVD market segment. Nevertheless, the return of political stability to the region, increasingly favorable economic scenario, and growing demand for advanced LDT services, which in turn, is boosting sales of related reagents and instrumentation, has led to an improved outlook for the regional market. Molecular cancer diagnostics, which is a high-growth market segment globally, is expected to grow by about just 4% in the EU owing to market maturity (as compared to the ROW markets) and limitations on reimbursement (in comparison to the US market which has a more diversified payer system).

Another notable trend is the sharp increase in urgent care centers (UCCs) numbering more than 10,000 in the US, as well as in retail clinics (1,200+), which has created a need for systems capable of dealing with the workflows generally associated with such clinics. Convenient hours are a key strength of UCCs as they offer walk-in, extended hour access for acute illness and injury care that is either beyond the scope or availability of the typical primary care practice. In comparison to traditional physicians, UCCs have a different type of office setting comprising of procedure rooms for lacerations and fractures, radiology department for providing X-ray services, and a laboratory in some cases. On the other hand, retail clinics are comparatively smaller than UCCs, provide limited services, and are usually manned by a single practitioner.

The global IVD market also continued to witness brisk merger activity in 2016. Some deals have allowed larger companies to acquire new technologies, though a shift towards globalization of IVD knowledge is clearly evident.

Related Links:

Kalorama Information

These are the latest findings of Kalorama Information, (New York, NY, USA), an independent medical market research firm, which has identified the top five trends in the global IVD market for 2016.

The global IVD market is responding to the trend of healthcare consolidation with a renewed approach to core lab markets and automation systems aimed at the big accounts. Integrated health networks are increasingly demanding greater centralization of diagnostic testing to streamline workflows and direct better healthcare information to professionals.

Meanwhile, in the last five years, China has strengthened its position as an IVD market close behind the US, European Union, and Japan. Apart from obtaining the US Food and Drug Administration’s (FDA) approval or European CE marking, receiving approval from the China FDA (CFDA) has now become the next significant milestone in product development for a number of IVD companies. What is particularly interesting about the significant growth of the Chinese IVD market is the growing importance of its cancer diagnostics space. Although advanced cancer testing is generally not associated with middle-income countries, China’s strong research abilities in sequencing and globally significant patient populations in the urban markets have given rise to huge opportunities for overseas IVD companies. Within the Chinese cancer diagnostics market, the highest activity is being seen in the area of next-generation sequencing (NGS), driven mainly by demand for non-invasive prenatal testing (NIPT). China’s clinical sequencer base currently includes over 40 hospitals in the region and other testing institutions catering to about 70 other hospitals and clinical clients. Cancer testing is the second-largest clinical application of NGS in China.

Another emerging trend affecting the global IVD market is the increasing penetration of major cancer-focused US LDT companies in the EU market. However, the rising profile of LDTs in the EU could restrict the growth opportunities for the region’s molecular cancer diagnostics market. The increased availability of CE-marked molecular cancer kits has failed to translate into a strong growth in the IVD market segment. Nevertheless, the return of political stability to the region, increasingly favorable economic scenario, and growing demand for advanced LDT services, which in turn, is boosting sales of related reagents and instrumentation, has led to an improved outlook for the regional market. Molecular cancer diagnostics, which is a high-growth market segment globally, is expected to grow by about just 4% in the EU owing to market maturity (as compared to the ROW markets) and limitations on reimbursement (in comparison to the US market which has a more diversified payer system).

Another notable trend is the sharp increase in urgent care centers (UCCs) numbering more than 10,000 in the US, as well as in retail clinics (1,200+), which has created a need for systems capable of dealing with the workflows generally associated with such clinics. Convenient hours are a key strength of UCCs as they offer walk-in, extended hour access for acute illness and injury care that is either beyond the scope or availability of the typical primary care practice. In comparison to traditional physicians, UCCs have a different type of office setting comprising of procedure rooms for lacerations and fractures, radiology department for providing X-ray services, and a laboratory in some cases. On the other hand, retail clinics are comparatively smaller than UCCs, provide limited services, and are usually manned by a single practitioner.

The global IVD market also continued to witness brisk merger activity in 2016. Some deals have allowed larger companies to acquire new technologies, though a shift towards globalization of IVD knowledge is clearly evident.

Related Links:

Kalorama Information

Latest Industry News

- Thermo Fisher and Bio-Techne Enter Into Strategic Distribution Agreement for Europe

- ECCMID Congress Name Changes to ESCMID Global

- Bosch and Randox Partner to Make Strategic Investment in Vivalytic Analysis Platform

- Siemens to Close Fast Track Diagnostics Business

- Beckman Coulter and Fujirebio Expand Partnership on Neurodegenerative Disease Diagnostics

- Sysmex and Hitachi Collaborate on Development of New Genetic Testing Systems

- Sysmex and CellaVision Expand Collaboration to Advance Hematology Solutions

- BD and Techcyte Collaborate on AI-Based Digital Cervical Cytology System for Pap Testing

- Medlab Middle East 2024 to Address Transformative Potential of Artificial Intelligence

- Seegene and Microsoft Collaborate to Realize a World Free from All Diseases and Future Pandemics

- Medlab Middle East 2024 to Highlight Importance of Sustainability in Laboratories

- Fujirebio and Agappe Collaborate on CLIA-Based Immunoassay

- Medlab Middle East 2024 to Highlight Groundbreaking NextGen Medicine

- bioMérieux Acquires Software Company LUMED to Support Fight against Antimicrobial Resistance

- Roche Acquires LumiraDx's Point of Care Technology for USD 295 Million

- Bruker Acquires IVD Manufacturer ELITech Group and Cell Imaging Company Phasefocus

Channels

Clinical Chemistry

view channel

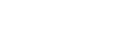

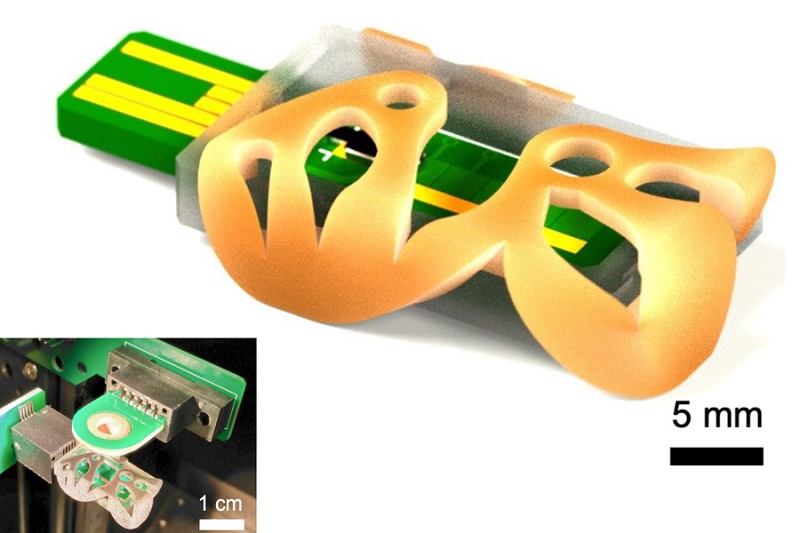

3D Printed Point-Of-Care Mass Spectrometer Outperforms State-Of-The-Art Models

Mass spectrometry is a precise technique for identifying the chemical components of a sample and has significant potential for monitoring chronic illness health states, such as measuring hormone levels... Read more.jpg)

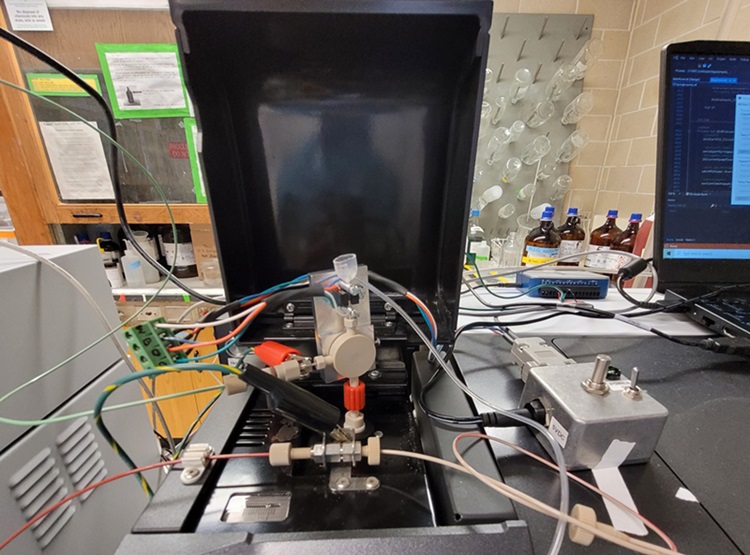

POC Biomedical Test Spins Water Droplet Using Sound Waves for Cancer Detection

Exosomes, tiny cellular bioparticles carrying a specific set of proteins, lipids, and genetic materials, play a crucial role in cell communication and hold promise for non-invasive diagnostics.... Read more

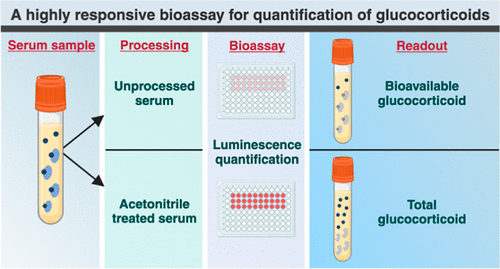

Highly Reliable Cell-Based Assay Enables Accurate Diagnosis of Endocrine Diseases

The conventional methods for measuring free cortisol, the body's stress hormone, from blood or saliva are quite demanding and require sample processing. The most common method, therefore, involves collecting... Read moreMolecular Diagnostics

view channel

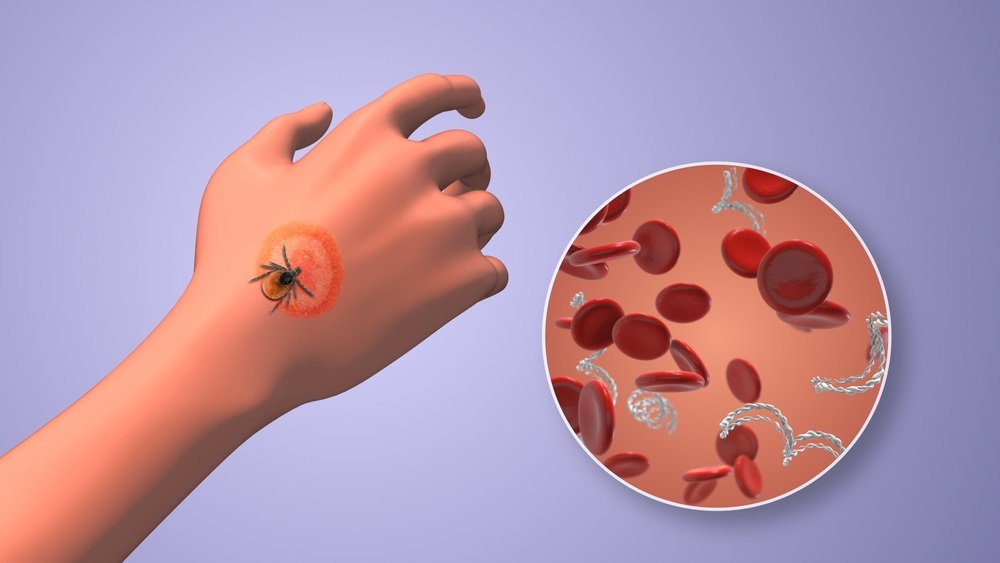

Urine Test to Revolutionize Lyme Disease Testing

Lyme disease is the most common animal-to-human transmitted disease in the United States, with around 476,000 people diagnosed and treated annually, and its incidence has been increasing.... Read more

Simple Blood Test Could Enable First Quantitative Assessments for Future Cerebrovascular Disease

Cerebral small vessel disease is a common cause of stroke and cognitive decline, particularly in the elderly. Presently, assessing the risk for cerebral vascular diseases involves using a mix of diagnostic... Read more

New Genetic Testing Procedure Combined With Ultrasound Detects High Cardiovascular Risk

A key interest area in cardiovascular research today is the impact of clonal hematopoiesis on cardiovascular diseases. Clonal hematopoiesis results from mutations in hematopoietic stem cells and may lead... Read moreHematology

view channel

Next Generation Instrument Screens for Hemoglobin Disorders in Newborns

Hemoglobinopathies, the most widespread inherited conditions globally, affect about 7% of the population as carriers, with 2.7% of newborns being born with these conditions. The spectrum of clinical manifestations... Read more

First 4-in-1 Nucleic Acid Test for Arbovirus Screening to Reduce Risk of Transfusion-Transmitted Infections

Arboviruses represent an emerging global health threat, exacerbated by climate change and increased international travel that is facilitating their spread across new regions. Chikungunya, dengue, West... Read more

POC Finger-Prick Blood Test Determines Risk of Neutropenic Sepsis in Patients Undergoing Chemotherapy

Neutropenia, a decrease in neutrophils (a type of white blood cell crucial for fighting infections), is a frequent side effect of certain cancer treatments. This condition elevates the risk of infections,... Read more

First Affordable and Rapid Test for Beta Thalassemia Demonstrates 99% Diagnostic Accuracy

Hemoglobin disorders rank as some of the most prevalent monogenic diseases globally. Among various hemoglobin disorders, beta thalassemia, a hereditary blood disorder, affects about 1.5% of the world's... Read moreImmunology

view channel

Diagnostic Blood Test for Cellular Rejection after Organ Transplant Could Replace Surgical Biopsies

Transplanted organs constantly face the risk of being rejected by the recipient's immune system which differentiates self from non-self using T cells and B cells. T cells are commonly associated with acute... Read more

AI Tool Precisely Matches Cancer Drugs to Patients Using Information from Each Tumor Cell

Current strategies for matching cancer patients with specific treatments often depend on bulk sequencing of tumor DNA and RNA, which provides an average profile from all cells within a tumor sample.... Read more

Genetic Testing Combined With Personalized Drug Screening On Tumor Samples to Revolutionize Cancer Treatment

Cancer treatment typically adheres to a standard of care—established, statistically validated regimens that are effective for the majority of patients. However, the disease’s inherent variability means... Read moreMicrobiology

view channelEnhanced Rapid Syndromic Molecular Diagnostic Solution Detects Broad Range of Infectious Diseases

GenMark Diagnostics (Carlsbad, CA, USA), a member of the Roche Group (Basel, Switzerland), has rebranded its ePlex® system as the cobas eplex system. This rebranding under the globally renowned cobas name... Read more

Clinical Decision Support Software a Game-Changer in Antimicrobial Resistance Battle

Antimicrobial resistance (AMR) is a serious global public health concern that claims millions of lives every year. It primarily results from the inappropriate and excessive use of antibiotics, which reduces... Read more

New CE-Marked Hepatitis Assays to Help Diagnose Infections Earlier

According to the World Health Organization (WHO), an estimated 354 million individuals globally are afflicted with chronic hepatitis B or C. These viruses are the leading causes of liver cirrhosis, liver... Read more

1 Hour, Direct-From-Blood Multiplex PCR Test Identifies 95% of Sepsis-Causing Pathogens

Sepsis contributes to one in every three hospital deaths in the US, and globally, septic shock carries a mortality rate of 30-40%. Diagnosing sepsis early is challenging due to its non-specific symptoms... Read morePathology

view channel

Robotic Blood Drawing Device to Revolutionize Sample Collection for Diagnostic Testing

Blood drawing is performed billions of times each year worldwide, playing a critical role in diagnostic procedures. Despite its importance, clinical laboratories are dealing with significant staff shortages,... Read more.jpg)

Use of DICOM Images for Pathology Diagnostics Marks Significant Step towards Standardization

Digital pathology is rapidly becoming a key aspect of modern healthcare, transforming the practice of pathology as laboratories worldwide adopt this advanced technology. Digital pathology systems allow... Read more

First of Its Kind Universal Tool to Revolutionize Sample Collection for Diagnostic Tests

The COVID pandemic has dramatically reshaped the perception of diagnostics. Post the pandemic, a groundbreaking device that combines sample collection and processing into a single, easy-to-use disposable... Read moreTechnology

view channel

New Diagnostic System Achieves PCR Testing Accuracy

While PCR tests are the gold standard of accuracy for virology testing, they come with limitations such as complexity, the need for skilled lab operators, and longer result times. They also require complex... Read more

DNA Biosensor Enables Early Diagnosis of Cervical Cancer

Molybdenum disulfide (MoS2), recognized for its potential to form two-dimensional nanosheets like graphene, is a material that's increasingly catching the eye of the scientific community.... Read more

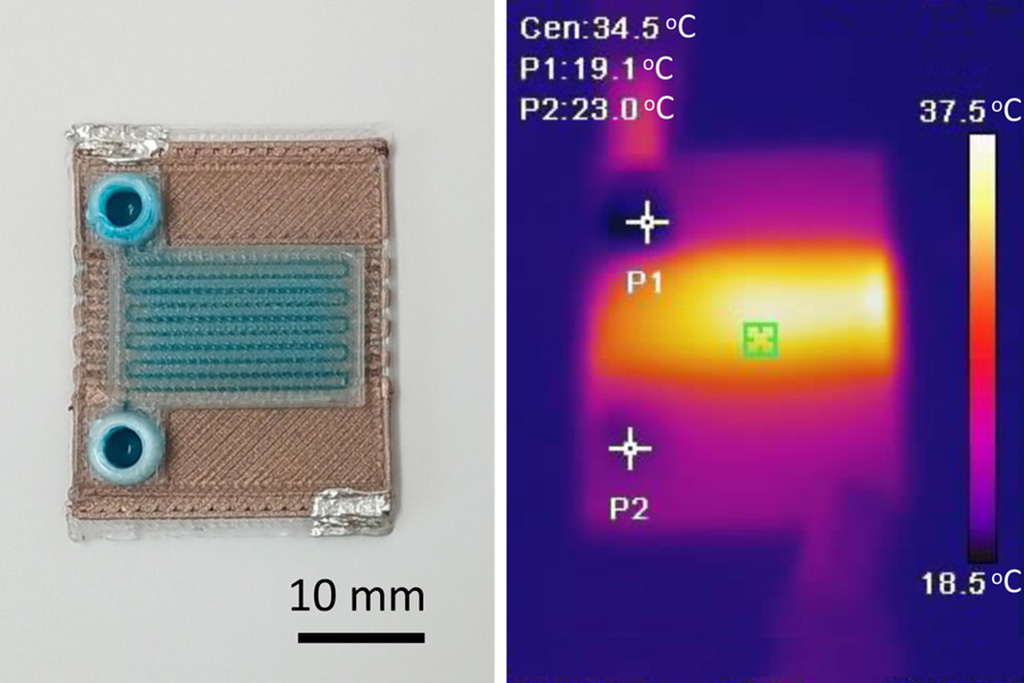

Self-Heating Microfluidic Devices Can Detect Diseases in Tiny Blood or Fluid Samples

Microfluidics, which are miniature devices that control the flow of liquids and facilitate chemical reactions, play a key role in disease detection from small samples of blood or other fluids.... Read more